AT&T Wireless 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

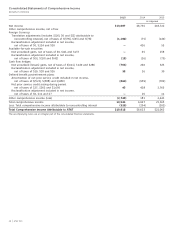

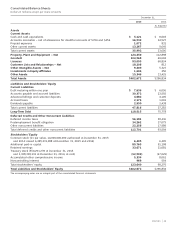

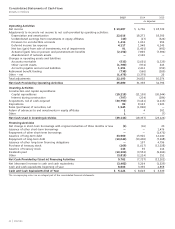

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

52

|

AT&T INC.

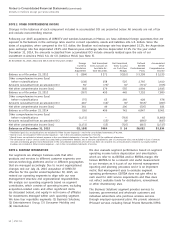

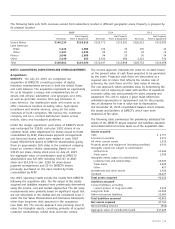

We also evaluate segment performance based on segment

operating income before depreciation and amortization,

which we refer to as EBITDA and/or EBITDA margin. We

believe EBITDA to be a relevant and useful measurement

to our investors as it is part of our internal management

reporting and planning processes and it is an important

metric that management uses to evaluate segment

operating performance. EBITDA does not give effect to

cash used for debt service requirements and thus does

not reflect available funds for distributions, reinvestment

or other discretionary uses.

The Business Solutions segment provides services to

business, governmental and wholesale customers and

individual subscribers who purchase wireless services

through employer-sponsored plans. We provide advanced

IP-based services including Virtual Private Networks (VPN),

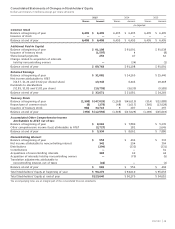

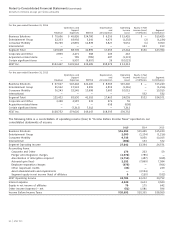

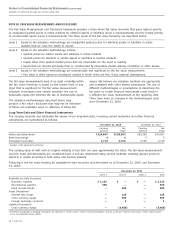

NOTE 3. OTHER COMPREHENSIVE INCOME

Changes in the balances of each component included in accumulated OCI are presented below. All amounts are net of tax

and exclude noncontrolling interest.

Following our 2015 acquisitions of DIRECTV and wireless businesses in Mexico, we have additional foreign operations that are

exposed to fluctuations in the exchange rates used to convert operations, assets and liabilities into U.S. dollars. Since the

dates of acquisition, when compared to the U.S. dollar, the Brazilian real exchange rate has depreciated 15.2%, the Argentinian

peso exchange rate has depreciated 29.1% and Mexican peso exchange rate has depreciated 13.1%. For the year ended

December 31, 2014, the amounts reclassified from accumulated OCI include amounts realized upon the sale of our

investment in América Móvil, S.A. de C.V. (América Móvil) (see Note 5).

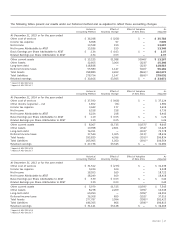

At December 31, 2015, 2014 and 2013 and for the years ended

Foreign Net Unrealized Net Unrealized Defined Accumulated

Currency Gains (Losses) on Gains (Losses) Benefit Other

Translation Available-for- on Cash Flow Postretirement Comprehensive

Adjustment Sale Securities Hedges Plans Income

Balance as of December 31, 2012 $ (284) $ 271 $(110) $ 5,358 $ 5,235

Other comprehensive income (loss)

before reclassifications (138) 258 525 2,765 3,410

Amounts reclassified from accumulated OCI 551 (79)2 303 (771)4 (765)

Net other comprehensive income (loss) (83) 179 555 1,994 2,645

Balance as of December 31, 2013 (367) 450 445 7,352 7,880

Other comprehensive income (loss)

before reclassifications (75) 65 260 428 678

Amounts reclassified from accumulated OCI 4161 (16)2 363 (933)4 (497)

Net other comprehensive income (loss) 341 49 296 (505) 181

Balance as of December 31, 2014 (26) 499 741 6,847 8,061

Other comprehensive income (loss)

before reclassifications (1,172) — (763) 45 (1,890)

Amounts reclassified from accumulated OCI —1 (15)2 383 (860)4 (837)

Net other comprehensive income (loss) (1,172) (15) (725) (815) (2,727)

Balance as of December 31, 2015 $(1,198) $484 $ 16 $6,032 $5,334

1 Translation (gain) loss reclassifications are included in Other income (expense) – net in the consolidated statements of income.

2 (Gains) losses are included in Other income (expense) – net in the consolidated statements of income.

3 (Gains) losses are included in interest expense in the consolidated statements of income. See Note 10 for additional information.

4 The amortization of prior service credits associated with postretirement benefits, net of amounts capitalized as part of construction labor, are included in Cost of services

and sales and Selling, general and administrative in the consolidated statements of income (see Note 12). Actuarial loss reclassifications related to our equity method

investees are included in Other income (expense) – net in the consolidated statements of income.

NOTE 4. SEGMENT INFORMATION

Our segments are strategic business units that offer

products and services to different customer segments over

various technology platforms and/or in different geographies

that are managed accordingly. Due to recent organizational

changes and our July 24, 2015 acquisition of DIRECTV,

effective for the quarter ended September 30, 2015, we

revised our operating segments to align with our new

management structure and organizational responsibilities.

We analyze our operating segments based on segment

contribution, which consists of operating income, excluding

acquisition-related costs and other significant items

(as discussed below), and equity in net income of affiliates

for investments managed within each operating segment.

We have four reportable segments: (1) Business Solutions,

(2) Entertainment Group, (3) Consumer Mobility and

(4) International.