AT&T Wireless 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

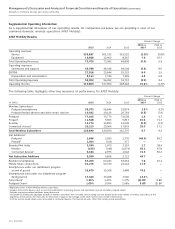

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

30

|

AT&T INC.

Virtually all of our capital expenditures are spent on our

communications networks and our video services and

support systems for our digital entertainment services.

Capital expenditures, excluding interest during construction,

decreased $1,981 from 2014, reflecting the completion

of our LTE build and other Project Velocity IP initiatives

in 2014. In connection with capital improvements to our

wireless network in Mexico, we also negotiated in 2015

favorable payment terms (referred to as vendor financing).

In 2015, we deferred $684 of vendor financing related

to capital additions to future periods. Capital expenditures

also include spending for DIRECTV, GSF Telecom and

Nextel Mexico after the acquisition dates. As part of

our organizational realignment, we no longer allocate

capital expenditures to our segments.

We expect our 2016 capital investment, which includes

our capital expenditures plus vendor financing payments

related to our Mexico network, for our existing businesses

to be in the $22,000 range, and we expect our capital

investment to be in the 15percent range of service revenues

or lower from 2016 through 2018. The amount of capital

investment is influenced by demand for services and products,

capacity needs and network enhancements. We are also

focused on ensuring merger commitments are met.

Cash Used in or Provided by Financing Activities

We paid dividends of $10,200 in 2015, $9,552 in 2014, and

$9,696 in 2013. The increase in 2015 is primarily due to the

increase in shares outstanding resulting from our acquisition

of DIRECTV and the increase in the quarterly dividend

approved by our Board of Directors in December 2014.

The decrease in 2014 reflects the decline in shares

outstanding resulting from repurchase activity, partially offset

by dividend rate increases. In December2015, our Board of

Directors approved a 2.1% increase in the quarterly dividend

from $0.47 to $0.48 per share. This follows a 2.2% dividend

increase approved by our Board in December2014. Dividends

declared by our Board of Directors totaled $1.89per share

in 2015, $1.85 per share in 2014, and $1.81per share in

2013. Our dividend policy considers the expectations and

requirements of stockholders, capital funding requirements of

AT&T and long-term growth opportunities. It is our intent to

provide the financial flexibility to allow our Board of Directors

to consider dividend growth and to recommend an increase in

dividends to be paid in future periods. All dividends remain

subject to declaration by our Board of Directors.

During 2015, we received net proceeds of $33,969 from

the issuance of $34,129 in long-term debt in various

markets, with an average weighted maturity of

approximately 12years and a weighted average coupon

of 2.7%. Debt issued included:

• February 2015 issuance of $2,619 of 4.600% global

notes due 2045.

• March 2015 borrowings under a variable rate term loan

facility due 2018, variable rate term loan facility due

LIQUIDITY AND CAPITAL RESOURCES

We had $5,121 in cash and cash equivalents available

at December 31, 2015. Approximately $807 of our cash

and cash equivalents resided in foreign jurisdictions, some

of which are subject to restrictions on repatriation.

Cash and cash equivalents decreased $3,482 since

December31,2014. We also had $401 in short-term

investments, which we included in “Other current assets”

on our consolidated balance sheets. In 2015, cash inflows

were primarily provided by cash receipts from operations,

including cash from our sale and transfer of certain

equipment installment receivables to third parties and

long-term debt issuances. These inflows were offset by

cash used to meet the needs of the business, including, but

not limited to, payment of operating expenses; acquisitions

of wireless spectrum, DIRECTV, GSF Telecom Holdings,

S.A.P.I.deC.V. (GSF Telecom) and Nextel Mexico; funding

capital expenditures; debt repayments; dividends to

stockholders; and collateral posting (see Note9).

We discuss many of these factors in detail below.

Cash Provided by or Used in Operating Activities

During 2015, cash provided by operating activities was

$35,880, compared to $31,338 in 2014. Higher operating

cash flows in 2015 were primarily due to improved

operating results, our acquisition of DIRECTV and working

capital improvements.

During 2014, cash provided by operating activities was

$31,338 compared to $34,796 in 2013. Lower operating

cash flows in 2014 were primarily due to wireless device

financing related to AT&T Next, which results in cash

collection over the installment period instead of at the time

of sale, increased inventory levels and retirement benefit

funding. Proceeds from the sale of equipment installment

receivables and the timing of working capital payments

partially offset the decline in operating cash flows.

Cash Used in or Provided by Investing Activities

During 2015, cash used in investing activities consisted

primarily of:

• $17,740 for acquisitions of spectrum licenses, largely

due to the remaining payment for AWS spectrum

licenses in the AWS-3 Auction.

• $19,218 in capital expenditures, excluding interest

during construction.

• $13,019 net of cash acquired for the acquisitions

of DIRECTV, GSF Telecom, Nextel Mexico and

other operations.

During 2015, we also received $1,945 upon the maturity

of certain short-term investments and paid $400 for

additional short-term investments.