AT&T Wireless 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

63

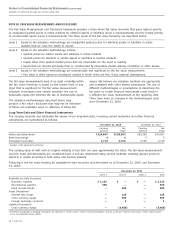

Investment Securities

Our investment securities include equities, fixed income

bonds and other securities. A substantial portion of the fair

values of our available-for-sale securities was estimated

based on quoted market prices. Investments in securities

not traded on a national securities exchange are valued

using pricing models, quoted prices of securities with

similar characteristics or discounted cash flows. Realized

gains and losses on securities are included in “Other income

(expense) – net” in the consolidated statements of income

using the specific identification method. Unrealized gains

and losses, net of tax, on available-for-sale securities are

recorded in accumulated OCI. Unrealized losses that are

considered other than temporary are recorded in “Other

income (expense) – net” with the corresponding reduction

to the carrying basis of the investment. Fixed income

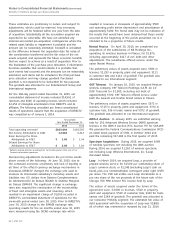

investments of $95 have maturities of less than one year,

$320 within one to three years, $52 within three to five

years, and $213 for five or more years.

Our cash equivalents (money market securities), short-term

investments (certificate and time deposits) and customer

deposits are recorded at amortized cost, and the respective

carrying amounts approximate fair values. Short-term

investments and customer deposits are recorded in “Other

current assets” and our investment securities are recorded

in “Other assets” on the consolidated balance sheets.

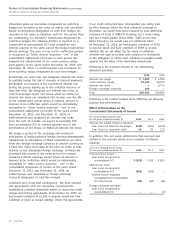

Derivative Financial Instruments

We employ derivatives to manage certain market risks,

primarily interest rate risk and foreign currency exchange

risk. This includes the use of interest rate swaps, interest

rate locks, foreign exchange forward contracts and combined

interest rate foreign exchange contracts (cross-currency

swaps). We do not use derivatives for trading or speculative

purposes. We record derivatives on our consolidated balance

sheets at fair value that is derived from observable market

data, including yield curves and foreign exchange rates (all

of our derivatives are Level 2). Cash flows associated with

derivative instruments are presented in the same category

on the consolidated statements of cash flows as the item

being hedged.

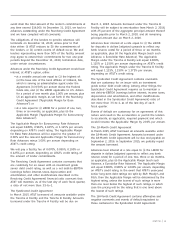

The majority of our derivatives are designated either as a

hedge of the fair value of a recognized asset or liability or

of an unrecognized firm commitment (fair value hedge), or

as a hedge of a forecasted transaction or of the variability

of cash flows to be received or paid related to a recognized

asset or liability (cash flow hedge).

Fair Value Hedging We designate our fixed-to-floating

interest rate swaps as fair value hedges. The purpose of

these swaps is to manage interest rate risk by managing

our mix of fixed-rate and floating-rate debt. These swaps

involve the receipt of fixed-rate amounts for floating

interest rate payments over the life of the swaps without

exchange of the underlying principal amount. Accrued and

realized gains or losses from interest rate swaps impact

interest expense in the consolidated statements of income.

Unrealized gains on interest rate swaps are recorded at

fair market value as assets, and unrealized losses on interest

rate swaps are recorded at fair market value as liabilities.

Changes in the fair values of the interest rate swaps are

exactly offset by changes in the fair value of the underlying

debt. Gains or losses realized upon early termination of our

fair value hedges are recognized in interest expense. In the

years ended December 31, 2015, and December 31, 2014,

no ineffectiveness was measured on interest rate swaps

designated as fair value hedges.

Cash Flow Hedging We designate our cross-currency

swaps as cash flow hedges. We have entered into multiple

cross-currency swaps to hedge our exposure to variability

in expected future cash flows that are attributable to

foreign currency risk generated from the issuance of our

Euro, British pound sterling, Canadian dollar and Swiss Franc

denominated debt. These agreements include initial and

final exchanges of principal from fixed foreign denominations

to fixed U.S. denominated amounts, to be exchanged at a

specified rate, usually determined by the market spot rate

upon issuance. They also include an interest rate swap of

a fixed or floating foreign-denominated rate to a fixed

U.S. denominated interest rate.

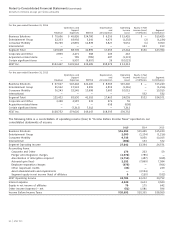

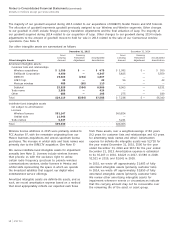

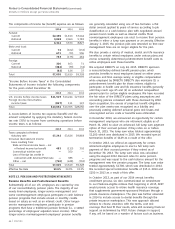

December 31, 2014

Level 1 Level 2 Level 3 Total

Available-for-Sale Securities

Domestic equities $ 1,160 $ — $ — $ 1,160

International equities 553 — — 553

Fixed income bonds — 836 — 836

Asset Derivatives1

Interest rate swaps — 157 — 157

Cross-currency swaps — 1,243 — 1,243

Interest rate locks — 5 — 5

Liability Derivatives1

Cross-currency swaps — (1,506) — (1,506)

Interest rate locks — (133) — (133)

1 Derivatives designated as hedging instruments are reflected as “Other assets,” “Other noncurrent liabilities” and, for a portion of interest rate swaps, “Other current assets”

in our consolidated balance sheets.