AT&T Wireless 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

73

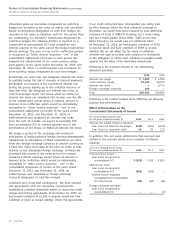

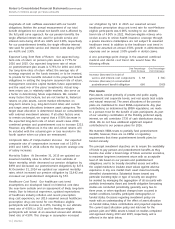

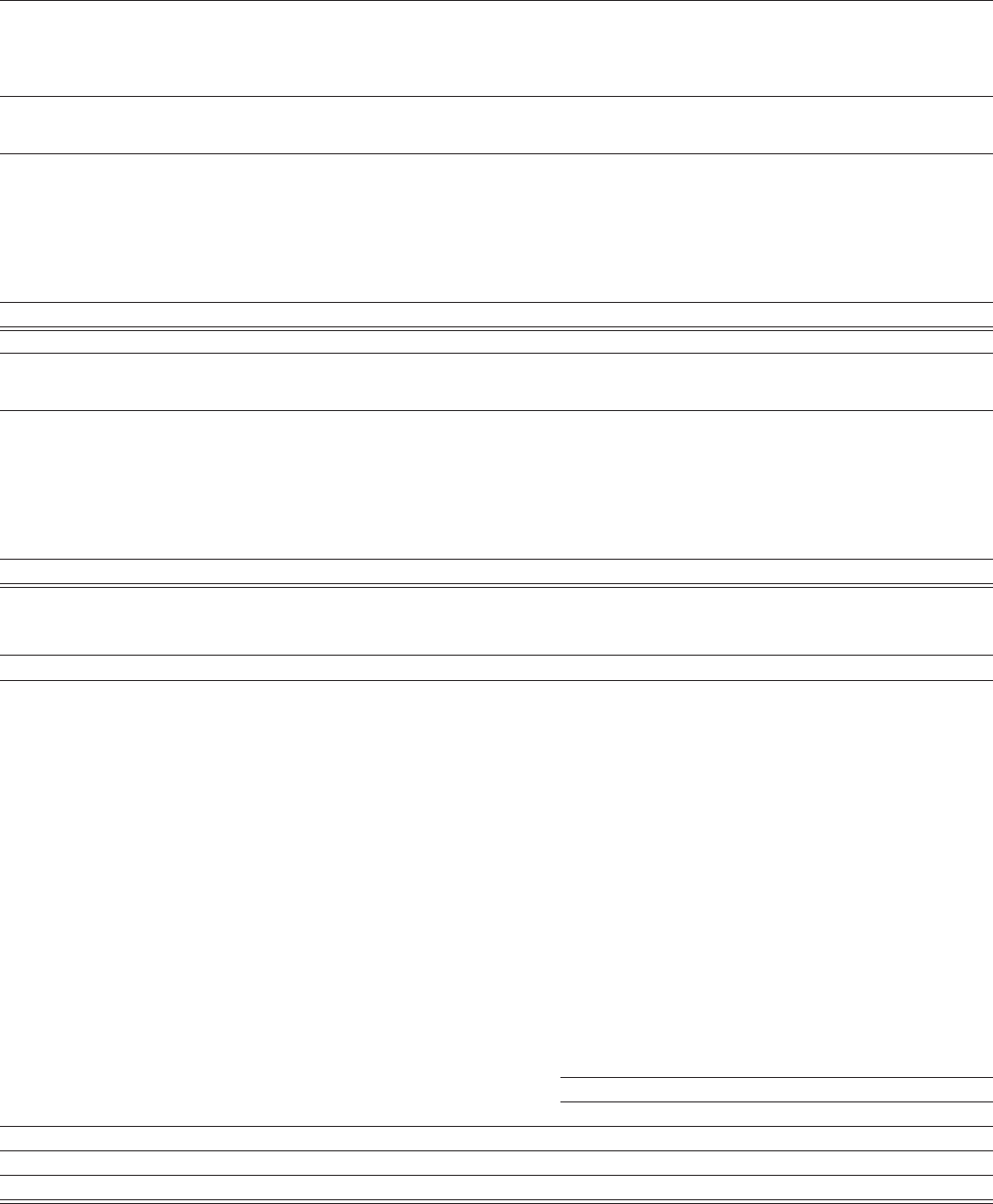

The tables below set forth a summary of changes in the fair value of the Level 3 pension and postretirement assets for the

year ended December 31, 2015:

Fixed Private Real Estate

Income Equity and

Pension Assets Equities Funds Funds Real Assets Total

Balance at beginning of year $ — $ 444 $ 5,399 $ 4,845 $10,688

Realized gains (losses) (1) 29 426 416 870

Unrealized gains (losses) 1 (16) 132 (114) 3

Transfers in — — — 19 19

Transfers out — — (19) — (19)

Purchases — 29 436 474 939

Sales — (110) (1,448) (1,283) (2,841)

Balance at end of year $ — $376 $4,926 $4,357 $ 9,659

Fixed Private

Income Equity

Postretirement Assets Funds Funds Real Assets Total

Balance at beginning of year $ 3 $ 218 $ 96 $317

Realized gains (losses) — (16) (2) (18)

Unrealized gains (losses) — 24 (1) 23

Transfers in 15 — 25 40

Transfers out (1) — (25) (26)

Purchases — 30 1 31

Sales (1) (101) (13) (115)

Balance at end of year $16 $155 $81 $252

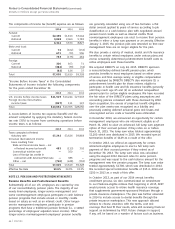

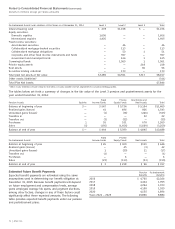

The following tables set forth by level, within the fair value hierarchy, the pension and postretirement assets and liabilities at

fair value as of December 31, 2014:

Pension Assets and Liabilities at Fair Value as of December 31, 2014 Level 1 Level 2 Level 3 Total

Non-interest bearing cash $ 45 $ — $ — $ 45

Interest bearing cash — 127 — 127

Foreign currency contracts — 25 — 25

Equity securities:

Domestic equities 8,613 74 — 8,687

International equities 4,805 171 — 4,976

Fixed income securities:

Asset-backed securities — 610 1 611

Mortgage-backed securities — 1,741 — 1,741

Collateralized mortgage-backed securities — 418 — 418

Collateralized mortgage obligations/REMICS — 531 — 531

Corporate and other fixed income instruments and funds 97 7,210 441 7,748

Government and municipal bonds 145 4,876 — 5,021

Private equity funds — — 5,399 5,399

Real estate and real assets — — 4,845 4,845

Commingled funds — 5,823 2 5,825

Securities lending collateral 310 3,140 — 3,450

Receivable for variation margin 6 — — 6

Purchased options 1 — — 1

Assets at fair value 14,022 24,746 10,688 49,456

Investments sold short and other liabilities at fair value (650) (260) — (910)

Total plan net assets at fair value $13,372 $24,486 $10,688 $48,546

Other assets (liabilities)1 (3,383)

Total Plan Net Assets $45,163

1 Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.