AT&T Wireless 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

68

|

AT&T INC.

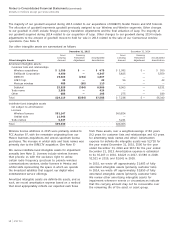

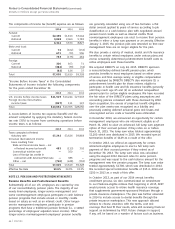

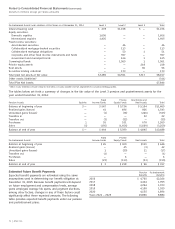

a qualified plan asset for funding purposes. The following

table presents a reconciliation of our pension plan assets

recognized in the consolidated financial statements of the

Company with the net assets available for benefits

included in the separate financial statements of the

pension plan at December 31:

2015 2014

Plan assets recognized in the

consolidated financial statements $42,195 $45,163

Preferred equity interest in Mobility 8,714 9,021

Net assets available for benefits $50,909 $54,184

Amounts recognized on our consolidated balance sheets at

December 31 are listed below:

Pension Benefits Postretirement Benefits

2015 2014 2015 2014

Current portion of

employee benefit

obligation1 $ — $ — $ (1,766) $ (1,842)

Employee benefit

obligation2 (13,269) (14,380) (19,461) (21,021)

Net amount

recognized $(13,269) $(14,380) $(21,227) $(22,863)

1 Included in “Accounts payable and accrued liabilities.”

2 Included in “Postemployment benefit obligation.”

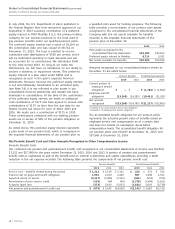

The accumulated benefit obligation for our pension plans

represents the actuarial present value of benefits based on

employee service and compensation as of a certain date

and does not include an assumption about future

compensation levels. The accumulated benefit obligation for

our pension plans was $54,007 at December 31, 2015, and

$57,949 at December 31, 2014.

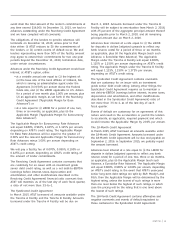

In July 2014, the U.S. Department of Labor published in

the Federal Register their final retroactive approval of our

September 9, 2013 voluntary contribution of a preferred

equity interest in AT&T Mobility II LLC, the primary holding

company for our wireless business, to the trust used to

pay pension benefits under our qualified pension plans.

The preferred equity interest had a value of $9,104 on

the contribution date and was valued at $8,714 at

December 31, 2015. The trust is entitled to receive

cumulative cash distributions of $560 per annum, which

will be distributed quarterly in equal amounts and will

be accounted for as contributions. We distributed $560

to the trust during 2015. So long as we make the

distributions, we will have no limitations on our ability to

declare a dividend, or repurchase shares. This preferred

equity interest is a plan asset under ERISA and is

recognized as such in the plan’s separate financial

statements. However, because the preferred equity interest

is not unconditionally transferable to an unrelated party

(see Note 14), it is not reflected in plan assets in our

consolidated financial statements and instead has been

eliminated in consolidation. At the time of the contribution

of the preferred equity interest, we made an additional

cash contribution of $175 and have agreed to annual cash

contributions of $175 no later than the due date for our

federal income tax return for each of 2014, 2015 and

2016. We made such a contribution of $175 in 2015.

These contributions combined with our existing pension

assets are in excess of 90% of the pension obligation at

December 31, 2015.

As noted above, this preferred equity interest represents

a plan asset of our pension trust, which is recognized in

the separate financial statements of our pension plan as

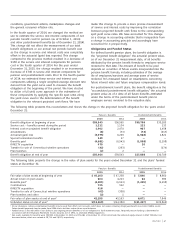

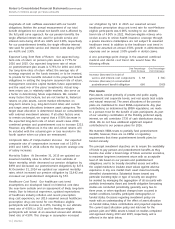

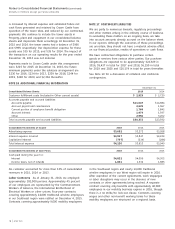

Net Periodic Benefit Cost and Other Amounts Recognized in Other Comprehensive Income

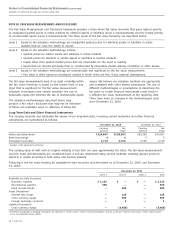

Periodic Benefit Costs

Our combined net pension and postretirement (credit) cost recognized in our consolidated statements of income was $(2,821),

$7,232 and $(7,390) for the years ended December 31, 2015, 2014 and 2013. A portion of pension and postretirement

benefit costs is capitalized as part of the benefit load on internal construction and capital expenditures, providing a small

reduction in the net expense recorded. The following table presents the components of net periodic benefit cost:

Pension Benefits Postretirement Benefits

2015 2014 2013 2015 2014 2013

Service cost – benefits earned during the period $ 1,212 $ 1,134 $ 1,321 $ 222 $ 233 $ 352

Interest cost on projected benefit obligation 1,902 2,470 2,429 967 1,458 1,532

Expected return on assets (3,317) (3,380) (3,312) (421) (653) (706)

Amortization of prior service credit (103) (94) (94) (1,278) (1,448) (1,161)

Actuarial (gain) loss (373) 5,419 (5,013) (1,632) 2,093 (2,738)

Net pension and postretirement (credit) cost $ (679) $ 5,549 $(4,669) $(2,142) $ 1,683 $(2,721)