Allstate 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280

|

|

9MAR201204034531

19MAR201514590205

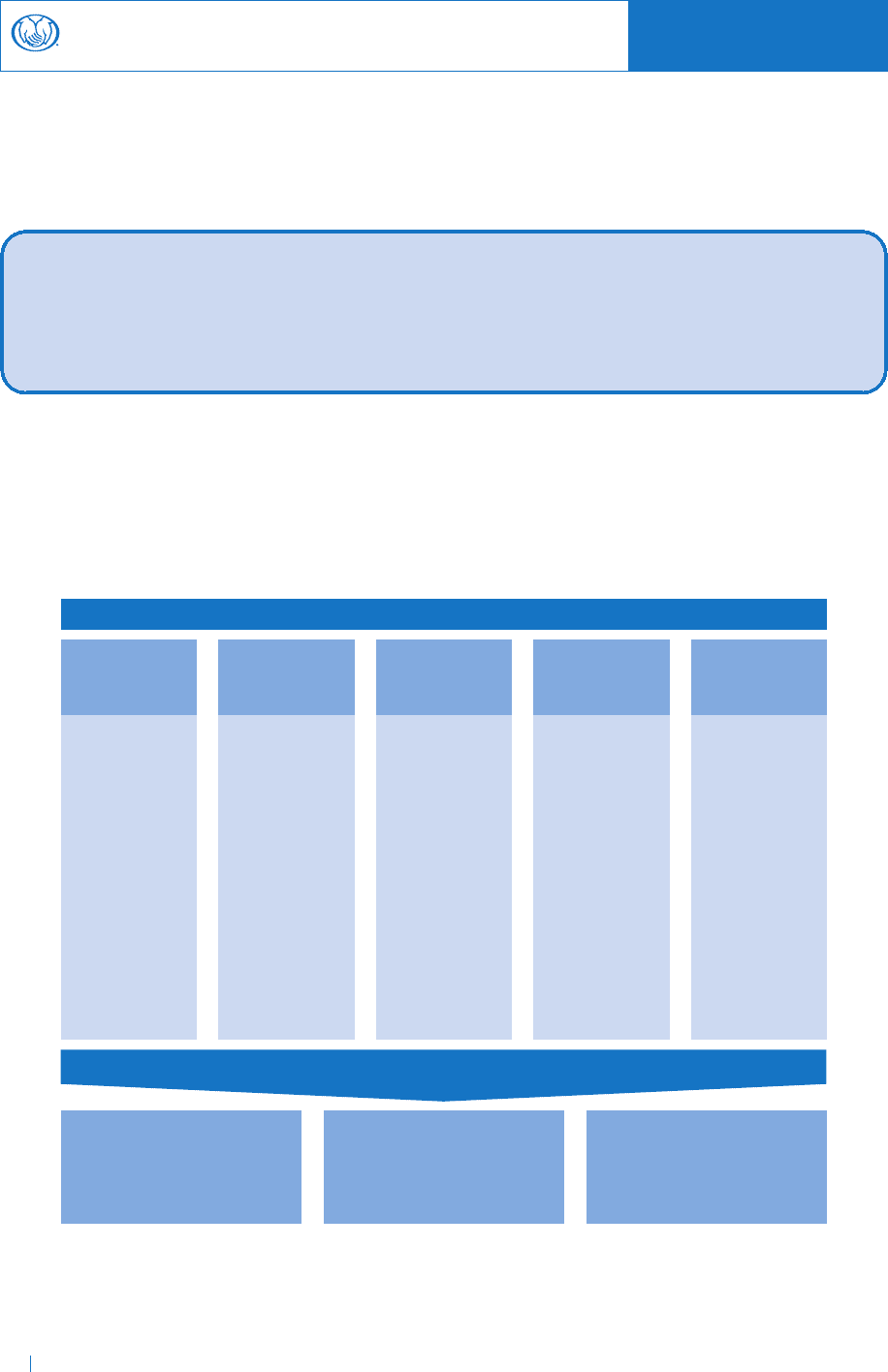

Executive Compensation — Overview

Compensation Discussion and Analysis

Named Executives

Our Compensation Discussion and Analysis describes Allstate’s executive compensation program, including total

2014 compensation for our named executives, who are listed below with titles as of December 31, 2014(1):

Thomas J. Wilson — Chairman, President and Chief Executive Officer (CEO)

Steven E. Shebik — Executive Vice President and Chief Financial Officer (CFO)

Don Civgin — President and Chief Executive Officer, Allstate Financial

Judith P. Greffin — Executive Vice President and Chief Investment Officer of Allstate Insurance Company

Matthew E. Winter — President, Allstate Personal Lines of Allstate Insurance Company

(1) The titles and responsibilities for Messrs. Wilson, Civgin, and Winter changed effective January 2015.

See Appendix C for their current titles.

Executive Overview

Performance Highlights

Allstate achieved broad-based growth and solid financial results in 2014. In addition, we proactively took action to

enhance our competitive position and execute our customer-driven strategy to provide unique offerings to each

major customer segment. This strategy is working as we achieved all five operating priorities in 2014:

++++

• Total policies in • Allstate’s • The total portfolio • Invested in • Increased

force for the Property-Liability yield for the year integrated data, Esurance’s market

Property-Liability business produced was 4.5%. analytics and share.

business grew by an underlying advanced

• Net investment • Strategically

2.5% in 2014. combined ratio for technology.

income reflected invested in

2014 of 87.2 (0.1

• Policies in force solid fixed income • Focused life and usage-based

points better than

increased across earnings in line retirement telematics

2013).

all three with operations on insurance

underwritten • Allstate brand management’s Allstate agency programs.

brands by auto and expectations, along distribution to • New business

840,000, which homeowners with continued further our trusted written premiums

led to a $1.5 billion generated strong strong limited advisor model. for Allstate

increase in returns. partnership • Improved the Benefits increased

Property-Liability results. agency and 5% in 2014.

premiums written customer

in 2014. experience through

technology

simplification.

RESULTS

* The underlying combined ratio measure is not based on accounting principles generally accepted in the

United States of America (‘‘non-GAAP’’) and is defined and reconciled to the most directly comparable

GAAP measure in Appendix D.

28

PROXY STATEMENT

The Allstate Corporation

2014 OPERATING PRIORITIES

Proactively manage

Maintain the

Grow insurance investments to Modernize the Build long-term

underlying

policies in force generate attractive operating model growth platforms

combined ratio* risk-adjusted returns

Strong profitability — net income Financial strength — repaid Cash return to stockholders —

available to common stockholders in $950 million of maturing debt and provided $2.78 billion in cash returns

2014 of $2.75 billion, or $6.27 per issued $998 million of preferred to common stockholders through

diluted common share, compared stock in 2014, which decreased ratio common stock dividends and share

with $2.26 billion, or $4.81 per of debt to capital resources to 18.9% repurchases

diluted common share in 2013 at year-end