AT&T Wireless 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

66

|

AT&T INC.

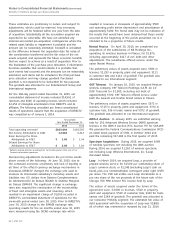

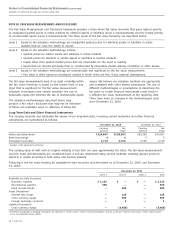

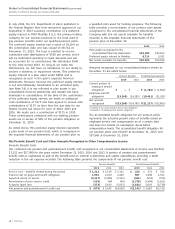

The components of income tax (benefit) expense are as follows:

2015 2014 2013

Federal:

Current $2,496 $1,610 $3,044

Deferred 3,828 2,060 5,783

6,324 3,670 8,827

State and local:

Current 72 (102) (132)

Deferred 671 (73) 596

743 (175) 464

Foreign:

Current 320 163 71

Deferred (382) (39) (34)

(62) 124 37

Total $7,005 $3,619 $9,328

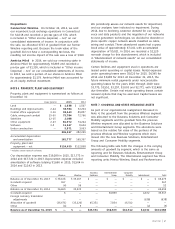

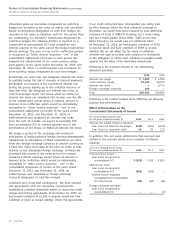

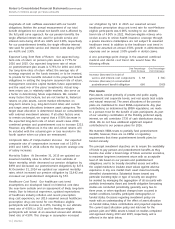

“Income Before Income Taxes” in the Consolidated

Statements of Income included the following components

for the years ended December 31:

2015 2014 2013

U.S. income before income taxes $21,519 $10,244 $27,903

Foreign income (loss) before

income taxes (827) 111 147

Total $20,692 $10,355 $28,050

A reconciliation of income tax expense (benefit) and the

amount computed by applying the statutory federal income

tax rate (35%) to income from continuing operations before

income taxes is as follows:

2015 2014 2013

Taxes computed at federal

statutory rate $7,242 $3,624 $9,818

Increases (decreases) in income

taxes resulting from:

State and local income taxes – net

of federal income tax benefit 483 (113) 302

Connecticut wireline sale — 350 —

Loss of foreign tax credits in

connection with América Móvil sale — 386 —

Other – net (720) (628) (792)

Total $7,005 $3,619 $9,328

Effective Tax Rate 33.9% 34.9% 33.3%

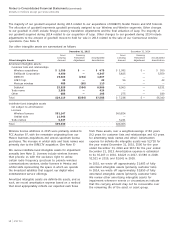

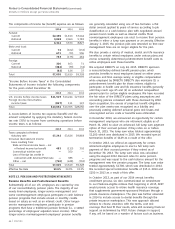

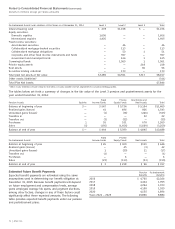

NOTE 12. PENSION AND POSTRETIREMENT BENEFITS

Pension Benefits and Postretirement Benefits

Substantially all of our U.S. employees are covered by one

of our noncontributory pension plans. The majority of our

newly hired employees, longer-service management and

some nonmanagement employees participate in cash balance

pension programs that include annual or monthly credits

based on salary as well as an interest credit. Other longer-

service management employees participate in pension

programs that have a traditional pension formula (i.e., a stated

percentage of employees’ adjusted career income). Other

longer-service nonmanagement employees’ pension benefits

are generally calculated using one of two formulas: a flat

dollar amount applied to years of service according to job

classification or a cash balance plan with negotiated annual

pension band credits as well as interest credits. Most

nonmanagement employees can elect to receive their pension

benefits in either a lump sum payment or an annuity. Effective

January 1, 2015, the pension plan was amended so that new

management hires are no longer eligible for the plan.

We also provide a variety of medical, dental and life insurance

benefits to certain retired employees under various plans and

accrue actuarially determined postretirement benefit costs as

active employees earn these benefits.

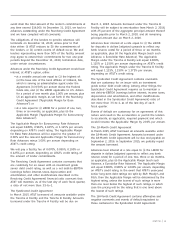

We acquired DIRECTV on July 24, 2015. DIRECTV sponsors

a noncontributory defined benefit pension plan, which

provides benefits to most employees based on either years

of service and final average salary, or eligible compensation

while employed by DIRECTV. DIRECTV also maintains (1) a

postretirement benefit plan for those retirees eligible to

participate in health care and life insurance benefits generally

until they reach age 65 and (2) an unfunded nonqualified

pension plan for certain eligible employees. We have recorded

the fair value of the DIRECTV plans using assumptions and

accounting policies consistent with those disclosed by AT&T.

Upon acquisition, the excess of projected benefit obligation

over the plan assets was recognized as a liability and

previously existing deferred actuarial gains and losses and

unrecognized service costs or benefits were eliminated.

In December 2014, we announced an opportunity for certain

management employees who are retirement eligible as of

March 31, 2015 to elect an enhanced, full lump sum payment

option of their accrued pension if they retire on or before

March 31, 2015. The lump sum value totaled approximately

$1,200 which was distributed in 2015. We recorded special

termination benefits of $149 as a result of the offer.

In October 2013, we offered an opportunity for certain

retirement-eligible employees to elect a full lump sum

payment of their accrued pension if they retired as of

December 30, 2013. The lump sum value was calculated

using the August 2012 discount rates for some pension

programs and was equal to the cash balance amount for the

management new hire pension program. The lump sum value

totaled approximately $2,700, which was distributed in 2014.

We recorded special termination benefits of $15 in 2014 and

$250 in 2013 as a result of this offer.

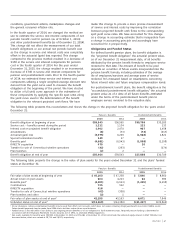

In October 2013, as part of our 2014 annual benefits

enrollment process, we also communicated an amendment

to our Medicare-eligible retirees that, beginning in 2015, AT&T

would provide access to retiree health insurance coverage

that supplements government-sponsored Medicare through a

private insurance marketplace. The plan was further amended

in 2014 to include access to dental benefits through the

private insurance marketplace. This new approach allowed

retirees to choose insurance with the terms, cost and

coverage that best fit their needs, while still receiving financial

support as determined by AT&T. Future changes in support,

if any, will be based on a number of factors such as business