AT&T Wireless 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

21

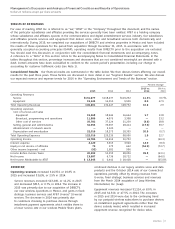

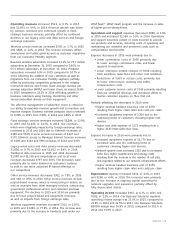

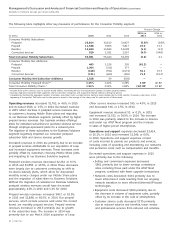

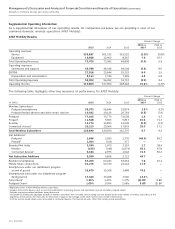

Operating income increased $1,903, or 10.6%, in 2015

and decreased $242, or 1.3%, in 2014. The operating

income margin of AT&T Mobility was 26.9% in 2015,

compared to 24.2% in 2014 and 26.0% in 2013. AT&T

Mobility’s EBITDA margin was 37.9% in 2015, compared

to 34.7% in 2014 and 36.3% in 2013. AT&T Mobility’s

EBITDA service margin was 46.7% in 2015, compared

to 42.0% in 2014 and 41.3% in 2013. (EBITDA service

margin is operating income before depreciation and

amortization, divided by total service revenues.)

Subscriber Relationships

As the wireless industry continues to mature, we believe

that future wireless growth will increasingly depend on

our ability to offer innovative services, plans and devices

and a wireless network that has sufficient spectrum

and capacity to support these innovations on as broad

a geographic basis as possible. To attract and retain

subscribers in a maturing market, we have launched

a wide variety of plans, including Mobile Share and

AT&T Next.

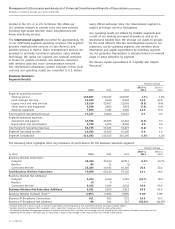

ARPU

Postpaid phone-only ARPU (average revenue per average

wireless subscriber) decreased 4.0% in 2015 and 6.6%

in 2014 reflecting subscribers’ continued adoption of

AT&T Next and Mobile Share plans. Postpaid phone-only

ARPU plus AT&T Next subscriber installment billings

(postpaid phone-only ARPU plus AT&T Next) increased

3.4% in 2015 due to the continuing growth of the

AT&T Next program. Postpaid phone-only ARPU plus

AT&T Next decreased 2.4% in 2014.

Churn

The effective management of subscriber churn is critical

to our ability to maximize revenue growth and to maintain

and improve margins. Total churn was lower in 2015.

Postpaid churn was slightly higher in 2015 reflecting

continuing competitive pressure in the industry.

Postpaid

Postpaid subscribers increased 1.8% and 4.3% in 2015

and 2014, respectively. At December31,2015, 87%

of our postpaid phone subscriber base used smartphones,

compared to 83% at December31,2014 and 77% at

December31,2013. About 98% of our postpaid smartphone

subscribers are on plans that provide for service on multiple

devices at reduced rates, and such subscribers tend to have

higher retention and lower churn rates. A growing percentage

of our postpaid smartphone subscribers are on usage-based

data plans, with approximately 51.1 million subscribers

on these plans as compared to 48.5 million and 38.7million,

respectively, in the prior two years. About half of our

Mobile Share accounts have chosen data plans with

10gigabytes or higher. Device connections on our

Mobile Share plans now represent over 79% of our

postpaid customer base. Such offerings are intended

to encourage existing subscribers to upgrade their current

services and/or add connected devices, attract subscribers

from other providers and minimize subscriber churn.

During 2015, we offered postpaid wireless service under

two alternatives: (1) for subscribers purchasing a device

on installments under the AT&T Next program or for those

that bring their own device, no annual service contract

is signed; however, the device must be paid in full under

the AT&T Next contract if the customer chooses to drop

their service from AT&T; and (2) for subscribers who

purchase their equipment under the traditional device

subsidy model, service contracts are for two-year periods

with an increasing portion of these subscribers receiving

unlimited voice and texting services in conjunction with

data services purchased through our Mobile Share plans.

Approximately 69% of all postpaid smartphone gross ads

and upgrades during 2015 chose AT&T Next. While BYOD

customers do not generate equipment revenue or incur

additional expenses for device subsidy, the service revenue

helps improve our margins. In late December 2015,

we announced an end to offering subsidized handsets

for most of our customers.

Our AT&T Next program allows for postpaid subscribers

to purchase certain devices in installments over a period

of up to 30 months. Additionally, after a specified period

of time, they also have the right to trade in the original device

for a new device with a new installment plan and have

the remaining unpaid balance satisfied. For customers who

elect these installment programs, we recognize equipment

revenue at the time of the sale for the amount of the

customer receivable, net of the fair value of the trade-in

right guarantee and imputed interest. A significant percentage

of our customers on the AT&T Next program pay a lower

monthly service charge, which results in lower service

revenue recorded for these subscribers.

Prepaid

In 2015, we updated our definition of prepaid subscribers

to exclude session-based tablets, which are now included

with connected devices. Prepaid subscribers now consist

primarily of phone users. Prepaid subscribers increased

15.9% and 71.3% in 2015 and 2014, respectively.

Connected Devices

Connected devices includes data-centric devices such

as session-based tablets, monitoring devices and automobile

systems. Connected device subscribers increased 25.0%

and 17.2% in 2015 and 2014, respectively. During 2015,

we added approximately 3.9 million “connected” cars through

agreements with various carmakers. We believe that these

connected car agreements give us the opportunity to

create future retail relationships with the car owners.