AT&T Wireless 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

55

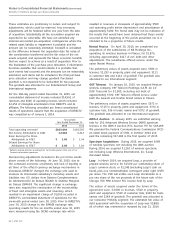

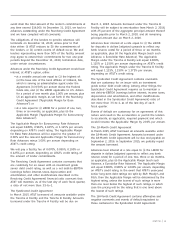

The income approach estimates fair value for an asset based

on the present value of cash flows projected to be generated

by the asset. Projected cash flows are discounted at a

required rate of return that reflects the relative risk of

achieving the cash flows and the time value of money.

The cost approach, which estimates value by determining the

current cost of replacing an asset with another of equivalent

economic utility, was used primarily for plant, property and

equipment. The cost to replace a given asset reflects the

estimated reproduction or replacement cost for the property,

less an allowance for loss in value due to depreciation.

Our December 31, 2015 consolidated balance sheet includes

the assets and liabilities of DIRECTV, which have been

measured at fair value.

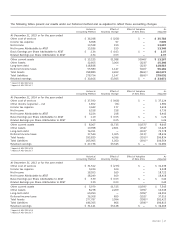

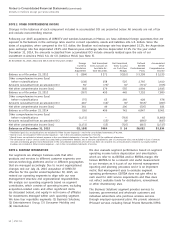

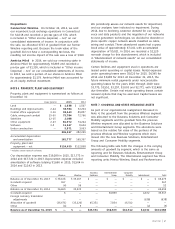

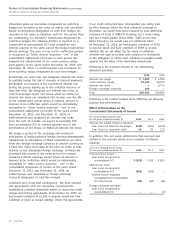

The following table summarizes the preliminary estimated fair

values of the DIRECTV assets acquired and liabilities assumed

and related deferred income taxes as of the acquisition date.

Assets acquired

Cash $ 4,797

Accounts receivable 2,011

All other current assets 1,535

Property, plant and equipment (including satellites) 9,301

Intangible assets not subject to amortization

Orbital slots 11,946

Trade name 1,382

Intangible assets subject to amortization

Customer lists and relationships 19,505

Trade name 2,905

Other 457

Investments and other assets 2,360

Goodwill 34,427

Total assets acquired 90,626

Liabilities assumed

Current liabilities, excluding

current portion of long-term debt 5,693

Long-term debt 20,585

Other noncurrent liabilities 16,585

Total liabilities assumed 42,863

Net assets acquired 47,763

Noncontrolling interest (354)

Aggregate value of consideration paid $47,409

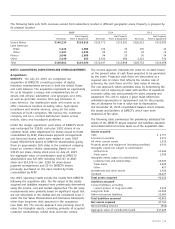

NOTE 5. ACQUISITIONS, DISPOSITIONS AND OTHER ADJUSTMENTS

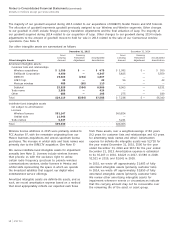

Acquisitions

DIRECTV On July 24, 2015, we completed our

acquisition of DIRECTV, a leading provider of digital

television entertainment services in both the United States

and Latin America. The acquisition represents an opportunity

for us to integrate a unique and complementary set of

assets and achieve substantial cost synergies over time,

as well as generate revenue from pay television in

Latin America. Our distribution scale will enable us to

offer consumers bundles including video, high-speed

broadband and mobile services, using all the sales

channels of both companies. We believe the combined

company will be a content distribution leader across

mobile, video and broadband platforms.

Under the merger agreement, each share of DIRECTV stock

was exchanged for $28.50 cash plus 1.892 shares of our

common stock. After adjustment for shares issued to trusts

consolidated by AT&T, share-based payment arrangements

and fractional shares, which were settled in cash, AT&T

issued 954,407,524 shares to DIRECTV shareholders, giving

them an approximate 16% stake in the combined company,

based on common shares outstanding. Based on our

$34.29 per share closing stock price on July 24, 2015,

the aggregate value of consideration paid to DIRECTV

shareholders was $47,409, including $32,727 of AT&T

stock and $14,378 in cash, $299 for share-based

payment arrangements and $5 for DIRECTV shares

previously purchased on the open market by trusts

consolidated by AT&T.

Our 2015 operating results include the results from DIRECTV

following the acquisition date. The fair values of the assets

acquired and liabilities assumed were preliminarily determined

using the income, cost and market approaches. The fair value

measurements were primarily based on significant inputs that

are not observable in the market and are considered Level 3

under the Fair Value Measurement and Disclosure framework,

other than long-term debt assumed in the acquisition

(see Note 10). The income approach was primarily used to

value the intangible assets, consisting primarily of acquired

customer relationships, orbital slots and trade names.

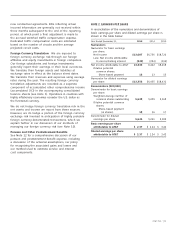

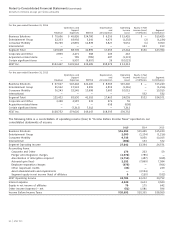

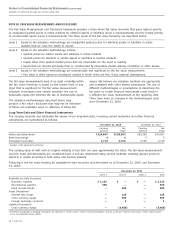

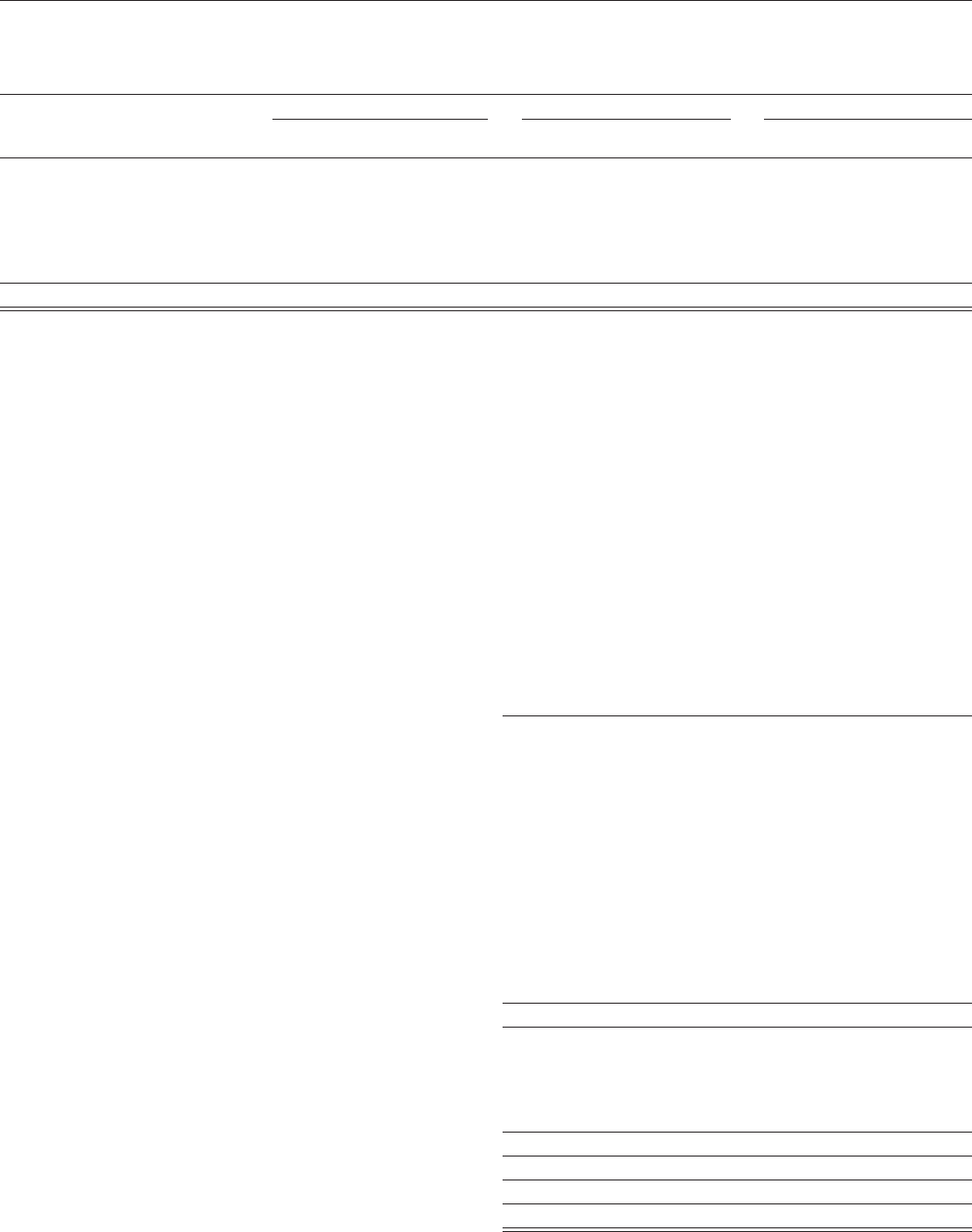

The following table sets forth revenues earned from subscribers located in different geographic areas. Property is grouped by

its physical location.

2015 2014 2013

Net Property, Net Property, Net Property,

Revenues Plant & Equipment Revenues Plant & Equipment Revenues Plant & Equipment

United States $140,234 $118,515 $129,772 $112,092 $126,212 $110,090

Latin American

Brazil 1,224 1,384 142 33 136 41

Other 1,157 1,530 99 67 92 72

Mexico 2,046 2,369 94 20 90 24

Other 2,140 652 2,340 686 2,222 741

Total $146,801 $124,450 $132,447 $112,898 $128,752 $110,968