Allstate 2014 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

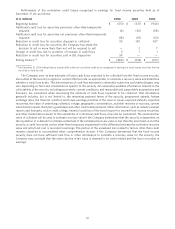

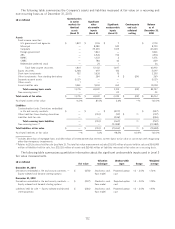

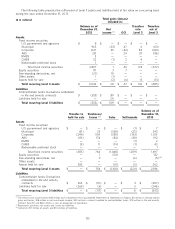

Certain assets are not carried at fair value on a recurring basis, including investments such as mortgage loans,

limited partnership interests, bank loans and policy loans. Accordingly, such investments are only included in the fair

value hierarchy disclosure when the investment is subject to remeasurement at fair value after initial recognition and the

resulting remeasurement is reflected in the consolidated financial statements. In addition, derivatives embedded in fixed

income securities are not disclosed in the hierarchy as free-standing derivatives since they are presented with the host

contracts in fixed income securities.

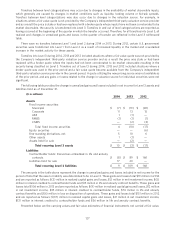

In determining fair value, the Company principally uses the market approach which generally utilizes market

transaction data for the same or similar instruments. To a lesser extent, the Company uses the income approach which

involves determining fair values from discounted cash flow methodologies. For the majority of Level 2 and Level 3

valuations, a combination of the market and income approaches is used.

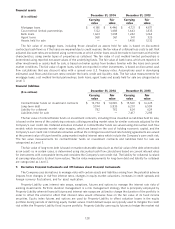

Summary of significant valuation techniques for assets and liabilities measured at fair value on a recurring basis

Level 1 measurements

• Fixed income securities: Comprise certain U.S. Treasury fixed income securities. Valuation is based on

unadjusted quoted prices for identical assets in active markets that the Company can access.

• Equity securities: Comprise actively traded, exchange-listed equity securities. Valuation is based on

unadjusted quoted prices for identical assets in active markets that the Company can access.

• Short-term: Comprise actively traded money market funds that have daily quoted net asset values for identical

assets that the Company can access.

• Separate account assets: Comprise actively traded mutual funds that have daily quoted net asset values for

identical assets that the Company can access. Net asset values for the actively traded mutual funds in which

the separate account assets are invested are obtained daily from the fund managers.

• Assets held for sale: Comprise U.S. Treasury fixed income securities, short-term investments and separate

account assets. The valuation is based on the respective asset type as described above.

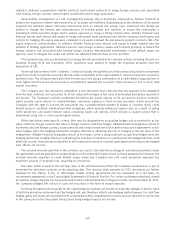

Level 2 measurements

• Fixed income securities:

U.S. government and agencies: The primary inputs to the valuation include quoted prices for identical or similar

assets in markets that are not active, contractual cash flows, benchmark yields and credit spreads.

Municipal: The primary inputs to the valuation include quoted prices for identical or similar assets in markets

that are not active, contractual cash flows, benchmark yields and credit spreads.

Corporate, including privately placed: The primary inputs to the valuation include quoted prices for identical or

similar assets in markets that are not active, contractual cash flows, benchmark yields and credit spreads. Also

included are privately placed securities valued using a discounted cash flow model that is widely accepted in

the financial services industry and uses market observable inputs and inputs derived principally from, or

corroborated by, observable market data. The primary inputs to the discounted cash flow model include an

interest rate yield curve, as well as published credit spreads for similar assets in markets that are not active that

incorporate the credit quality and industry sector of the issuer.

Foreign government: The primary inputs to the valuation include quoted prices for identical or similar assets in

markets that are not active, contractual cash flows, benchmark yields and credit spreads.

ABS and RMBS: The primary inputs to the valuation include quoted prices for identical or similar assets in

markets that are not active, contractual cash flows, benchmark yields, prepayment speeds, collateral

performance and credit spreads. Certain ABS are valued based on non-binding broker quotes whose inputs

have been corroborated to be market observable.

CMBS: The primary inputs to the valuation include quoted prices for identical or similar assets in markets that

are not active, contractual cash flows, benchmark yields, collateral performance and credit spreads.

Redeemable preferred stock: The primary inputs to the valuation include quoted prices for identical or similar

assets in markets that are not active, contractual cash flows, benchmark yields, underlying stock prices and

credit spreads.

119