AT&T Wireless 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

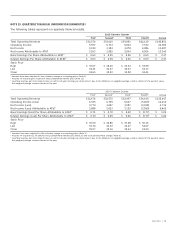

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

78

|

AT&T INC.

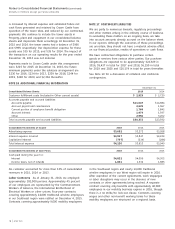

NOTE 17. CONTINGENT LIABILITIES

We are party to numerous lawsuits, regulatory proceedings

and other matters arising in the ordinary course of business.

In evaluating these matters on an ongoing basis, we take

into account amounts already accrued on the balance sheet.

In our opinion, although the outcomes of these proceedings

are uncertain, they should not have a material adverse effect

on our financial position, results of operations or cash flows.

We have contractual obligations to purchase certain

goods or services from various other parties. Our purchase

obligations are expected to be approximately $22,929 in

2016, $9,437 in total for 2017 and 2018, $6,159 in total

for 2019 and 2020 and $10,174 in total for years thereafter.

See Note 10 for a discussion of collateral and credit-risk

contingencies.

is increased by interest expense and estimated future net

cash flows generated and retained by Crown Castle from

operation of the tower sites, and reduced by our contractual

payments. We continue to include the tower assets in

Property, plant and equipment in our consolidated balance

sheets and depreciate them accordingly. At December 31,

2015 and 2014, the tower assets had a balance of $960

and $999, respectively. Our depreciation expense for these

assets was $39 for 2015, and $39 for 2014. The impact of

the transaction on our operating results for the year ended

December 31, 2013 was not material.

Payments made to Crown Castle under this arrangement

were $225 for 2015. At December 31, 2015, the future

minimum payments under the sublease arrangement are

$230 for 2016, $234 for 2017, $239 for 2018, $244 for

2019, $248 for 2020, and $2,304 thereafter.

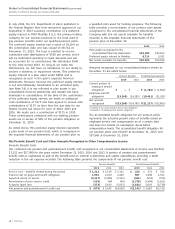

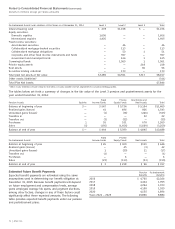

NOTE 18. ADDITIONAL FINANCIAL INFORMATION

December 31,

Consolidated Balance Sheets 2015 2014

Customer fulfillment costs (included in Other current assets) $ 2,923 $ 2,720

Accounts payable and accrued liabilities:

Accounts payable $21,047 $14,984

Accrued payroll and commissions 2,629 1,967

Current portion of employee benefit obligation 1,766 1,842

Accrued interest 1,974 1,597

Other 2,956 3,202

Total accounts payable and accrued liabilities $30,372 $23,592

Consolidated Statements of Income 2015 2014 2013

Advertising expense $3,632 $3,272 $3,268

Interest expense incurred $4,917 $3,847 $4,224

Capitalized interest (797) (234) (284)

Total interest expense $4,120 $3,613 $3,940

Consolidated Statements of Cash Flows 2015 2014 2013

Cash paid during the year for:

Interest $4,822 $4,099 $4,302

Income taxes, net of refunds 1,851 1,532 1,985

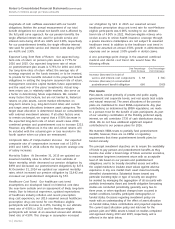

in the Southwest region and nearly 16,000 traditional

wireline employees in our West region will expire in 2016.

After expiration of the current agreements, work stoppages

or labor disruptions may occur in the absence of new

contracts or other agreements being reached. A separate

contract covering only benefits with approximately 40,000

employees in our mobility business expires in 2016, though

there is a no strike/no lock-out clause. Contracts covering

wages and other non-benefit working terms for these

mobility employees are structured on a regional basis.

No customer accounted for more than 10% of consolidated

revenues in 2015, 2014 or 2013.

Labor Contracts As of January 31, 2016, we employed

approximately 281,000 persons. Approximately 45 percent

of our employees are represented by the Communications

Workers of America, the International Brotherhood of

Electrical Workers or other unions. Four-year contracts

covering approximately 24,000 traditional wireline employees

in our Southeast region were ratified on December 4, 2015.

Contracts covering approximately 9,000 mobility employees