AT&T Wireless 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

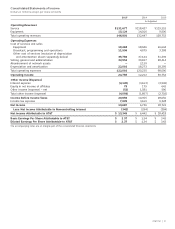

46

|

AT&T INC.

Notes to Consolidated Financial Statements

Dollars in millions except per share amounts

enhances comparability to other companies in the industry.

This change in accounting did not have an impact on our

wireless activities, due to the absence of these types of

expenses in those business activities.

The cumulative effect of the change on Retained Earnings as

of January 1, 2013, was an increase of approximately $2,959

on our consolidated balance sheet. This change did not have

an impact on cash provided by or used in operations for any

period presented.

New Accounting Standards

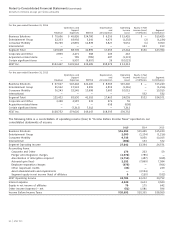

Long-Term Debt and Debt Issuance Costs In April 2015,

the Financial Accounting Standards Board (FASB) issued

Accounting Standards Update (ASU) No. 2015-03, “Interest

– Imputation of Interest: Simplifying the Presentation of

Debt Issuance Costs” (ASU 2015-03), which resulted in the

reclassification of debt issuance costs from “Other Assets”

to inclusion as a reduction of our reportable “Long-Term

Debt” balance on our consolidated balance sheets. Since

ASU 2015-03 does not address deferred issuance costs for

line-of-credit arrangements, the FASB issued ASU No. 2015-15,

“Interest – Imputation of Interest: Presentation and

Subsequent Measurement of Debt Issuance Costs Associated

with Line-of-Credit Arrangements” (ASU 2015-15), in

August 2015. ASU 2015-15 allows a company to defer debt

issuance costs associated with line-of-credit arrangements,

including arrangements with no outstanding borrowings,

classify them as an asset, and amortize them over the term

of the arrangements. We elected to adopt ASU 2015-03 early,

with full retrospective application as required by the guidance,

and ASU 2015-15, which was effective immediately. These

standards did not have a material impact on our consolidated

balance sheets and had no impact on our cash flows

provided by or used in operations for any period presented.

Business Combinations In September 2015, the FASB

issued ASU No. 2015-16, “Business Combinations –

Simplifying the Accounting for Measurement-Period

Adjustments” (ASU 2015-16), which results in the ability

to recognize, in current period earnings, any changes in

provisional amounts during the measurement period after

the closing of an acquisition, instead of restating prior

periods for these changes. We elected to adopt ASU

2015-16 early, which had no impact on our consolidated

balance sheet as of December 31, 2015, or our consolidated

operating results and cash flows for the year ended.

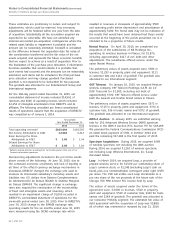

Deferred Income Taxes and Liabilities In November 2015,

the FASB issued ASU No. 2015-17, “Income Taxes

(Topic 740) – Balance Sheet Classification of Deferred Taxes”

(ASU 2015-17), which requires companies report their

deferred tax liabilities and deferred tax assets, together as

a single noncurrent item on their classified balance sheets.

We elected to adopt ASU 2015-17 early, and applied it

retrospectively as allowed by the standard. Our adoption

of ASU 2015-17 did not have a material impact on our

consolidated balance sheets and had no impact on our cash

provided by or used in operations for any period presented.

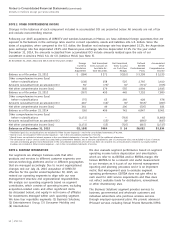

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation Throughout this document, AT&T Inc.

is referred to as “AT&T,” “we” or the “Company.” The

consolidated financial statements include the accounts of

the Company and our majority-owned subsidiaries and

affiliates, including the results of DIRECTV and wireless

properties in Mexico for the period from acquisition through

December 31, 2015. Our subsidiaries and affiliates operate

in the communications and digital entertainment services

industry, providing services and equipment that deliver voice,

video and broadband services domestically and internationally.

All significant intercompany transactions are eliminated in the

consolidation process. Investments in less than majority-

owned subsidiaries and partnerships where we have

significant influence are accounted for under the equity

method. Earnings from certain investments accounted for

using the equity method are included for periods ended

within up to one quarter of our period end. We also recorded

our proportionate share of our equity method investees’

other comprehensive income (OCI) items, including actuarial

gains and losses on pension and other postretirement benefit

obligations and cumulative translation adjustments.

The preparation of financial statements in conformity with

U.S. generally accepted accounting principles (GAAP) requires

management to make estimates and assumptions that

affect the amounts reported in the financial statements

and accompanying notes, including estimates of probable

losses and expenses. Actual results could differ from

those estimates. Certain amounts have been reclassified to

conform to the current period’s presentation, including our

presentation of “Equipment” and “Broadcast, programming

and operations” costs separately from other cost of services

in the consolidated statements of income.

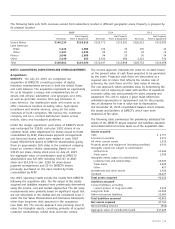

Customer Fulfillment Costs In August 2015, with

our acquisition of DIRECTV, we announced a change in

accounting for customer set-up and installation costs.

Historically we have followed an accounting policy of

deferring customer set-up and installation costs only to

the extent of deferred revenues recorded for upfront fees

(e.g., activation charges), and to expense any costs that

exceed deferred revenues. After discussing this change with

the Securities and Exchange Commission, we changed our

accounting to a preferable method of capitalizing these

costs and amortizing them over the expected economic life

of the customer relationship of approximately four years,

subject to an assessment of the recoverability of such

costs. This change in accounting principle impacts video,

broadband Internet and wireline voice services and is

considered preferable in that it provides an accurate

reflection of assets (i.e., the contractual customer

relationship obtained through the set-up and installation)

generated by those specific business activities. Our new

accounting method is more comparable with the accounting

method used in the cable entertainment industry. With our

acquisition of DIRECTV, changing to this accounting method