Allstate 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

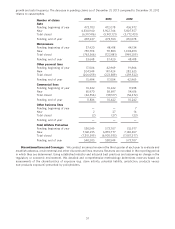

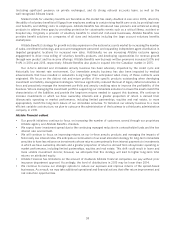

Summary analysis Summarized financial data for the years ended December 31 is presented in the following

table.

($ in millions) 2014 2013 2012

Revenues

Life and annuity premiums and contract charges $ 2,157 $ 2,352 $ 2,241

Net investment income 2,131 2,538 2,647

Realized capital gains and losses 144 74 (13)

Total revenues 4,432 4,964 4,875

Costs and expenses

Life and annuity contract benefits (1,765) (1,917) (1,818)

Interest credited to contractholder funds (919) (1,278) (1,316)

Amortization of DAC (260) (328) (401)

Operating costs and expenses (466) (565) (576)

Restructuring and related charges (2) (7) —

Total costs and expenses (3,412) (4,095) (4,111)

(Loss) gain on disposition of operations (90) (687) 18

Income tax expense (299) (87) (241)

Net income available to common shareholders $ 631 $ 95 $ 541

Life insurance $ 242 $ 15 $ 226

Accident and health insurance 105 87 81

Annuities and institutional products 284 (7) 234

Net income available to common shareholders $ 631 $ 95 $ 541

Allstate Life $ 232 $ 2 $ 224

Allstate Benefits 115 100 83

Allstate Annuities 284 (7) 234

Net income available to common shareholders $ 631 $ 95 $ 541

Investments as of December 31 $ 38,809 $ 39,105 $ 56,999

Investments classified as held for sale as of

December 31 — 11,983 —

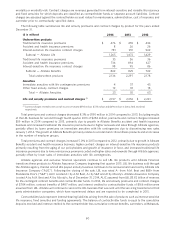

Net income available to common shareholders was $631 million in 2014 compared to $95 million in 2013. The increase

primarily relates to lower loss on disposition charges related to the LBL sale, partially offset by the reduction in business

due to the sale of LBL on April 1, 2014. Net income available to common shareholders in 2014 and 2013 included an

after-tax loss on disposition of LBL totaling $60 million and $521 million, respectively. Excluding the loss on disposition

as well as the net income of the LBL business for second through fourth quarter 2013 of $116 million, net income

available to common shareholders increased $191 million in 2014 compared to 2013, primarily due to lower interest

credited to contractholder funds, higher net realized capital gains, lower operating costs and expenses, lower

amortization of DAC, and higher life and annuity premiums and contract charges, partially offset by higher life and

annuity contract benefits and lower net investment income.

Net income available to common shareholders was $95 million in 2013 compared to $541 million in 2012. The

decrease was primarily due to the estimated loss on disposition related to the pending LBL sale, lower net investment

income and higher life and annuity contract benefits, partially offset by higher life and annuity premiums and contract

charges, net realized capital gains in 2013 compared to net realized capital losses in 2012 and decreased amortization of

DAC.

Analysis of revenues Total revenues decreased 10.7% or $532 million in 2014 compared to 2013. Excluding

results of the LBL business for second through fourth quarter 2013 of $651 million, total revenues increased 2.8% or

$119 million in 2014 compared to 2013, due to higher net realized capital gains and higher life and annuity premiums and

contract charges, partially offset by lower net investment income. Total revenues increased 1.8% or $89 million in 2013

compared to 2012, primarily due to higher life and annuity premiums and contract charges and net realized capital gains

in 2013 compared to net realized capital losses in 2012, partially offset by lower net investment income.

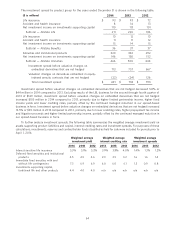

Life and annuity premiums and contract charges Premiums represent revenues generated from traditional life

insurance, immediate annuities with life contingencies, and accident and health insurance products that have significant

59