AT&T Wireless 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

22

|

AT&T INC.

distributions of $560, which will result in a $560

contribution during 2016. In addition, we will contribute

$175 no later than the due date for our federal income tax

return for 2015. We do not have significant additional

contribution requirements to our pension plans for 2016.

However, a weakness in the equity, fixed income and real

asset markets could require us in future years to make

contributions to the pension plans in order to maintain

minimum funding requirements as established by ERISA.

Investment returns on these assets depend largely on

trends in the U.S. securities markets and the U.S. economy.

In addition, our policy of recognizing actuarial gains and

losses related to our pension and other postretirement plans

in the period in which they arise subjects us to earnings

volatility caused by changes in market conditions. Changes

in our discount rate, which are tied to changes in the bond

market, and changes in the performance of equity markets,

may have significant impacts on the valuation of our

pension and other postretirement obligations at the end

of 2016 (see “Accounting Policies and Estimates”).

OPERATING ENVIRONMENT OVERVIEW

AT&T subsidiaries operating within the United States are

subject to federal and state regulatory authorities. AT&T

subsidiaries operating outside the United States are subject

to the jurisdiction of national and supranational regulatory

authorities in the markets where service is provided.

In the Telecommunications Act of 1996 (Telecom Act),

Congress established a national policy framework intended

to bring the benefits of competition and investment

in advanced telecommunications facilities and services

to all Americans by opening all telecommunications

markets to competition and reducing or eliminating regulatory

burdens that harm consumer welfare. However, since the

Telecom Act was passed, the Federal Communications

Commission (FCC) and some state regulatory commissions

have maintained or expanded certain regulatory requirements

that were imposed decades ago on our traditional wireline

subsidiaries when they operated as legal monopolies.

We are pursuing, at both the state and federal levels,

additional legislative and regulatory measures to reduce

regulatory burdens that are no longer appropriate in a

competitive telecommunications market and that inhibit

our ability to compete more effectively and offer services

wanted and needed by our customers, including initiatives

to transition services from traditional networks to all IP-based

networks. At the same time, we also seek to ensure that

legacy regulations are not further extended to broadband or

wireless services, which are subject to vigorous competition.

In February 2015, the FCC released an order reclassifying

both fixed and mobile consumer broadband Internet access

services as telecommunications services, subject to

comprehensive regulation under the Telecom Act.

The FCC’s decision significantly expands the FCC’s existing

OPERATING ENVIRONMENT AND TRENDS OF THE BUSINESS

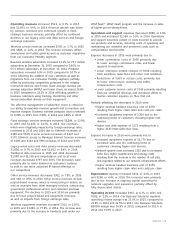

2016 Revenue Trends We expect our operating

environment in 2016 to be very competitive, especially

in the wireless area, as companies and consumers continue

to demand instant connectivity and yet we face a regulatory

environment that appears increasingly unfriendly to

investment in broadband services. Despite these challenges,

we expect to grow our consolidated operating revenues in

2016, driven by our ability to offer integrated wireless, video

and wireline services, as well as continuing growth in fixed

strategic services. We expect that robust competition in the

wireless industry will continue to pressure service revenue

and ARPU. Our AT&T Next program is expected to generate

continued growth in equipment revenue, which has the

corresponding impact of lowering service revenues. In late

December 2015, we announced an end to offering subsidized

handsets for most of our customers. We expect that all our

major customer categories will continue to increase their

use of Internet-based broadband/data services. We expect

continuing declines in traditional telephone service revenues.

We expect our 2015 acquisitions of DIRECTV and wireless

properties in Mexico to increase revenues, although we expect

to incur significant integration costs in the same period.

2016 Expense Trends We expect stable consolidated

operating income margins in 2016 as growth in AT&T Next is

reducing subsidized handset costs over time and we lower

our marginal cost of providing video services and operating

our network. We expect to continue our focus on cost

reductions, driving savings through automation, supply chain,

benefits, digitizing transactions and optimizing network costs.

In addition, the transition of our network to a more

efficient software-based technology is expected to contribute

to favorable expense trends over the next several years.

Expenses related to growth areas of our business, including

wireless data, and integration of DIRECTV’s operations, will

apply offsetting pressure to our operating income margin.

Market Conditions During 2015, the ongoing slow

recovery in the general economy continued to negatively

affect our customers. Certain industries, such as energy

and export-driven businesses are being especially cautious

while residential customers continue to be price sensitive

in selecting offerings, especially in the wireless area, and

continue to focus on offerings that give them efficient

access to video and broadcast services. We expect continued

pressure on pricing during 2016 as we respond to this

intense competition, especially in the wireless business.

Included on our consolidated balance sheets are assets

held by benefit plans for the payment of future benefits.

Our pension plans are subject to funding requirements

of the Employee Retirement Income Security Act of 1974,

as amended (ERISA). In September 2013, we made a

voluntary contribution of a preferred equity interest in

AT&TMobilityIILLC to the trust used to pay pension benefits.

The trust is entitled to receive cumulative annual cash