AT&T Wireless 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

19

• Other cost of service decreased $209 primarily due

to incollect roaming fee rate declines, which were

partially offset by increased data volume.

Increased operations and support expenses in 2014

were primarily due to the following:

• Equipment costs increased $613, reflecting

increased sales and customers choosing more

expensive smartphones.

• Handset insurance cost increased $283 due to

an increase in the cost of replacement phones.

• Network costs increased $222 due to increased lease

fees, higher maintenance and energy costs resulting from

the increase in the number of cell sites and expenses

related to our network enhancement efforts. These

increases were partially offset by lower interconnect

costs resulting from our ongoing network transition to

more efficient Ethernet/IP-based technologies.

• Other cost of service increased $190 primarily due

to equipment/device service-related costs associated

with home monitoring services and higher incollect

roaming costs resulting from increased data volume,

which was partially due to the acquisition of Leap.

These increases were partially offset by incollect

roaming fee rate declines.

Partially offsetting these increases in 2014 were lower

selling and commission expenses of $253, which were

primarily due to lower average commission rates, including

those paid under the AT&T Next program.

Depreciation expense increased $24, or 0.6%, in 2015

and $144, or 3.9%, in 2014. The increase in 2015 was

primarily due to ongoing capital spending for network

upgrades and expansion that was largely offset by fully

depreciated assets. The increase in 2014 was primarily

due to ongoing capital spending for network upgrades

and expansion, as well as the acquisition of Leap partially

offset by fully depreciated assets and extending the

estimated useful life of software.

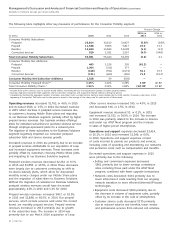

Operating income increased $687, or 7.6%, in 2015

and decreased $964, or 9.6%, in 2014. Our Consumer

Mobility segment operating income margin was 27.8%

in 2015, compared to 24.6% in 2014 and 27.6% in 2013.

Our Consumer Mobility EBITDA margin was 38.8% in 2015,

compared to 35.0% in 2014 and 37.8% in 2013.

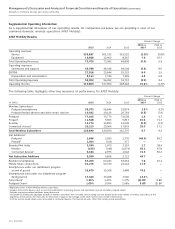

International

Segment Results

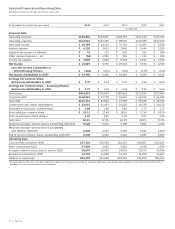

Percent Change

2015 vs. 2014 vs.

2015 2014 2013 2014 2013

Segment operating revenues

Video entertainment $2,150 $ — $ — — —

Wireless 1,647 — — — —

Equipment 305 — — — —

Total Segment Operating Revenues 4,102 — — — —

Segment operating expenses

Operations and support 3,930 — — — —

Depreciation and amortization 655 — — — —

Total Segment Operating Expenses 4,585 — — — —

Segment Operating Income (Loss) (483) — — — —

Equity in Net Income (Loss) of Affiliates (5) 153 532 — (71.2)

Segment Contribution $ (488) $153 $532 — (71.2)%

Operating Results

Our International segment consists of the Latin America

operations acquired in our July 2015 acquisition of DIRECTV

as well as the Mexican wireless operations acquired earlier

in 2015 (see Note 7). For 2015, our International segment

operating income margin was (11.8)% and our International

EBITDA margin was 4.2%.

Our 2015 operating revenues were $4,102, with $1,952

attributable to wireless revenues in Mexico and $2,150

in video services in Latin America. Operations and support

expenses consist of costs incurred to provide our products

and services, including costs of operating and maintaining

our networks, providing video content and personnel

costs, such as compensation and benefits. Our 2015

operating expenses were $3,930 and operating loss

was $483.

Connections Summary

At December 31, 2015, we had approximately 8.7 million

wireless subscribers in Mexico and 12.5 million video

connections in Latin America, including 5.4 million

in Brazil. Since acquisition, our Mexico wireless business

had a net loss of 96,000 subscribers, mainly prepaid

customers, and our Latin America operations had

a net loss of 147,000 video connections.