AT&T Wireless 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

|

AT&T INC.

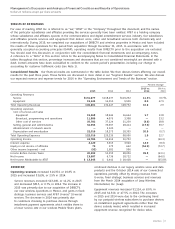

Our second priority is to provide a consistent

cash return to our owners through a methodical

dividend policy.

We have increased the quarterly dividend

for 32 consecutive years, and we are proud

of that achievement.

In 2014, as we invested significantly to build

out our wireless, fiber and IP networks, our

dividend payout as a percentage of cash flows

moved above our historic average. But in 2015,

our ratio moved back in line with our normal

targeted levels, as we completed those major

investment projects. Going forward, we expect

our dividend payout to be in the 70s as a

percentage of free cash flow.

In a highly capital-intensive industry where

the ability to invest is a competitive advantage,

we believe a strong balance sheet with high-

quality investment-grade debt is critical.

As a result of last year’s DIRECTV acquisition,

we increased our debt levels higher than our

historical norm. However, we’re confident that

our future cash flows are sufficient to bring

those debt levels back into our traditional

target range over the next 3 years. In fact, for

the next 3 years, we’re planning to use nearly

all of our cash flow after dividends to pay

down debt.

Finally, we have a strong history of returning

cash to our owners through share repurchases

when our cash flows exceed the capital

requirements of the business, plus the dividend

and debt retirements.

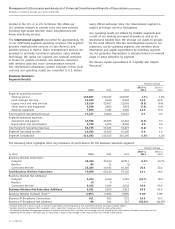

mobile device in the United States and Canada,

as if they were in Mexico. And it’s all enabled by

our network’s ability to provide fast and highly

secure mobile LTE connectivity to 355 million

people and businesses in the United States

and Mexico.

Meanwhile, our DIRECTV operations in Latin

America are good, self-sustaining franchises.

Despite operating in a region of the world with

challenged economies, our local management

teams are experienced operators in these

environments and know the markets well. This

gives us the confidence to be patient as we

evaluate options for how best to take advantage

of these quality businesses in the future.

CAPITAL ALLOCATION

Our capital allocation approach

is very straightforward. Our first

priority is to invest for growth.

We operate in a highly capital-intensive industry.

Leadership over the long term requires

consistent, sustained investment. In fact,

over the last 5 years, we have invested over

$140 billion, including capital investments

in our wireless and wireline networks and

acquisitions of wireless spectrum and

operations, to build out one of the most

advanced wireless, fiber and IP networks in

the world. We believe it is critical to lead in

developing new technologies to ensure we

have the integrated products and services

that will set us apart and give us the lowest

cost structure with the greatest efficiency

and productivity in the industry. As we look

out over the next 3 years, we anticipate that

our capital spending will continue to run

around 15% of our service revenues.