Allstate 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

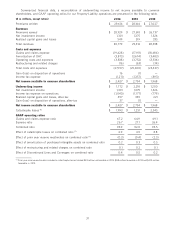

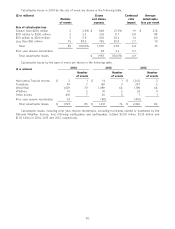

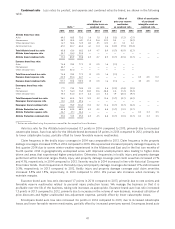

Combined ratio Loss ratios by product, and expense and combined ratios by brand, are shown in the following

table.

Effect of Effect of amortization

Effect of prior year reserve of purchased

catastrophe losses on reestimates intangible assets on

Ratio (1) combined ratio on combined ratio combined ratio

2014 2013 2012 2014 2013 2012 2014 2013 2012 2014 2013 2012

Allstate brand loss ratio:

Auto 69.2 68.5 70.3 1.6 1.0 3.8 (1.2) (1.2) (2.1)

Homeowners 58.7 53.4 64.1 21.4 15.6 23.2 0.4 — (5.2)

Other personal lines 61.7 58.6 72.3 8.2 3.5 12.3 2.1 1.8 2.2

Commercial lines 67.0 60.7 60.4 6.1 0.4 0.6 (4.2) (7.9) (10.4)

Total Allstate brand loss ratio 65.8 63.6 68.3 6.9 4.7 8.9 (0.7) (0.9) (2.7)

Allstate brand expense ratio 25.7 26.3 25.5 — — — — — — — — —

Allstate brand combined ratio 91.5 89.9 93.8 6.9 4.7 8.9 (0.7) (0.9) (2.7) — — —

Esurance brand loss ratio:

Auto 76.8 78.5 77.2 1.3 0.9 1.6 (1.1) — —

Homeowners 66.7 — — — — — — — —

Other personal lines 60.0 50.0 — — — — — — —

Total Esurance brand loss ratio 76.8 78.5 77.2 1.3 0.9 1.6 (1.1) — —

Esurance brand expense ratio 40.9 39.0 42.7 — — — — — — 3.3 4.9 10.1

Esurance brand combined ratio 117.7 117.5 119.9 1.3 0.9 1.6 (1.1) — — 3.3 4.9 10.1

Encompass brand loss ratio:

Auto 77.1 73.5 78.5 3.2 0.3 3.6 (2.0) (4.8) (3.9)

Homeowners 74.7 56.3 76.5 28.2 12.6 28.8 0.4 (1.2) (3.2)

Other personal lines 75.5 54.0 67.7 6.6 4.0 5.4 1.9 (8.0) (9.7)

Total Encompass brand loss ratio 76.0 65.4 76.9 13.2 5.2 12.6 (0.7) (3.7) (4.2)

Encompass brand expense ratio 30.1 30.5 29.6 — — — — — — — — —

Encompass brand combined ratio 106.1 95.9 106.5 13.2 5.2 12.6 (0.7) (3.7) (4.2) — — —

Allstate Protection loss ratio 66.8 64.4 68.9 6.9 4.5 8.8 (0.7) (1.0) (2.7)

Allstate Protection expense ratio 26.7 27.1 26.4 — — — — — — 0.2 0.3 0.5

Allstate Protection combined ratio 93.5 91.5 95.3 6.9 4.5 8.8 (0.7) (1.0) (2.7) 0.2 0.3 0.5

(1) Ratios are calculated using the premiums earned for the respective line of business.

Auto loss ratio for the Allstate brand increased 0.7 points in 2014 compared to 2013, primarily due to increased

catastrophe losses. Auto loss ratio for the Allstate brand decreased 1.8 points in 2013 compared to 2012, primarily due

to lower catastrophe losses, partially offset by lower favorable reserve reestimates.

Claim frequency in the bodily injury coverages in 2014 was comparable to 2013. Claim frequency in the property

damage coverages increased 0.5% in 2014 compared to 2013. We experienced increased property damage frequency in

first quarter 2014 due to severe winter weather experienced in the Midwest and East and in the first two months of

fourth quarter 2014 in geographically widespread areas with improved unemployment rates leading to higher miles

driven and areas that experienced higher precipitation. Otherwise, frequencies in bodily injury and property damage

performed within historical ranges. Bodily injury and property damage coverage paid claim severities increased 2.7%

and 4.1%, respectively, in 2014 compared to 2013. Severity results in 2014 increased in line with historical Consumer

Price Index trends. Claim frequencies in the bodily injury and property damage coverages decreased 1.1% and increased

0.3%, respectively, in 2013 compared to 2012. Bodily injury and property damage coverage paid claim severities

increased 3.8% and 1.8%, respectively, in 2013 compared to 2012. We pursue rate increases when necessary to

maintain margins.

Esurance brand auto loss ratio decreased 1.7 points in 2014 compared to 2013, primarily due to rate actions and

favorable reserve reestimates related to personal injury protection losses. We manage the business so that it is

profitable over the life of the business, taking rate increases as appropriate. Esurance brand auto loss ratio increased

1.3 points in 2013 compared to 2012, primarily due to increases in the volume of new business, increased utilization of

price discounts and higher unallocated loss adjustment expense, partially offset by lower catastrophe losses.

Encompass brand auto loss ratio increased 3.6 points in 2014 compared to 2013, due to increased catastrophe

losses and lower favorable reserve reestimates, partially offset by increased premiums earned. Encompass brand auto

41