Allstate 2014 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.companies in proportion to their respective North Carolina property insurance writings. Member companies are

assessed when plan deficits occur, or collect based on their participation ratios, which are determined annually. As of

December 31, 2014, the Company has a $3 million receivable from the NCJUA reflecting a plan surplus from all open

years.

North Carolina Insurance Underwriting Association

The North Carolina Insurance Underwriting Association (‘‘NCIUA’’) provides windstorm and hail coverage as well

as homeowners policies for properties located in the state’s beach and coastal areas that insurers are not otherwise

willing to insure. All insurers licensed to write residential and commercial property insurance in North Carolina are

members of the NCIUA. Members are assessed in proportion to their North Carolina residential and commercial

property insurance writings, which is determined annually and varies by coverage, for plan deficits. The plan currently

has a surplus. No member company shall be entitled to the distribution of any portion of the Association’s surplus.

Legislation in 2009 capped insurers’ assessments for losses incurred in any year at $1 billion. Subsequent to an industry

assessment of $1 billion, if the plan continues to require funding, it may authorize insurers to assess a 10% surcharge on

each property insurance policy statewide to be remitted to the plan.

Guaranty funds

Under state insurance guaranty fund laws, insurers doing business in a state can be assessed, up to prescribed

limits, for certain obligations of insolvent insurance companies to policyholders and claimants. Amounts assessed to

each company are typically related to its proportion of business written in each state. The Company’s policy is to accrue

assessments when the entity for which the insolvency relates has met its state of domicile’s statutory definition of

insolvency, the amount of the loss is reasonably estimable and the related premium upon which the assessment is based

is written. In most states, the definition is met with a declaration of financial insolvency by a court of competent

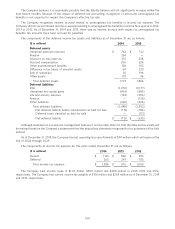

jurisdiction. In certain states there must also be a final order of liquidation. As of December 31, 2014 and 2013, the

liability balance included in other liabilities and accrued expenses was $16 million and $36 million, respectively. The

related premium tax offsets included in other assets were $15 million and $31 million as of December 31, 2014 and 2013,

respectively.

PMI runoff support agreement

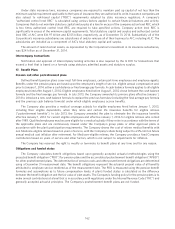

The Company has certain limited rights and obligations under a capital support agreement (‘‘Runoff Support

Agreement’’) with PMI Mortgage Insurance Company (‘‘PMI’’), the primary operating subsidiary of PMI Group, related

to the Company’s disposition of PMI in prior years. Under the Runoff Support Agreement, the Company would be

required to pay claims on PMI policies written prior to October 28, 1994 if PMI fails certain financial covenants and fails

to pay such claims. The agreement only covers these policies and not any policies issued on or after that date. In the

event any amounts are so paid, the Company would receive a commensurate amount of preferred stock or subordinated

debt of PMI Group or PMI. The Runoff Support Agreement also restricts PMI’s ability to write new business and pay

dividends under certain circumstances. On October 20, 2011, the Director of the Arizona Department of Insurance took

control of the PMI insurance companies; effective October 24, 2011, the Director instituted a partial claim payment plan:

claim payments will be made at 50%, with the remaining amount deferred as a policyholder claim. In 2014, the Director

increased the partial payments to 67%. The effect of these developments to the Company is uncertain. The Company

has not received any notices or requests for payments under this agreement. Management does not believe these

developments will have a material effect on results of operations, cash flows or financial position of the Company.

Guarantees

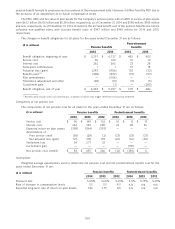

The Company provides residual value guarantees on Company leased automobiles. If all outstanding leases were

terminated effective December 31, 2014, the Company’s maximum obligation pursuant to these guarantees, assuming

the automobiles have no residual value, would be $32 million as of December 31, 2014. The remaining term of each

residual value guarantee is equal to the term of the underlying lease that ranges from less than one year to three years.

Historically, the Company has not made any material payments pursuant to these guarantees.

The Company owns certain investments that obligate the Company to exchange credit risk or to forfeit principal

due, depending on the nature or occurrence of specified credit events for the reference entities. In the event all such

specified credit events were to occur, the Company’s maximum amount at risk on these investments, as measured by

the amount of the aggregate initial investment, was $4 million as of December 31, 2014. The obligations associated with

these investments expire at various dates on or before March 11, 2018.

Related to the sale of LBL on April 1, 2014, ALIC has agreed to indemnify Resolution Life Holdings, Inc. related to

representations, warranties and covenants of ALIC, as well as for certain liabilities specifically excluded from the

154