AT&T Wireless 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

50

|

AT&T INC.

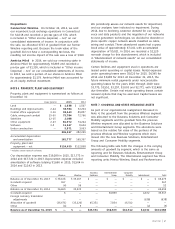

Software Costs We capitalize certain costs incurred in

connection with developing or obtaining internal-use

software. Capitalized software costs are included in

“Property, Plant and Equipment” on our consolidated

balance sheets. In addition, there is certain network software

that allows the equipment to provide the features and

functions unique to the AT&T network, which we include

in the cost of the equipment categories for financial

reporting purposes.

We amortize our capitalized software costs over a three-year

to five-year period, reflecting the estimated period during

which these assets will remain in service, which also aligns

with the estimated useful lives used in the industry.

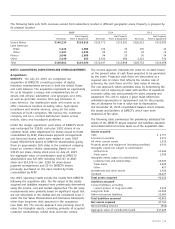

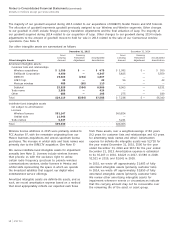

Goodwill and Other Intangible Assets AT&T has five

major classes of intangible assets: goodwill, licenses, which

include Federal Communications Commission (FCC), other

wireless licenses and orbital slots, other indefinite-lived

intangible assets, primarily made up of the AT&T and

DIRECTV International trade names including SKY, customer

lists and various other finite-lived intangible assets

(see Note 7).

Goodwill represents the excess of consideration paid

over the fair value of net assets acquired in business

combinations. FCC and wireless licenses (wireless licenses)

provide us with the exclusive right to utilize certain radio

frequency spectrum to provide wireless communications

services. While wireless licenses are issued for a fixed

period of time (generally 10 years), renewals of wireless

licenses have occurred routinely and at nominal cost.

Moreover, we have determined that there are currently

no legal, regulatory, contractual, competitive, economic

or other factors that limit the useful lives of our wireless

licenses. Orbital slots represent the space in which we

operate the broadcast satellites that support our digital

video entertainment service offerings. Similar to our

wireless licenses, there are no factors that limit the useful

lives of our orbital slots. We acquired the rights to the

AT&T and other brand names in previous acquisitions.

We have the effective ability to retain these exclusive

rights permanently at a nominal cost.

Goodwill, licenses and other indefinite-lived intangible

assets are not amortized but are tested at least annually

for impairment. The testing is performed on the value as

of October 1 each year, and compares the book value of

the assets to their fair value. Goodwill is tested by

comparing the book value of each reporting unit, deemed

to be our principal operating segments or one level

below them (Business Solutions, Entertainment Group,

Consumer Mobility, and Mexico Wireless, Brazil and

PanAmericana in the International segment), to the fair

value of those reporting units calculated using a discounted

cash flow approach as well as a market multiple approach.

Licenses are tested for impairment on an aggregate basis,

consistent with our use of the licenses on a national

scope using a discounted cash flow approach. We also

corroborated the value of wireless licenses with a market

approach as the AWS-3 auction provided market price

information for national wireless licenses. Brand names

are tested by comparing the book value to a fair value

calculated using a discounted cash flow approach on a

presumed royalty rate derived from the revenues related

to the brand name.

Intangible assets that have finite useful lives are amortized

over their useful lives (see Note 7). Customer lists and

relationships are amortized using primarily the sum-of-the-

months-digits method of amortization over the period in

which those relationships are expected to contribute to our

future cash flows. The remaining finite-lived intangible assets

are generally amortized using the straight-line method.

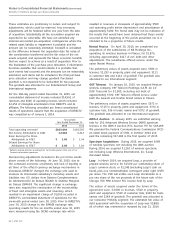

Broadcast Programming and Other Costs We recognize

the costs of television programming distribution rights

when we distribute the related programming. We

recognize the costs of television programming rights to

distribute live sporting events to expense using the

straight-line method over the course of the season or

tournament, which approximates the pattern of usage.

Advertising Costs We expense advertising costs for

products and services or for promoting our corporate

image as we incur them (see Note 18).

Traffic Compensation Expense We use various

estimates and assumptions to determine the amount

of traffic compensation expense recognized during

any reporting period. Switched traffic compensation

costs are accrued utilizing estimated rates and

volumes by product, formulated from historical

data and adjusted for known rate changes. Such

estimates are adjusted monthly to reflect newly

available information, such as rate changes and