AT&T Wireless 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

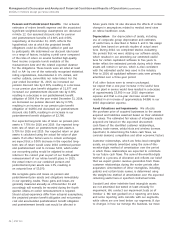

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

16

|

AT&T INC.

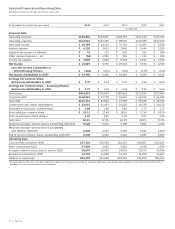

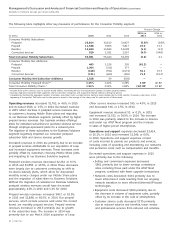

Entertainment Group

Segment Results

Percent Change

2015 vs. 2014 vs.

2015 2014 2013 2014 2013

Segment operating revenues

Video entertainment $20,271 $ 6,826 $ 5,810 — 17.5%

High-speed Internet 6,601 5,522 4,219 19.5 30.9

Legacy voice and data services 5,914 7,592 9,667 (22.1) (21.5)

Other service and equipment 2,508 2,293 1,846 9.4 24.2

Total Segment Operating Revenues 35,294 22,233 21,542 58.7 3.2

Segment operating expenses

Operations and support 28,345 18,992 17,943 49.2 5.8

Depreciation and amortization 4,945 4,473 4,815 10.6 (7.1)

Total Segment Operating Expenses 33,290 23,465 22,758 41.9 3.1

Segment Operating Income (Loss) 2,004 (1,232) (1,216) — (1.3)

Equity in Net Income (Loss) of Affiliates (4) (2) — — —

Segment Contribution $ 2,000 $ (1,234) $ (1,216) — (1.5)%

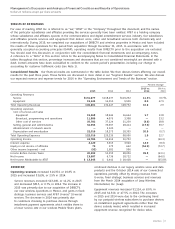

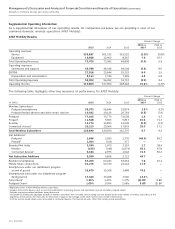

The following table highlights other key measures of performance for the Entertainment Group segment:

Percent Change

2015 vs. 2014 vs.

(in 000s) 2015 2014 2013 2014 2013

Video Connections

Satellite 19,784 — — — —

U-verse 5,614 5,920 5,257 (5.2) 12.6

Total Video Connections 25,398 5,920 5,257 — 12.6

Video Net Additions1

Satellite 240 — — — —

U-verse (306) 663 889 — (25.4)

Net Video Additions (66) 663 889 — (25.4)

Broadband Connections

IP 12,356 11,383 9,484 8.5 20.0

DSL 1,930 3,061 4,829 (36.9) (36.6)

Total Broadband Connections 14,286 14,444 14,313 (1.1) 0.9

Broadband Net Additions

IP 973 1,899 2,266 (48.8) (16.2)

DSL (1,130) (1,768) (2,103) 36.1 15.9

Net Broadband Additions (157) 131 163 — (19.6)

Retail Consumer Switched Access Lines 7,286 9,243 12,013 (21.2) (23.1)

U-verse Consumer VoIP Connections 5,212 4,759 3,701 9.5 28.6

Total Retail Consumer Voice Connections 12,498 14,002 15,714 (10.7)% (10.9)%

1 Excludes acquisition-related additions during the period.

Video entertainment revenues increased $13,445 in

2015 and $1,016, or 17.5%, in 2014. The 2015 increase

was primarily related to our acquisition of DIRECTV.

With our acquisition of DIRECTV, we are now focusing

our sales efforts on satellite service as there are lower

content costs for satellite subscribers. U-verse video

revenue increased $932 in 2015. The 2014 increase

Operating revenues increased $13,061, or 58.7%, in 2015

and $691, or 3.2%, in 2014. Our July 2015 acquisition of

DIRECTV was largely responsible for higher revenues

beginning in the third quarter of 2015. Also contributing to

the increases was continued strong growth in consumer

IP broadband and U-verse video, which more than offset

lower revenues from legacy voice and data products.