AT&T Wireless 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

49

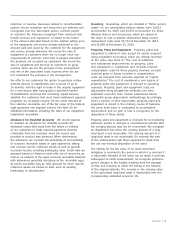

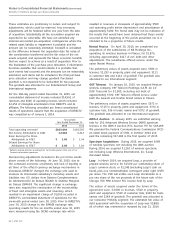

Inventory Inventories, which are included in “Other current

assets” on our consolidated balance sheets, were $4,033

at December 31, 2015, and $1,933 at December 31, 2014.

Wireless devices and accessories, which are valued at

the lower of cost or market (determined using current

replacement cost), were $3,733 at December 31, 2015,

and $1,858 at December 31, 2014.

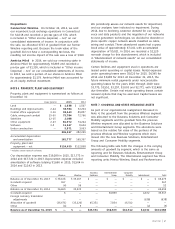

Property, Plant and Equipment Property, plant and

equipment is stated at cost, except for assets acquired

using acquisition accounting, which are initially recorded

at fair value (see Note 6). The cost of additions

and substantial improvements to property, plant

and equipment is capitalized, and includes internal

compensation costs for these projects; however, noncash

actuarial gains or losses included in compensation

costs are excluded from amounts reported as “capital

expenditures.” The cost of maintenance and repairs of

property, plant and equipment is charged to operating

expenses. Property, plant and equipment costs are

depreciated using straight-line methods over their

estimated economic lives. Certain subsidiaries follow

composite group depreciation methodology. Accordingly,

when a portion of their depreciable property, plant and

equipment is retired in the ordinary course of business,

the gross book value is reclassified to accumulated

depreciation, and no gain or loss is recognized on the

disposition of these assets.

Property, plant and equipment is reviewed for recoverability

whenever events or changes in circumstances indicate that

the carrying amount may not be recoverable. We recognize

an impairment loss when the carrying amount of a long-

lived asset is not recoverable. The carrying amount of a

long-lived asset is not recoverable if it exceeds the sum

of the undiscounted cash flows expected to result from

the use and eventual disposition of the asset.

The liability for the fair value of an asset retirement

obligation is recorded in the period in which it is incurred if

a reasonable estimate of fair value can be made. In periods

subsequent to initial measurement, we recognize period-to-

period changes in the liability resulting from the passage

of time and revisions to either the timing or the amount

of the original estimate. The increase in the carrying value

of the associated long-lived asset is depreciated over the

corresponding estimated economic life.

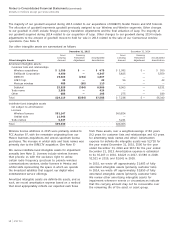

reduction of revenue. Revenues related to nonrefundable,

upfront service activation and setup fees are deferred and

recognized over the associated service contract period

or customer life. Revenue recognized from contracts that

bundle services and equipment is limited to the lesser

of the amount allocated based on the relative selling price

of the equipment and service already delivered or the

amount paid and owed by the customer for the equipment

and service already delivered. We record the sale of

equipment to customers when we no longer have any

requirements to perform, when title is passed and when

the products are accepted by customers. We record the

sale of equipment and services to customers as gross

revenue when we are the principal in the arrangement

and net of the associated costs incurred when we are

not considered the principal in the arrangement.

We offer to our customers the option to purchase certain

wireless devices in installments over a period of up to

30 months, with the right to trade in the original equipment

for a new device, after having paid a specified number

of installments, and have the remaining unpaid balance

satisfied. For customers that elect these installment payment

programs, we recognize revenue for the entire amount of

the customer receivable, net of the fair value of the trade-in

right guarantee and imputed interest. See Note 15 for

additional information, including the sales of our equipment

installment receivables.

Allowance for Doubtful Accounts We record expense

to maintain an allowance for doubtful accounts for

estimated losses that result from the failure or inability

of our customers to make required payments deemed

collectable from the customer when the service was

provided or product was delivered. When determining

the allowance, we consider the probability of recoverability

of accounts receivable based on past experience, taking

into account current collection trends as well as general

economic factors, including bankruptcy rates. Credit risks are

assessed based on historical write-offs, net of recoveries, as

well as an analysis of the aged accounts receivable balances

with allowances generally increasing as the receivable ages.

Accounts receivable may be fully reserved for when specific

collection issues are known to exist, such as pending

bankruptcy or catastrophes.