AT&T Wireless 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

13

discussed below for each segment follow our internal

management reporting. We analyze our operating segments

based on segment contribution, which consists of operating

income, excluding acquisition-related costs and other

significant items, and equity in net income of affiliates for

investments managed within each operating segment.

Each segment’s percentage calculation of total segment

operating revenue and income is derived from our segment

results table in Note 4, and may total more than 100percent

due to losses in one or more segments. We have four

reportable segments: (1) Business Solutions, (2)Entertainment

Group, (3)Consumer Mobility and (4)International.

We also evaluate segment performance based on

segment operating income before depreciation and

amortization, which we refer to as EBITDA and/or EBITDA

margin. We believe EBITDA to be a relevant and useful

measurement to our investors as it is part of our internal

management reporting and planning processes and it is

an important metric that management uses to evaluate

operating performance. EBITDA does not give effect to

cash used for debt service requirements and thus does

not reflect available funds for distributions, reinvestment

or other discretionary uses. EBITDA margin is operating

income before depreciation and amortization, divided

by total revenues.

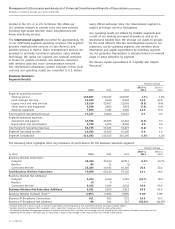

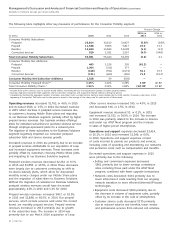

The Business Solutions segment accounted for

approximately 49% of our 2015 total segment operating

revenues as compared to 54% in 2014 and 59% of our

2015 total segment contribution as compared to 66%

in 2014. This segment provides services to business,

governmental and wholesale customers, and individual

subscribers who purchase wireless services through

employer-sponsored plans. We provide advanced IP-based

services including Virtual Private Networks (VPN), Ethernet-

related products and broadband, collectively referred to as

strategic business services, as well as traditional data and

voice products. We utilize our wireless and wired network

and are marketed to provide a complete communications

solution to our business customers.

The Entertainment Group segment accounted for

approximately 24% of our 2015 total segment operating

revenues as compared to 17% in 2014 and 7% of our

2015 total segment contribution as compared to a loss

in 2014. This segment provides video, Internet and voice

communication services to residential customers located

in the U.S. or in U.S. territories. We utilize our copper and

IP-based (referred to as “wired” or “wireline”) wired network

and/or our satellite technology.

The Consumer Mobility segment accounted for

approximately 24% of our 2015 total segment operating

revenues as compared to 28% in 2014 and 35% of our

2015 total segment contribution as compared to 39%

in 2014. This segment provides nationwide wireless service

to consumers, and wireless wholesale and resale subscribers

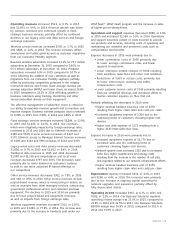

interest rates and an increase in capitalized interest resulting

from spectrum acquired in the AWS-3 Auction (see Note 5).

The decrease in 2014 was primarily due to a $581 charge

related to debt tender offers in 2013 and lower interest

rates resulting from refinancing activity, partially offset by

interest expense related to our December 2013 tower

transaction (see Note 16), higher debt balances and charges

associated with the early redemption of debt during 2014.

Equity in net income of affiliates decreased $96,

or 54.9%, in 2015 and $467, or 72.7%, in 2014. The

decrease in 2015 primarily resulted from the sale of our

investment in América Móvil, S.A. de C.V. (América Móvil)

in June 2014 (see Note5), combined with lower earnings

from YP Holdings LLC (YPHoldings) and increased expenses

in Otter Media Holdings. The decrease in 2015 was slightly

offset by earnings from investments acquired in our purchase

of DIRECTV (see Note8). The sale of the investment in

América Móvil, lower earnings from YP Holdings and our

investment in the mobile payment joint venture SoftcardTM

(Softcard) contributed to lower equity in net income of

affiliates in 2014.

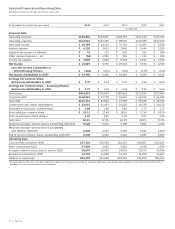

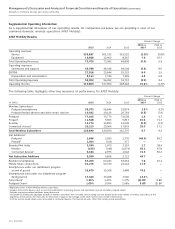

2015 2014 2013

YP Holdings $ 101 $ 134 $ 182

Game Show Network 14 — —

MLB Network 9 — —

SKY Mexico (2) — —

Otter Media Holdings (31) (2) —

Softcard (15) (112) (75)

América Móvil — 153 532

Other 3 2 3

Equity in net income of affiliates $ 79 $ 175 $ 642

Other income (expense) – net We had other expense of

$52 in 2015, and other income of $1,581 and $596 in 2014

and 2013, respectively. Results for 2015 included foreign

exchange losses of $74, net losses on the sale of investments

of $87 and interest and dividend income of $95.

Other income for 2014 included a combined net gain of

$1,470 on the sale of América Móvil shares, our Connecticut

operations and other investments and interest and dividend

income of $68. Results for 2013 included a net gain on

the sale of América Móvil shares and other investments

of $498 and interest and dividend income of $68.

Income tax expense increased $3,386 in 2015 and decreased

$5,709 in 2014. The increase in 2015 and decrease in 2014

were primarily due to a change in income before income taxes.

Our effective tax rate was 33.9% in 2015, 34.9% in 2014 and

33.3% in 2013 (see Note 11).

Segment Results

Our segments are strategic business units that offer different

products and services over various technology platforms and/

or in different geographies that are managed accordingly.

Our operating segment results presented in Note 4 and