AT&T Wireless 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

72

|

AT&T INC.

Non-interest bearing cash and overdrafts are valued at cost,

which approximates fair value.

Fair Value Measurements

See Note 10 for a discussion of fair value hierarchy that

prioritizes the inputs to valuation techniques used to

measure fair value.

rating, sector add-ons or credits, issue-specific add-ons or

credits as well as call or other options.

Purchases and sales of securities are recorded as of the

trade date. Realized gains and losses on sales of securities

are determined on the basis of average cost. Interest income

is recognized on the accrual basis. Dividend income is

recognized on the ex-dividend date.

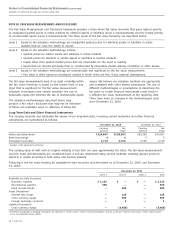

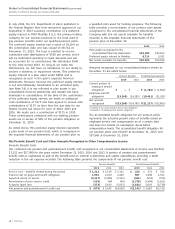

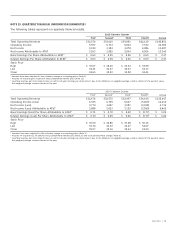

The following tables set forth by level, within the fair value hierarchy, the pension and postretirement assets and liabilities at

fair value as of December 31, 2015:

Pension Assets and Liabilities at Fair Value as of December 31, 2015 Level 1 Level 2 Level 3 Total

Non-interest bearing cash $ 160 $ — $ — $ 160

Interest bearing cash — 25 — 25

Foreign currency contracts — 25 — 25

Equity securities:

Domestic equities 8,315 4 — 8,319

International equities 4,287 — — 4,287

Fixed income securities:

Asset-backed securities — 403 1 404

Mortgage-backed securities — 792 — 792

Collateralized mortgage-backed securities — 278 — 278

Collateralized mortgage obligations/REMICS — 345 — 345

Corporate and other fixed income instruments and funds 65 8,274 373 8,712

Government and municipal bonds 75 4,495 - 4,570

Private equity funds — — 4,926 4,926

Real estate and real assets — — 4,357 4,357

Commingled funds — 5,522 2 5,524

Securities lending collateral 512 3,538 — 4,050

Receivable for variation margin 13 — — 13

Assets at fair value 13,427 23,701 9,659 46,787

Investments sold short and other liabilities at fair value (824) (12) — (836)

Total plan net assets at fair value $12,603 $23,689 $9,659 $ 45,951

Other assets (liabilities)1 (3,756)

Total Plan Net Assets $42,195

1

Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.

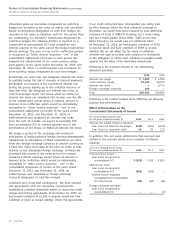

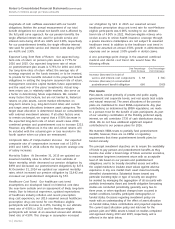

Postretirement Assets and Liabilities at Fair Value as of December 31, 2015 Level 1 Level 2 Level 3 Total

Non-interest bearing cash $ 2 $ — $ — $ 2

Interest bearing cash 220 1,292 — 1,512

Foreign currencies 4 — — 4

Equity securities:

Domestic equities 1,187 — — 1,187

International equities 869 — — 869

Fixed income securities:

Asset-backed securities — 35 2 37

Collateralized mortgage-backed securities — 120 13 133

Collateralized mortgage obligations — 45 — 45

Corporate and other fixed income instruments and funds — 389 — 389

Government and municipal bonds — 617 — 617

Commingled funds — 1,681 1 1,682

Private equity assets — — 155 155

Real assets — — 81 81

Securities lending collateral 6 189 — 195

Futures Contracts 1 — — 1

Total plan net assets at fair value $2,289 $4,368 $252 $ 6,909

Other assets (liabilities)1 (238)

Total Plan Net Assets $6,671

1 Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.