AT&T Wireless 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

31

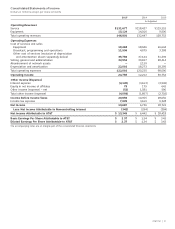

At December31,2015, we had $7,636 of debt maturing

within one year, substantially all of which was related to

long-term debt issuances. Debt maturing within one year

includes the following notes that may be put back to us

by the holders:

• $1,000 of annual put reset securities issued by

BellSouth Corporation that may be put back to us

each April until maturity in 2021.

• An accreting zero-coupon note that may be redeemed

each May until maturity in 2022. If the zero-coupon

note (issued for principal of $500 in 2007) is held to

maturity, the redemption amount will be $1,030.

Our Board of Directors has approved repurchase

authorizations of 300 million shares each in 2013 and

2014 (see Note 14). For the year ended December31,2014,

we had repurchased approximately 48 million shares totaling

$1,617 under these authorizations and for the year ended

December31,2015, we had repurchased approximately

8million shares totaling $269 under these authorizations.

At December 31, 2015 we had approximately 407 million

shares remaining from the 2013 and 2014 authorizations.

The emphasis of our 2016 financing activities will be the

issuance of debt, the payment of dividends, which is subject

to approval by our Board of Directors, and the repayment

of debt. We plan to fund our financing uses of cash through

a combination of cash from operations, debt issuances and

asset sales. The timing and mix of debt issuance will be

guided by credit market conditions and interest rate trends.

Credit Facilities

On December 11, 2015, we entered into a five-year,

$12,000 credit agreement (the “Revolving Credit

Agreement”) with Citibank, N.A. (Citibank), as administrative

agent, replacing our $5,000 credit agreement that would

have expired in December 2018. At the same time, AT&T

and the lenders terminated their obligations under the

existing revolving $3,000 credit agreement with Citibank

that would have expired in December2017.

In January 2015, we entered into a $9,155 credit agreement

(the “Syndicated Credit Agreement”) containing (i)a $6,286

term loan facility (the “Tranche A Facility”) and (ii)a $2,869

term loan facility (the “Tranche B Facility”), with certain

investment and commercial banks and MizuhoBank,Ltd.

(“Mizuho”), as administrative agent. We also entered into

a $2,000 18-month credit agreement (the “18-Month Credit

Agreement”) with Mizuho as initial lender and agent. On

December11,2015, AT&T amended the Syndicated Credit

Agreement and the 18-Month Credit Agreement to, among

other things, revise the financial covenant to match the

financial covenant in the Revolving Credit Agreement.

2020 and variable rate 18-month credit agreement

due 2016, together totaling $11,155.

• March 2015 issuance of €1,250 of 1.300% global notes

due 2023 and €1,250 of 2.450% global notes due

2035 (together, equivalent to $2,844, when issued).

• May 2015 issuance of $3,000 of 2.450% global notes

due 2020; $2,750 of 3.000% global notes due 2022;

$5,000 of 3.400% global notes due 2025; $2,500 of

4.500% global notes due 2035; $3,500 of 4.750%

global notes due 2046; and $750 floating rate global

notes due 2020. The floating rate for the note is based

upon the three-month London Interbank Offered Rate

(LIBOR), reset quarterly, plus 93 basis points.

During 2015, we redeemed $10,042 in debt, primarily

consisting of the following repayments:

• Redemption of $902 of various senior notes in

connection with the January 2015 GSF Telecom

acquisition and April 2015 Nextel Mexico acquisition.

• April2015 redemption of €1,250 (approximately

$1,975 at maturity) of AT&T 6.125% notes due 2015.

• August 2015 redemption of $1,500 of AT&T 2.500%

notes due August 2015.

• September2015 redemption of $1,000 of 0.800% notes

due December2015; $1,000 of 0.900% AT&T notes due

February2016; $750 of 3.125% DIRECTVHoldingsLLC

and DIRECTVFinancing Co., Inc. notes due February

2016; and $1,500 of 3.500% of DIRECTV senior notes

due March 2016.

• September 2015 prepayment of $1,000 of the

outstanding advances under the $2,000 18-month

credit agreement (the “18-Month Credit Agreement”)

by and between AT&T and Mizuho. (See the “Credit

Facilities” discussion below.)

In 2015, we continued to take advantage of lower market

interest rates and undertook several activities related to

our long-term debt which caused our weighted average

interest rate of our entire long-term debt portfolio,

including the impact of derivatives, to decrease from

4.2% at December31,2014 to 4.0% at December31,2015.

We had $124,847 of total notes and debentures outstanding

(see Note 9) at December31,2015, which included

Euro, British pound sterling, Swiss franc, Brazilian real and

Canadian dollar denominated debt of approximately $26,221.

On February 9, 2016, we issued $6,000 of long-term debt

which included:

• $1,250 of 2.800% global notes due 2021.

• $1,500 of 3.600% global notes due 2023.

• $1,750 of 4.125% global notes due 2026.

• $1,500 of 5.650% global notes due 2047.