AT&T Wireless 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

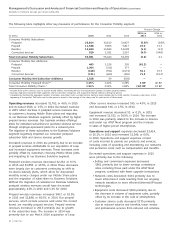

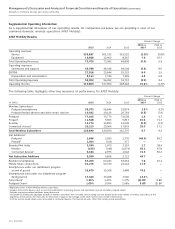

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

28

|

AT&T INC.

We review customer relationships and other long-lived

assets for impairment whenever events or circumstances

indicate that the carrying amount may not be recoverable

over the remaining life of the asset or asset group.

To determine that the asset is recoverable, we verify

that the expected undiscounted future cash flows

directly related to that asset exceed its book value.

We evaluate our investments to determine whether

market declines are temporary and accordingly reflected

in accumulated other comprehensive income, or other-

than-temporary and recorded as an expense in “Other

income (expense) – net” in the consolidated statements

of income. This evaluation is based on the length of time

and the severity of decline in the investment’s value.

In 2014, we identified an immaterial other-than-

temporary decline in the value of equity method

investments and various cost investments.

Income Taxes Our estimates of income taxes and

the significant items giving rise to the deferred assets

and liabilities are shown in Note 11 and reflect our

assessment of actual future taxes to be paid on items

reflected in the financial statements, giving consideration

to both timing and probability of these estimates. Actual

income taxes could vary from these estimates due to

future changes in income tax law or the final review of

our tax returns by federal, state or foreign tax authorities.

We use our judgment to determine whether it is more

likely than not that we will sustain positions that we have

taken on tax returns and, if so, the amount of benefit

to initially recognize within our financial statements.

We regularly review our uncertain tax positions and

adjust our unrecognized tax benefits (UTBs) in light

of changes in facts and circumstances, such as

changes in tax law, interactions with taxing authorities

and developments in case law. These adjustments to

our UTBs may affect our income tax expense. Settlement

of uncertain tax positions may require use of our cash.

New Accounting Standards

See Note 1 for a discussion of recently issued or adopted

accounting standards.

OTHER BUSINESS MATTERS

DIRECTV In July 2015, we completed our acquisition

of DIRECTV, a leading provider of digital television

entertainment services in both the United States and

Latin America. The acquisition gives us a unique and

complementary set of assets and the opportunity to

achieve substantial cost synergies over time, as well as

increasing revenue from bundling and integrating services.

Our distribution scale enables us to offer consumers attractive

combinations of video, high-speed broadband and mobile

services, using all the sales channels of both companies. We

believe the combined company will be a content distribution

leader across mobile, video and broadband platforms.

Under the merger agreement, each share of DIRECTV

stock was exchanged for $28.50 cash plus 1.892 shares

of our common stock. After adjustment for shares issued

to trusts consolidated by AT&T, stock based payment

arrangements and fractional shares, which were settled

in cash, AT&T issued 954,407,524 shares to DIRECTV

shareholders, giving them an approximate 16% stake

in the combined company, based on common shares

outstanding. Based on our $34.29per share closing stock

price on July 24, 2015, the aggregate value of consideration

paid to DIRECTV shareholders was $47,409, including

$32,727 of AT&T stock and $14,378 in cash, $299 for

share-based payment arrangements and $5 for DIRECTV

shares previously purchased on the open market by

trusts consolidated by AT&T.

The FCC approved the transaction subject to the following

conditions:

• Fiber to the Premises Deployment – Within four

years, we will offer our all-fiber Internet access service

to at least 12.5 million customer locations such as

residences, home offices and very small businesses.

Combined with our existing high-speed broadband

network, at least 25.7 million customer locations will

have access to broadband speeds of 45Mbps or higher

by the end of the four-year build. While the addition

of medium and large businesses do not count towards

the commitments, we will have the opportunity to

provide services to those customers as part of this

expansion. In addition, we will offer 1 Gbps fiber

Internet access service pursuant to applicable E-rate

rules to any eligible school or library requesting that

service within or contiguous to our all-fiber footprint.

• Discounted Broadband Services Program – Within our

21-state area, we will offer a discounted fixed broadband

service to low-income households that qualify for the

government’s Supplemental Nutrition Assistance Program.

In locations where it is available, service with speeds

of at least 10Mbps will be offered for ten dollars per

month. Elsewhere, 5Mbps service will be offered for

ten dollars per month or, in some locations, 3Mbps

service will be offered for five dollars per month.

• Non-Discriminatory Usage-Based Practices – We are

required to refrain from using usage-based allowances

or other retail terms and conditions on our fixed

broadband Internet access service, as defined in the

order, to discriminate in favor of our own online video

services. We can and will continue to offer discounts

on integrated bundles of our video and fixed

broadband services.