Allstate 2014 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2014 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

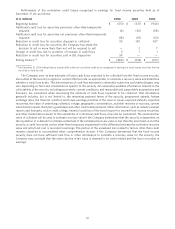

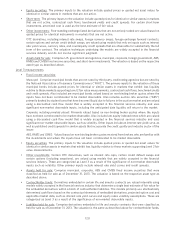

ABS, RMBS and CMBS in an unrealized loss position were evaluated based on actual and projected collateral losses

relative to the securities’ positions in the respective securitization trusts, security specific expectations of cash flows,

and credit ratings. This evaluation also takes into consideration credit enhancement, measured in terms of

(i) subordination from other classes of securities in the trust that are contractually obligated to absorb losses before the

class of security the Company owns, (ii) the expected impact of other structural features embedded in the securitization

trust beneficial to the class of securities the Company owns, such as overcollateralization and excess spread, and (iii) for

ABS and RMBS in an unrealized loss position, credit enhancements from reliable bond insurers, where applicable.

Municipal bonds in an unrealized loss position were evaluated based on the underlying credit quality of the primary

obligor, obligation type and quality of the underlying assets. Unrealized losses on equity securities are primarily related

to temporary equity market fluctuations of securities that are expected to recover.

As of December 31, 2014, the Company has not made the decision to sell and it is not more likely than not the

Company will be required to sell fixed income securities with unrealized losses before recovery of the amortized cost

basis. As of December 31, 2014, the Company had the intent and ability to hold equity securities with unrealized losses

for a period of time sufficient for them to recover.

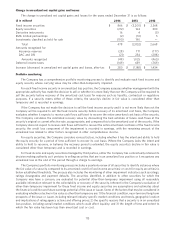

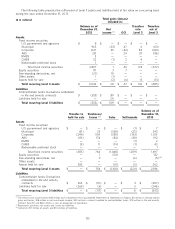

Limited partnerships

As of December 31, 2014 and 2013, the carrying value of equity method limited partnerships totaled $3.41 billion

and $3.52 billion, respectively. The Company recognizes an impairment loss for equity method limited partnerships

when evidence demonstrates that the loss is other than temporary. Evidence of a loss in value that is other than

temporary may include the absence of an ability to recover the carrying amount of the investment or the inability of the

investee to sustain a level of earnings that would justify the carrying amount of the investment.

As of December 31, 2014 and 2013, the carrying value for cost method limited partnerships was $1.12 billion and

$1.44 billion, respectively. To determine if an other-than-temporary impairment has occurred, the Company evaluates

whether an impairment indicator has occurred in the period that may have a significant adverse effect on the carrying

value of the investment. Impairment indicators may include: significantly reduced valuations of the investments held by

the limited partnerships; actual recent cash flows received being significantly less than expected cash flows; reduced

valuations based on financing completed at a lower value; completed sale of a material underlying investment at a price

significantly lower than expected; or any other adverse events since the last financial statements received that might

affect the fair value of the investee’s capital. Additionally, the Company’s portfolio monitoring process includes a

quarterly review of all cost method limited partnerships to identify instances where the net asset value is below

established thresholds for certain periods of time, as well as investments that are performing below expectations, for

further impairment consideration. If a cost method limited partnership is other-than-temporarily impaired, the carrying

value is written down to fair value, generally estimated to be equivalent to the reported net asset value of the underlying

funds.

Tax credit funds were reclassified from limited partnership interests to other assets during 2014 since the return on

these funds is in the form of tax credits rather than investment income. These tax credit funds totaled $560 million as of

December 31, 2014.

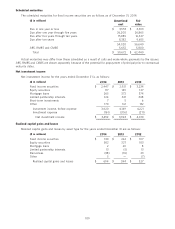

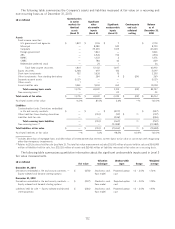

Mortgage loans

The Company’s mortgage loans are commercial mortgage loans collateralized by a variety of commercial real estate

property types located across the United States and totaled, net of valuation allowance, $4.19 billion and $4.72 billion as

of December 31, 2014 and 2013, respectively. Substantially all of the commercial mortgage loans are non-recourse to

the borrower. The following table shows the principal geographic distribution of commercial real estate represented in

the Company’s mortgage loan portfolio. No other state represented more than 5% of the portfolio as of December 31.

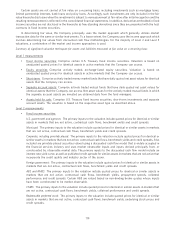

(% of mortgage loan portfolio carrying value) 2014 2013

California 23.9% 23.0%

Illinois 9.4 10.0

New Jersey 8.0 6.8

Texas 8.0 6.3

New York 5.9 6.0

Florida 5.0 5.7

District of Columbia 2.4 5.3

115