AT&T Wireless 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

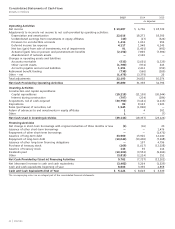

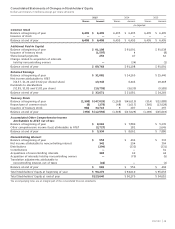

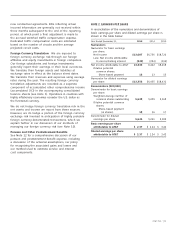

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

54

|

AT&T INC.

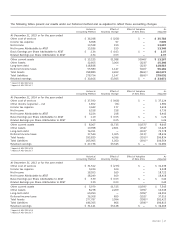

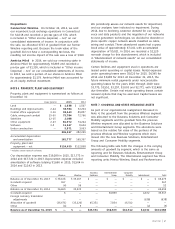

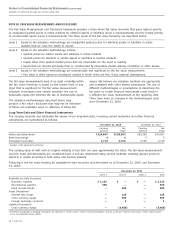

For the year ended December 31, 2014

Operations and Depreciation Operating Equity in Net

Support and Income Income (Loss) Segment

Revenue Expenses EBITDA Amortization (Loss) of Affiliates Contribution

Business Solutions $ 70,606 $ 45,826 $24,780 $ 9,355 $ 15,425 $ — $15,425

Entertainment Group 22,233 18,992 3,241 4,473 (1,232) (2) (1,234)

Consumer Mobility 36,769 23,891 12,878 3,827 9,051 (1) 9,050

International — — — — — 153 153

Segment Total 129,608 88,709 40,899 17,655 23,244 $150 $23,394

Corporate and Other 2,839 2,471 368 105 263

Acquisition-related items — 785 (785) 487 (1,272)

Certain significant items — 9,997 (9,997) 26 (10,023)

AT&T Inc. $132,447 $101,962 $30,485 $18,273 $ 12,212

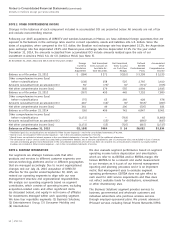

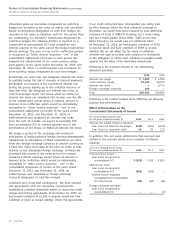

For the year ended December 31, 2013

Operations and Depreciation Operating Equity in Net

Support and Income Income (Loss) Segment

Revenue Expenses EBITDA Amortization (Loss) of Affiliates Contribution

Business Solutions $ 67,647 $43,442 $24,205 $ 8,965 $15,240 $ — $15,240

Entertainment Group 21,542 17,943 3,599 4,815 (1,216) — (1,216)

Consumer Mobility 36,243 22,545 13,698 3,683 10,015 — 10,015

International — — — — — 532 532

Segment Total 125,432 83,930 41,502 17,463 24,039 $532 $24,571

Corporate and Other 3,320 2,987 333 274 59

Acquisition-related items — — — 658 (658)

Certain significant items — (7,312) 7,312 — 7,312

AT&T Inc. $128,752 $79,605 $49,147 $18,395 $30,752

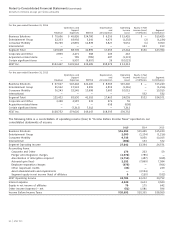

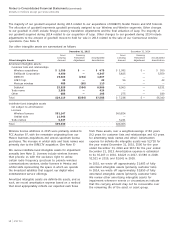

The following table is a reconciliation of operating income (loss) to “Income Before Income Taxes” reported on our

consolidated statements of income:

2015 2014 2013

Business Solutions $16,392 $15,425 $15,240

Entertainment Group 2,000 (1,234) (1,216)

Consumer Mobility 9,738 9,050 10,015

International (488) 153 532

Segment Operating Income 27,642 23,394 24,571

Reconciling Items:

Corporate and Other 176 263 59

Merger and integration charges (2,072) (785) —

Amortization of intangibles acquired (2,712) (487) (658)

Actuarial gain (loss) 2,152 (7,869) 7,584

Employee separation charges (375) — (501)

Other (expenses) credits (35) — 229

Asset abandonments and impairments — (2,154) —

Segment equity in net income (loss) of affiliates 9 (150) (532)

AT&T Operating Income 24,785 12,212 30,752

Interest expense 4,120 3,613 3,940

Equity in net income of affiliates 79 175 642

Other income (expense) – net (52) 1,581 596

Income Before Income Taxes $20,692 $10,355 $28,050