AT&T Wireless 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

56

|

AT&T INC.

resulted in revenues in Venezuela of approximately $500

and operating profit before depreciation and amortization of

approximately $180. Pro forma data may not be indicative of

the results that would have been obtained had these events

occurred at the beginning of the perids presented, nor is it

intended to be a projection of future results.

Nextel Mexico On April 30, 2015, we completed our

acquisition of the subsidiaries of NII Holdings Inc.,

operating its wireless business in Mexico, for $1,875,

including approximately $427 of net debt and other

adjustments. The subsidiaries offered service under the

name Nextel Mexico.

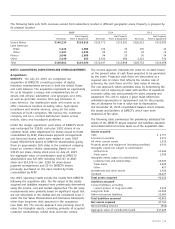

The preliminary values of assets acquired were: $383 in

licenses, $1,293 in property, plant and equipment, $111

in customer lists and $112 of goodwill. The goodwill was

allocated to our International segment.

GSF Telecom On January 16, 2015, we acquired Mexican

wireless company GSF Telecom Holdings, S.A.P.I. de C.V.

(GSF Telecom) for $2,500, including net debt of

approximately $700. GSF Telecom offered service under

both the Iusacell and Unefon brand names in Mexico.

The preliminary values of assets acquired were: $673 in

licenses, $715 in property, plant and equipment, $374 in

customer lists, $26 in trade names and $972 of goodwill.

The goodwill was allocated to our International segment.

AWS-3 Auction In January 2015, we submitted winning

bids for 251 Advanced Wireless Service (AWS) spectrum

licenses in the AWS-3 Auction (FCC Auction 97) for $18,189.

We provided the Federal Communications Commission (FCC)

an initial down payment of $921 in October 2014 and

paid the remaining $17,268 in the first quarter of 2015.

Spectrum Acquisitions During 2015, we acquired $489

of wireless spectrum, not including the AWS auction.

During 2014, we acquired $1,263 of wireless spectrum,

not including Leap Wireless International, Inc. (Leap)

discussed below.

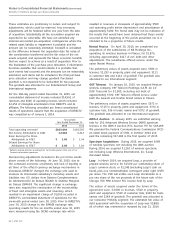

Leap In March 2014, we acquired Leap, a provider of

prepaid wireless service, for $15.00 per outstanding share of

Leap’s common stock, or $1,248 (excluding Leap’s cash on

hand), plus one nontransferable contingent value right (CVR)

per share. The CVR will entitle each Leap stockholder to a

pro rata share of the net proceeds of the future sale of the

Chicago 700 MHz A-band FCC license held by Leap.

The values of assets acquired under the terms of the

agreement were: $3,000 in licenses, $510 in property,

plant and equipment, $520 of customer lists, $340 for trade

names and $248 of goodwill. The goodwill was allocated to

our Consumer Mobility segment. The estimated fair value of

debt associated with the acquisition of Leap was $3,889,

all of which was redeemed or matured by July 31, 2014.

These estimates are preliminary in nature and subject to

adjustments, which could be material. Any necessary

adjustments will be finalized within one year from the date

of acquisition. Substantially all the receivables acquired are

expected to be collectable. We have not identified any

material unrecorded pre-acquisition contingencies where the

related asset, liability or impairment is probable and the

amount can be reasonably estimated. Goodwill is calculated

as the difference between the acquisition date fair value of

the consideration transferred and the fair value of the net

assets acquired, and represents the future economic benefits

that we expect to achieve as a result of acquisition. Prior to

the finalization of the purchase price allocation, if information

becomes available that would indicate it is probable that

such events had occurred and the amounts can be reasonably

estimated, such items will be included in the final purchase

price allocation and may change goodwill. Purchased

goodwill is not expected to be deductible for tax purposes.

The goodwill was allocated to our Entertainment Group and

International segments.

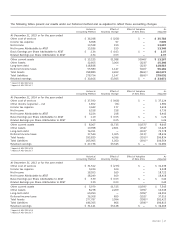

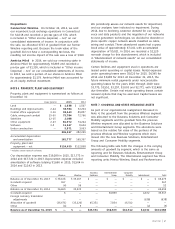

For the 160-day period ended December 31, 2015, our

consolidated statement of income included $14,561 of

revenues and $(46) of operating income, which included

$2,254 of intangible amortization from DIRECTV, and its

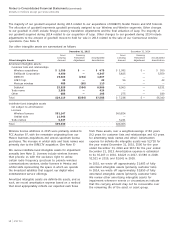

affiliates. The following unaudited pro forma consolidated

results of operations assume that the acquisition of DIRECTV

was completed as of January 1, 2014.

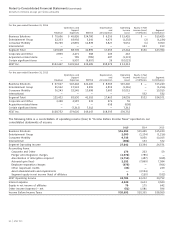

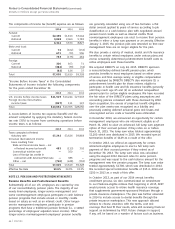

(Unaudited)

Year Ended December 31,

2015 2014

Total operating revenues1 $165,694 $165,595

Net Income Attributable to AT&T 12,683 6,412

Basic Earnings Per Share

Attributable to AT&T $ 2.06 $ 1.04

Diluted Earnings Per Share

Attributable to AT&T $ 2.06 $ 1.04

1 Reflects revenue declines resulting from our fourth-quarter 2014 sale of our

Connecticut wireline operations.

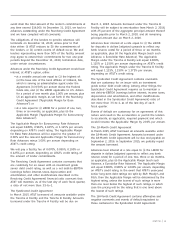

Nonrecurring adjustments included in the pro forma results

above consist of the following: At June 30, 2015, due to

the continued economic uncertainty and lack of liquidity in

all three of the official currency exchange mechanisms in

Venezuela, DIRECTV changed the exchange rate used to

measure its Venezuelan subsidiary’s monetary assets and

liabilities into U.S. dollars from Sistema Complementario

de Administración de Divisas (SICAD) to Sistema Marginal

de Divisas (SIMADI). The significant change in exchange

rates also required the reevaluation of the recoverability

of fixed and intangible assets and inventory, which

resulted in an impairment charge of $1,060 recorded in

DIRECTV’s consolidated statement of operations for the

six-month period ended June 30, 2015. Prior to DIRECTV’s

June 30, 2015 change to the SIMADI exchange rate,

operating results for the six months ended June 30, 2015

were measured using the SICAD exchange rate which