Allstate 2014 Annual Report Download - page 138

Download and view the complete annual report

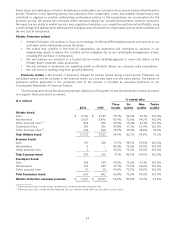

Please find page 138 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Premiums written for Allstate’s House and Home姞 product, our redesigned homeowners new business offering

currently available in 34 states, totaled $934 million in 2014 compared to $471 million in 2013. Most House and Home

policies are issued to customers new to Allstate homeowners policies. Allstate House and Home accounted for 86% of

Allstate brand homeowners new issued applications in 2014. Allstate House and Home PIF increased 102.6% as of

December 31, 2014 compared to December 31, 2013.

In states with severe weather and risk, our excess and surplus lines carrier North Light as well as non-proprietary

products will remain a critical component to our overall homeowners strategy to profitably grow and serve our

customers.

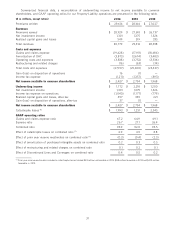

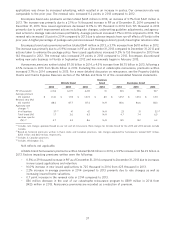

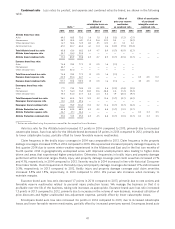

Allstate brand homeowners premiums written totaled $6.29 billion in 2013, a 3.8% increase from $6.06 billion in

2012. Factors impacting premiums written were the following:

– 2.2% decrease in PIF as of December 31, 2013 compared to December 31, 2012 due to fewer policies available

to renew.

– 31.6% increase in new issued applications to 625 thousand in 2013 from 475 thousand in 2012.

– 3.8% increase in average premium in 2013 compared to 2012 primarily due to rate changes.

– 0.3 point increase in the renewal ratio in 2013 compared to 2012.

– $56 million decrease in the cost of our catastrophe reinsurance program to $425 million in 2013 from

$481 million in 2012.

Esurance brand homeowners premiums written totaled $9 million in 2014. New issued applications totaled

11 thousand in 2014. As of December 31, 2014, Esurance is writing homeowners insurance in 14 states with lower

hurricane risk that have lower average premium.

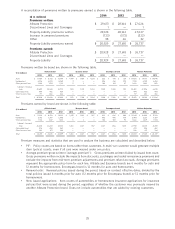

Encompass brand homeowners premiums written totaled $506 million in 2014, a 9.8% increase from $461 million

in 2013. The increase was primarily due to rate increases and a 2.5% or 9 thousand increase in PIF as of December 31,

2014 compared to December 31, 2013. New issued applications decreased 11.4% to 70 thousand in 2014 from

79 thousand in 2013 due to profit improvement actions including rate changes, underwriting guideline adjustments, and

agency-level actions. Average premium increased 6.0% in 2014 compared to 2013. The renewal ratio decreased 1.0

point in 2014 compared to 2013.

Encompass brand homeowners premiums written totaled $461 million in 2013, a 15.8% increase from $398 million

in 2012. The increase was primarily due to an 8.9% increase in PIF as of December 31, 2013 compared to December 31,

2012 and actions taken to enhance the package policy. New issued applications increased 12.9% to 79 thousand in 2013

from 70 thousand in 2012. The renewal ratio increased 3.3 points in 2013 compared to 2012.

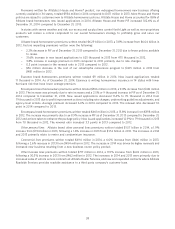

Other personal lines Allstate brand other personal lines premiums written totaled $1.57 billion in 2014, a 1.9%

increase from $1.54 billion in 2013, following a 1.6% increase in 2013 from $1.52 billion in 2012. The increases in 2014

and 2013 primarily relate to renter and condominium insurance.

Commercial lines premiums written totaled $494 million in 2014, a 6.0% increase from $466 million in 2013,

following a 2.6% increase in 2013 from $454 million in 2012. The increase in 2014 was driven by higher renewals and

increased new business resulting from a new business owner policy product.

Other business lines premiums written totaled $717 million in 2014, a 19.1% increase from $602 million in 2013,

following a 30.3% increase in 2013 from $462 million in 2012. The increases in 2014 and 2013 were primarily due to

increased sales of vehicle service contracts at Allstate Dealer Services, and new and expanded contracts where Allstate

Roadside Services provides roadside assistance to a third party company’s customer base.

38