AT&T Wireless 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

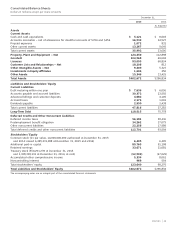

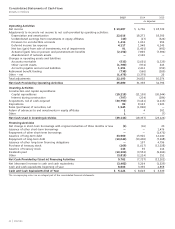

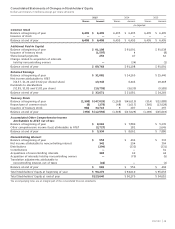

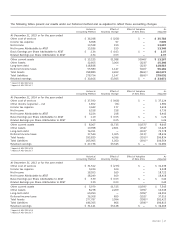

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

48

|

AT&T INC.

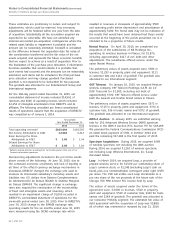

Financial Instruments In January 2016, the FASB issued

ASU No. 2016-01, “Financial Instruments – Overall (Subtopic

825-10): Recognition and Measurement of Financial Assets

and Financial Liabilities” (ASU 2016-01), which will require

us to record changes in the fair value of our equity

investments, except for those accounted for under the equity

method, in net income instead of in accumulated other

comprehensive income. ASU 2016-01 will become effective

for fiscal years and interim periods beginning after

December 15, 2017, and with the exception of certain

disclosure requirements, is not subject to early adoption.

Income Taxes We provide deferred income taxes for

temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and

the computed tax basis of those assets and liabilities.

We provide valuation allowances against the deferred tax

assets (included, together with our deferred income tax

assets, as part of our reportable net deferred income tax

liabilities on our consolidated balance sheets), for which

the realization is uncertain. We review these items regularly

in light of changes in federal and state tax laws and

changes in our business.

Cash and Cash Equivalents Cash and cash equivalents

include all highly liquid investments with original

maturities of three months or less. The carrying amounts

approximate fair value. At December 31, 2015, we held

$2,117 in cash and $3,004 in money market funds and

other cash equivalents.

Revenue Recognition Revenues derived from wireless,

fixed telephone, data and video services are recognized

when services are provided. This is based upon either usage

(e.g., minutes of traffic/bytes of data processed), period of

time (e.g., monthly service fees) or other established fee

schedules. Our service revenues are billed either in advance,

arrears or are prepaid.

We record revenue reductions for estimated future

adjustments to customer accounts, other than bad debt

expense, at the time revenue is recognized based on

historical experience. Service revenues include billings

to our customers for various regulatory fees imposed on

us by governmental authorities. We report revenues from

transactions between us and our customers net of taxes

the government authorities require us to collect from

our customers in our consolidated statements of income.

Cash incentives given to customers are recorded as a

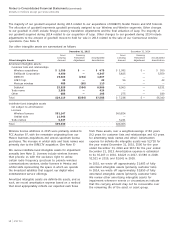

Revenue Recognition In May 2014, the FASB issued

ASU No. 2014-09, “Revenue from Contracts with Customers

(Topic 606)” (ASU 2014-09) and has since modified the

standard with ASU 2015-14, “Deferral of the Effective

Date.” These standards replace existing revenue recognition

rules with a comprehensive revenue measurement and

recognition standard and expanded disclosure requirements.

ASU 2014-09 becomes effective for annual reporting

periods beginning after December 15, 2017, at which point

we plan to adopt the standard. Upon initial evaluation,

we believe the key changes in the standard that impact

our revenue recognition relate to the allocation of contract

revenues between various services and equipment, and

the timing in which those revenues are recognized.

We are still in the process of determining the impact

on the timing of revenue recognition and the allocation

of revenue to products and segments.

ASU 2014-09 also specifies that all incremental costs of

obtaining and direct costs of fulfilling our contracts with

customers should be deferred and recognized over the

contract period or expected customer life. In the third quarter

of 2015, we changed our accounting policy for the costs of

fulfilling contracts with customers to defer all recoverable

costs while not changing our approach to acquisition costs.

We believe, as a result of our accounting policy change for

fulfillment costs, that the requirement to defer such costs in

the new standard will not result in a significant change to our

results. The requirement to defer contract acquisition costs

however, will result in the recognition of a deferred charge on

our balance sheets, but as the industry continues to undergo

changes in how devices and services are sold to customers

with impacts on the resulting commissions paid to our

internal and external salesforces, we cannot currently

estimate impact of this change.

The FASB allows two adoption methods under ASU 2014-09.

Under one method, a company will apply the rules to

contracts in all reporting periods presented, subject to

certain allowable exceptions. Under the other method, a

company will apply the rules to all contracts existing as of

January 1, 2018, recognizing in beginning retained earnings

an adjustment for the cumulative effect of the change and

provide additional disclosures comparing results to previous

rules. While we continue to evaluate the impact of the

new standard and available adoption methods, we believe

the standard will require us to implement new revenue

accounting systems and processes, which will significantly

change our internal controls over revenue recognition.

In addition, the implementation of the new systems and

processes will impact our considerations of which adoption

methods we intend to use.