AT&T Wireless 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

59

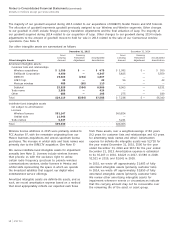

NOTE 8. EQUITY METHOD INVESTMENTS

Investments in partnerships, joint ventures and less than

majority-owned subsidiaries in which we have significant

influence are accounted for under the equity method.

In the third quarter of 2015, we acquired DIRECTV (see

Note 5), which included various equity method investments.

The earnings from these investments, subsequent to the

acquisition date, are included in the 2015 activity in the

table below, as well as our consolidated statement of

income for 2015.

Our investments in equity affiliates at December 31, 2015

primarily include our interests in SKY Mexico, Game

Show Network, Otter Media Holdings, YP Holdings LLC

(YP Holdings), MLB Network and NW Sports Net.

SKY Mexico We hold a 41.0% interest in SKY Mexico,

which was acquired as part of DIRECTV. SKY Mexico is a

leading pay-TV provider in Mexico.

Game Show Network (GSN) We hold a 42.0% interest in

GSN, which was also a part of the acquisition of DIRECTV.

GSN is a television network dedicated to game-related

programming and Internet interactive game playing.

Otter Media Holdings We hold a 43.4% interest in Otter

Media Holdings, a venture between The Chernin Group and

AT&T that is focused on acquiring, investing in and launching

over-the-top subscription video services.

YP Holdings We hold a 47.0% interest in YP Holdings, an

online advertising company and directory publisher.

MLB Network We hold a 16.7% interest in MLB Network,

which offers broadcasts dedicated to Major League Baseball

and was acquired with DIRECTV.

NW Sports Net We hold a 29.0% interest in NW Sports

Net, a regional sports network acquired as part of DIRECTV.

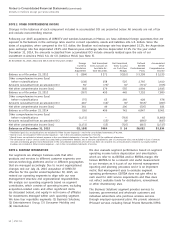

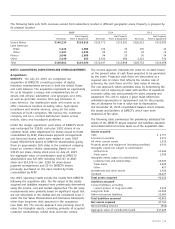

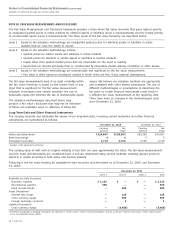

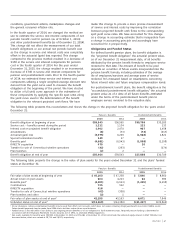

The following table is a reconciliation of our investments

in equity affiliates as presented on our consolidated

balance sheets:

2015 2014

Beginning of year $ 250 $ 3,860

Additional investments 77 226

DIRECTV investments acquired 1,232 —

Equity in net income of affiliates 79 175

Dividends and distributions received (30) (148)

Sale of América Móvil shares — (3,817)

Other adjustments (2) (46)

End of year $1,606 $ 250

Undistributed earnings from equity affiliates were $162 and

$88 at December 31, 2015 and 2014.

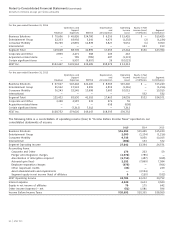

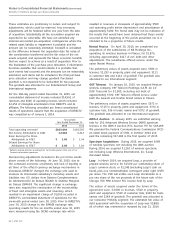

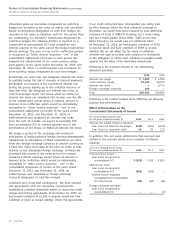

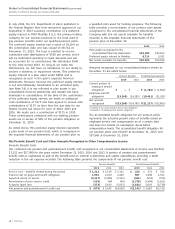

NOTE 9. DEBT

Long-term debt of AT&T and its subsidiaries, including interest

rates and maturities, is summarized as follows at December 31:

2015 2014

Notes and debentures1

Interest Rates Maturities2

0.49% – 2.99% 2015 – 2022 $ 34,265 $ 22,127

3.00% – 4.99% 2015 – 2046 54,678 31,516

5.00% – 6.99% 2015 – 2095 31,140 23,260

7.00% – 9.50% 2015 – 2097 5,805 6,153

Other 15 —

Fair value of interest rate swaps

recorded in debt 109 125

126,012 83,181

Unamortized (discount) premium – net (842) (1,549)

Unamortized issuance costs (323) (233)

Total notes and debentures 124,847 81,399

Capitalized leases 884 430

Other 416 —

Total long-term debt, including

current maturities 126,147 81,829

Current maturities of long-term debt (7,632) (6,051)

Total long-term debt $118,515 $ 75,778

1 Includes credit agreement borrowings.

2 Maturities assume putable debt is redeemed by the holders at the next opportunity.

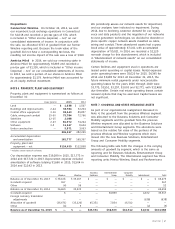

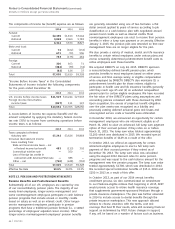

On July 24, 2015, we added $20,585 in long-term debt,

including capital leases, related to our acquisition of DIRECTV.

DIRECTV’s debt included both fixed and floating-rate coupons

with a weighted average rate of approximately 4.6% (ranging

from 1.75% to 9.50%) and had maturities ranging from 2015

to 2042. Included in our “Total notes and debentures” balance

in the table above was the face value of acquired debt from

DIRECTV of $17,050, which had a carrying amount of $17,787

at December 31, 2015.

Included in the table above at December 31, 2015, was

approximately $738, representing the remaining excess

of the fair value over the recorded value of debt in

connection with the acquisition of DIRECTV, all of which

was included in our “Unamortized (discount) premium – net.”

The excess is amortized over the remaining lives of the

underlying debt obligations.

We had outstanding Euro, British pound sterling, Canadian

dollar, Swiss franc and Brazilian real denominated debt of

approximately $26,221 and $24,568 at December 31, 2015

and 2014. The weighted-average interest rate of our entire

long-term debt portfolio, including the impact of derivatives,

decreased from 4.2% at December 31, 2014 to 4.0% at

December 31, 2015.

Other debt includes financing arrangements we have in

Mexico for the construction of wireless network facilities

that totaled $416, at December 31, 2015.