Allstate 2014 Annual Report Download - page 106

Download and view the complete annual report

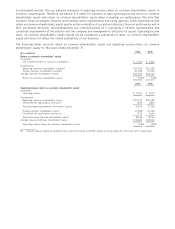

Please find page 106 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sale of an asset in an orderly transaction between market participants at the measurement date. Moreover, the use of

different valuation assumptions may have a material effect on the assets’ fair values. The difference between amortized

cost or cost and fair value, net of deferred income taxes, certain life and annuity DAC, certain deferred sales inducement

costs, and certain reserves for life-contingent contract benefits, is reflected as a component of accumulated other

comprehensive income in shareholders’ equity. Changing market conditions could materially affect the determination of

the fair value of securities and unrealized net capital gains and losses could vary significantly.

Risks Relating to the Insurance Industry

Our future growth and profitability are dependent in part on our ability to successfully operate in an insurance

industry that is highly competitive

The insurance industry is highly competitive. Many of our primary insurance competitors have well-established

national reputations and market similar products.

We have invested in growth strategies by acting on our customer value propositions for each of our brands, through

our differentiated product offerings and our distinctive advertising campaigns. If we are unsuccessful in generating new

business and retaining a sufficient number of our customers, our ability to increase premiums written could be

impacted. In addition, if we experience unexpected increases in our underlying costs (such as the frequency or severity

of claims costs) generated by our new business, it could result in decreases in our profitability and lead to price

increases which could impair our ability to compete effectively for insurance business.

We are also investing in telematics and broadening the value proposition for the connected consumer. If we are not

effective in anticipating the impact on our business of changing technology, including automotive technology, our ability

to successfully operate may be impaired.

Because of the competitive nature of the insurance industry, there can be no assurance that we will continue to

effectively compete with our industry rivals, or that competitive pressures will not have a material effect on our

business, operating results or financial condition. This includes competition for producers such as exclusive and

independent agents and their licensed sales professionals. In the event we are unable to attract and retain these

producers or they are unable to attract and retain customers for our products, growth and retention could be materially

affected. Furthermore, certain competitors operate using a mutual insurance company structure and therefore may have

dissimilar profitability and return targets. Additionally, many of our voluntary benefits products are underwritten

annually. There is a risk that employers may be able to obtain more favorable terms from competitors than they could by

renewing coverage with us. These competitive pressures may adversely affect the persistency of these products, as well

as our ability to sell our products in the future.

Our ability to successfully operate may also be impaired if we are not effective in developing the talent and skills of

our human resources, attracting and assimilating new executive talent into our organization, or deploying human

resource talent consistently with our business goals.

Difficult conditions in the global economy and capital markets generally could adversely affect our business and

operating results and these conditions may not improve in the near future

As with most businesses, we believe difficult conditions in the global economy and capital markets, such as

significant negative macroeconomic trends, including relatively high and sustained unemployment, reduced consumer

spending, lower residential and commercial real estate prices, substantial increases in delinquencies on consumer debt,

including defaults on home mortgages, and the relatively low availability of credit could have an adverse effect on our

business and operating results.

Stressed conditions, volatility and disruptions in global capital markets, particular markets or financial asset classes

could adversely affect our investment portfolio. Disruptions in one market or asset class can also spread to other

markets or asset classes. Although the disruption in the global financial markets has moderated, not all global financial

markets are functioning normally, and the rate of recovery from the U.S. recession has been below historic averages.

Several governments around the world have announced austerity actions to address their budget deficits that may lead

to a decline in economic activity.

In the years since the financial crisis, the central banks of most developed countries have pursued fairly similar, and

highly accommodative, monetary policies. While European policy makers have developed mechanisms to address

funding concerns, risks to the European economy and financial markets remain. Additionally, monetary policies among

major central banks have begun to diverge. The United States Federal Reserve and the Bank of England continue to

evaluate the timing and pace of normalizing their respective policies. In contrast, the European Central Bank has recently

6