AT&T Wireless 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

75

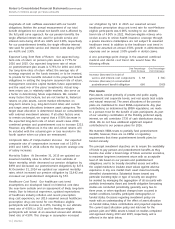

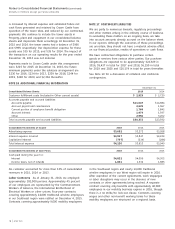

The estimated prior service credit for our supplemental

retirement plan benefits that will be amortized from

accumulated OCI into net periodic benefit cost over

the next fiscal year is $1.

Deferred compensation expense was $122 in 2015, $121 in

2014 and $122 in 2013. Our deferred compensation liability,

included in “Other noncurrent liabilities,” was $1,221 at

December 31, 2015, and $1,156 at December 31, 2014.

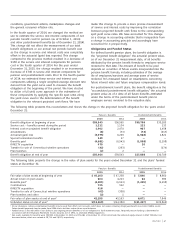

Contributory Savings Plans

We maintain contributory savings plans that cover

substantially all employees. Under the savings plans, we

match in cash or company stock a stated percentage of

eligible employee contributions, subject to a specified ceiling.

There are no debt-financed shares held by the Employee

Stock Ownership Plans, allocated or unallocated.

Our match of employee contributions to the savings plans

is fulfilled with purchases of our stock on the open market

or company cash. Benefit cost is based on the cost of

shares or units allocated to participating employees’

accounts and was $653, $654 and $654 for the years

ended December 31, 2015, 2014 and 2013.

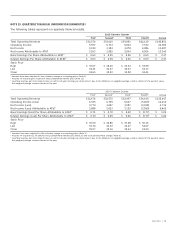

NOTE 13. SHARE-BASED PAYMENTS

Under our various plans, senior and other management

employees and nonemployee directors have received

nonvested stock and stock units. In conjunction with the

acquisition of DIRECTV, restricted stock units issued under

DIRECTV plans were converted to AT&T shares. The shares

will vest over a period of one to four years in accordance

with the terms of those plans. We do not intend to issue

any additional grants under the DIRECTV plans. Any future

grants will be made under the AT&T plans.

We grant performance stock units, which are nonvested

stock units, based upon our stock price at the date of

grant and award them in the form of AT&T common stock

and cash at the end of a three-year period, subject to

the achievement of certain performance goals. We treat

the cash portion of these awards as a liability. We grant

forfeitable restricted stock and stock units, which are valued

at the market price of our common stock at the date of

grant and vest typically over a two- to ten-year period.

We also grant other nonvested stock units and award them

in cash at the end of a three-year period, subject to the

achievement of certain market based conditions. As of

December 31, 2015, we were authorized to issue up to

approximately 109 million shares of common stock (in

addition to shares that may be issued upon exercise of

outstanding options or upon vesting of performance stock

units or other nonvested stock units) to officers, employees

and directors pursuant to these various plans.

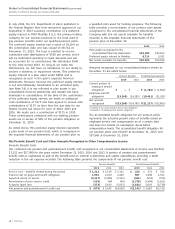

Supplemental Retirement Plans

We also provide certain senior- and middle-management

employees with nonqualified, unfunded supplemental

retirement and savings plans. While these plans are

unfunded, we have assets in a designated nonbankruptcy

remote trust that are independently managed and used to

provide for these benefits. These plans include supplemental

pension benefits as well as compensation-deferral plans,

some of which include a corresponding match by us based

on a percentage of the compensation deferral.

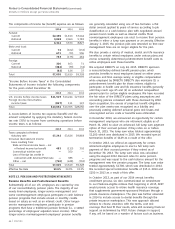

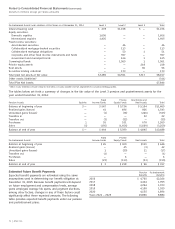

We use the same significant assumptions for the composite

rate of compensation increase in determining our

projected benefit obligation and the net pension and

postemployment benefit cost. Our discount rates of 4.4%

at December 31, 2015 and 4.1% at December 31, 2014

were calculated using the same methodologies used in

calculating the discount rate for our qualified pension and

postretirement benefit plans. The following tables provide

the plans’ benefit obligations and fair value of assets at

December 31 and the components of the supplemental

retirement pension benefit cost. The net amounts are

recorded as “Other noncurrent liabilities” on our

consolidated balance sheets.

The following table provides information for our

supplemental retirement plans with accumulated benefit

obligations in excess of plan assets at December 31:

2015 2014

Projected benefit obligation $(2,444) $(2,458)

Accumulated benefit obligation (2,372) (2,410)

Fair value of plan assets — —

The following tables present the components of net periodic

benefit cost and other changes in plan assets and benefit

obligations recognized in OCI:

Net Periodic Benefit Cost 2015 2014 2013

Service cost – benefits earned

during the period $ 9 $ 7 $ 9

Interest cost on projected

benefit obligation 77 109 101

Amortization of prior

service cost (credit) 1 (1) —

Actuarial (gain) loss (36) 243 (106)

Net supplemental retirement

pension cost $ 51 $358 $ 4

Other Changes Recognized in

Other Comprehensive Income 2015 2014 2013

Prior service (cost) credit $(1) $(11) $(1)

Amortization of prior

service cost (credit) 1 (1) —

Total recognized in other

comprehensive (income)

loss (net of tax) $— $(12) $(1)