AT&T Wireless 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

74

|

AT&T INC.

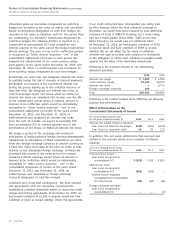

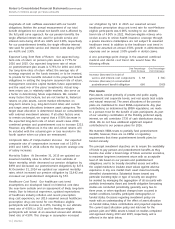

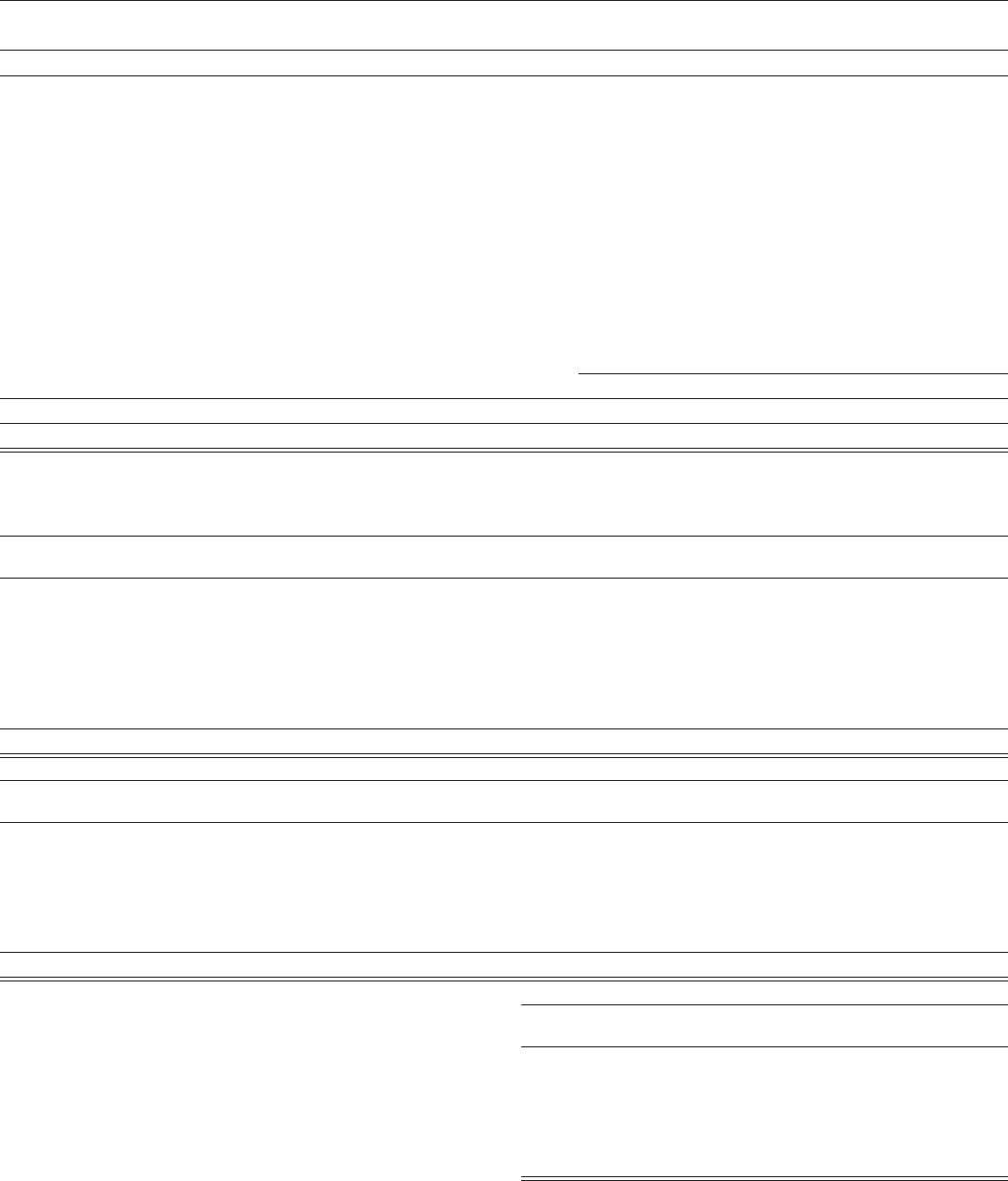

Postretirement Assets and Liabilities at Fair Value as of December 31, 2014 Level 1 Level 2 Level 3 Total

Interest bearing cash $ 278 $1,198 $ — $1,476

Equity securities:

Domestic equities 1,606 — — 1,606

International equities 1,405 — — 1,405

Fixed income securities:

Asset-backed securities — 46 — 46

Collateralized mortgage-backed securities — 113 — 113

Collateralized mortgage obligations — 50 1 51

Corporate and other fixed income instruments and funds — 397 — 397

Government and municipal bonds — 614 1 615

Commingled funds — 1,960 1 1,961

Private equity assets — — 218 218

Real assets — — 96 96

Securities lending collateral — 173 — 173

Total plan net assets at fair value $3,289 $4,551 $317 $8,157

Other assets (liabilities)1 (311)

Total Plan Net Assets $7,846

1 Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.

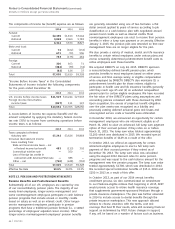

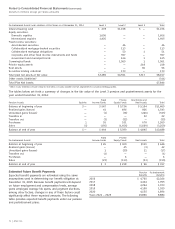

The tables below set forth a summary of changes in the fair value of the Level 3 pension and postretirement assets for the

year ended December 31, 2014:

Fixed Private Real Estate and

Pension Assets Equities Income Funds Equity Funds Real Assets Total

Balance at beginning of year $ — $ 547 $ 5,724 $ 5,194 $11,465

Realized gains (losses) — 41 696 806 1,543

Unrealized gains (losses) — (1) (76) (246) (323)

Transfers in — — — 22 22

Transfers out — (3) (22) — (25)

Purchases 1 55 531 678 1,265

Sales (1) (195) (1,454) (1,609) (3,259)

Balance at end of year $ — $ 444 $ 5,399 $ 4,845 $10,688

Fixed Private

Postretirement Assets Income Funds Equity Funds Real Assets Total

Balance at beginning of year $ 26 $ 309 $111 $ 446

Realized gains (losses) — 45 (3) 42

Unrealized gains (losses) 1 (29) 11 (17)

Transfers out (1) — — (1)

Purchases — 6 — 6

Sales (23) (113) (23) (159)

Balance at end of year $ 3 $ 218 $ 96 $ 317

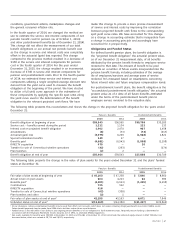

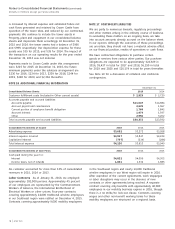

Estimated Future Benefit Payments

Expected benefit payments are estimated using the same

assumptions used in determining our benefit obligation at

December 31, 2015. Because benefit payments will depend

on future employment and compensation levels, average

years employed, average life spans, and payment elections,

among other factors, changes in any of these factors could

significantly affect these expected amounts. The following

table provides expected benefit payments under our pension

and postretirement plans:

Pension Postretirement

Benefits Benefits

2016 $ 4,705 $2,024

2017 4,424 1,995

2018 4,294 1,973

2019 4,198 1,939

2020 4,155 1,894

Years 2021 – 2025 19,886 8,884