Allstate 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9MAR201204034531

15MAR201510311246

Executive Compensation — Tables

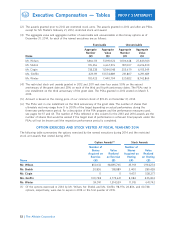

(2) The following table shows the lump sum present value of the non-qualified pension benefits for each named

executive earned through December 31, 2014, if the named executives’ employment terminated on that date.

Lump Sum

Amount

Name Plan Name ($)

Mr. Wilson SRIP 13,365,728

Mr. Shebik SRIP 3,438,715

Mr. Civgin SRIP 257,423

Ms. Greffin SRIP 4,987,970

Mr. Winter SRIP 306,768

The amount shown is based on the lump sum methodology used by the Allstate pension plans in 2014.

Specifically, the interest rate for 2014 is based on 100% of the average corporate bond segmented yield

curve from August of the prior year. As required under the Internal Revenue Code, the mortality table used

for 2014 is the 2014 combined static Pension Protection Act funding mortality table with a blend of 50%

males and 50% females.

Allstate Retirement Plan (ARP) their Base Benefit by 4.8% for each year of early

payment before age 65 and their Additional Benefit by

Contributions to the ARP are made entirely by Allstate 8% for each year of early payment from age 62 to age

and are paid into a trust fund from which benefits are 65 and 4% for each year of early payment from age

paid. Before January 1, 2014, ARP participants earned 55 to age 62, prorated on a monthly basis based on

benefits under one of two formulas (final average pay age at the date payments begin.

or cash balance) based on their date of hire or their

choice at the time Allstate introduced the cash

balance formula. In order to better align our pension

benefits with market practices, provide future pension

benefits more equitably to Allstate employees, and All named executives earned benefits under the cash

reduce costs, final average pay benefits were frozen as balance formula in 2014. Under this formula,

of December 31, 2013. Beginning on January 1, 2014, participants receive pay credits while employed at

all eligible participants earn benefits under a new cash Allstate, based on a percentage of eligible annual

balance formula only. compensation and years of service, plus interest

credits. Pay credits are allocated to a hypothetical

Final Average Pay Formula — Frozen as of 12/31/13 account in an amount equal to 3% to 5% of eligible

Benefits under the final average pay formula were annual compensation, depending on years of vesting

earned and are stated in the form of a straight life service. Interest credits are allocated to the

annuity payable at the normal retirement age of 65. hypothetical account based on the interest crediting

Ms. Greffin and Messrs. Shebik and Wilson have rate in effect for that plan year as published by the

earned final average pay benefits equal to the sum of Internal Revenue Service. The interest crediting rate is

a Base Benefit and an Additional Benefit. The Base set annually and is currently based on the average

Benefit equals 1.55% of the participant’s average yield for 30-year U.S. Treasury securities for August of

annual compensation, multiplied by credited service the prior year. Prior to 2014, Messrs. Civgin and

after 1988 through 2013. The Additional Benefit equals Winter earned cash balance credits equal to 2.5% of

0.65% of the amount of the participant’s average eligible annual compensation after they completed one

annual compensation that exceeds the participant’s year of vesting service based on the prior cash

covered compensation, multiplied by credited service balance formula.

after 1988 through 2013. Covered compensation is the

average of the maximum annual salary taxable for Supplemental Retirement Income Plan (SRIP)

Social Security over the 35-year period ending the year SRIP benefits are generally determined using a

the participant would reach Social Security retirement two-step process: (1) determine the amount that

age. Messrs. Shebik and Wilson are eligible for a would be payable under the ARP formula(s) specified

reduced early retirement benefit which would reduce above if Internal Revenue Code limits did not apply,

54

PROXY STATEMENT

Cash Balance Formula — For all Participants

Beginning 1/1/14

The Allstate Corporation