AT&T Wireless 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

47

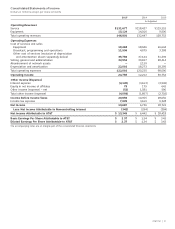

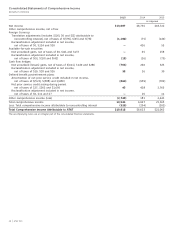

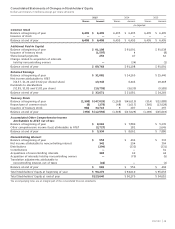

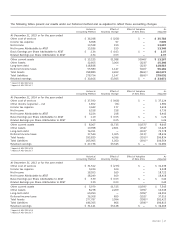

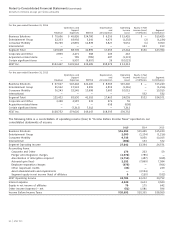

The following tables present our results under our historical method and as adjusted to reflect these accounting changes:

Historical Effect of Effect of Adoption As

Accounting Method Voluntary Change of New ASUs Adjusted

At December 31, 2015 or for the year ended

Other cost of services $ 36,038 $ (256) $ — $ 35,782

Income tax expense 6,908 97 — 7,005

Net Income 13,528 159 — 13,687

Net Income Attributable to AT&T 13,186 159 — 13,345

Basic Earnings per Share Attributable to AT&T $ 2.34 $ 0.03 $ — $ 2.37

Diluted Earnings per Share Attributable to AT&T 2.34 0.03 — 2.37

Other current assets $ 12,225 $1,588 $(546)2 $ 13,267

Other Assets 12,605 3,064 (323)1 15,346

Long-term debt 118,838 — (323)1 118,515

Deferred income taxes 55,580 1,147 (546)2 56,181

Total Assets 398,889 4,652 (869)1,2 402,672

Total Liabilities 278,754 1,147 (869)1,2 279,032

Retained earnings $ 30,166 $3,505 $ — $ 33,671

1 Impact of ASU 2015-03.

2 Impact of ASU 2015-17.

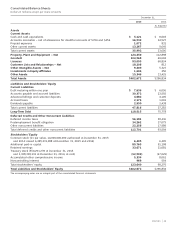

Historical Effect of Effect of Adoption As

Accounting Method Voluntary Change of New ASUs Adjusted

At December 31, 2014 or for the year ended

Other cost of services $ 37,590 $ (466) $ — $ 37,124

Other income (expense) – net 1,652 (71) — 1,581

Income tax expense 3,442 177 — 3,619

Net Income 6,518 218 — 6,736

Net Income Attributable to AT&T 6,224 218 — 6,442

Basic Earnings per Share Attributable to AT&T $ 1.19 $ 0.05 $ — $ 1.24

Diluted Earnings per Share Attributable to AT&T 1.19 0.05 — 1.24

Other current assets $ 8,067 $1,735 $(157)2 $ 9,645

Other Assets 10,998 2,661 (234)1 13,425

Long-term debt 76,011 — (233)1 75,778

Deferred income taxes 37,544 1,005 (113)2 38,436

Total Assets 292,829 4,396 (391)1,2 296,834

Total Liabilities 205,905 1,050 (391)1,2 206,564

Retained earnings $ 27,736 $3,345 $ — $ 31,081

1 Impact of ASU 2015-03.

2 Impact of ASU 2015-17.

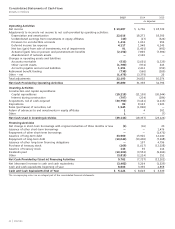

Historical Effect of Effect of Adoption As

Accounting Method Voluntary Change of New ASUs Adjusted

At December 31, 2013 or for the year ended

Other cost of services $ 31,512 $ (273) $ — $ 31,239

Income tax expense 9,224 104 — 9,328

Net Income 18,553 169 — 18,722

Net Income Attributable to AT&T 18,249 169 — 18,418

Basic Earnings per Share Attributable to AT&T $ 3.39 $ 0.03 $ — $ 3.42

Diluted Earnings per Share Attributable to AT&T 3.39 0.03 — 3.42

Other current assets $ 5,979 $1,725 $(159)2 $ 7,545

Other Assets 8,278 2,269 (199)1 10,348

Long-term debt 69,290 — (199)1 69,091

Deferred income taxes 36,308 859 (152)2 37,015

Total Assets 277,787 3,994 (358)1,2 281,423

Total Liabilities 186,305 866 (358)1,2 186,813

Retained earnings $ 31,141 $3,128 $ — $ 34,269

1 Impact of ASU 2015-03.

2 Impact of ASU 2015-17.