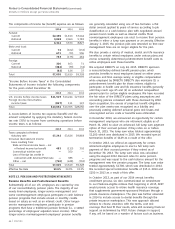

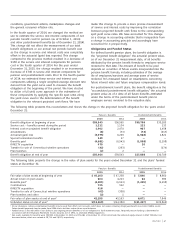

AT&T Wireless 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

60

|

AT&T INC.

Current maturities of long-term debt include debt that may

be put back to us by the holders in 2016. We have $1,000

of annual put reset securities that may be put each April

until maturity in 2021. If the holders do not require us to

repurchase the securities, the interest rate will be reset based

on current market conditions. Likewise, we have an accreting

zero-coupon note that may be redeemed each May, until

maturity in 2022. If the zero-coupon note (issued for principal

of $500 in 2007) is held to maturity, the redemption amount

will be $1,030.

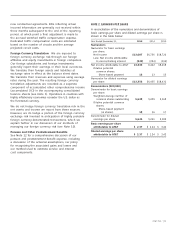

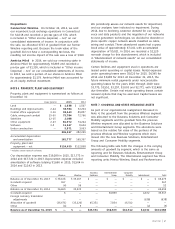

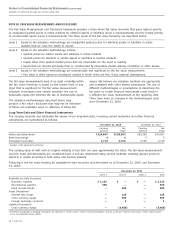

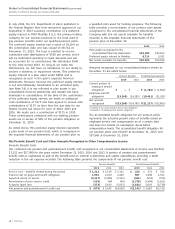

Debt maturing within one year consisted of the following at

December 31:

2015 2014

Current maturities of long-term debt $7,632 $6,051

Bank borrowings1 4 5

Total $7,636 $6,056

1 Outstanding balance of short-term credit facility of a foreign subsidiary.

Financing Activities

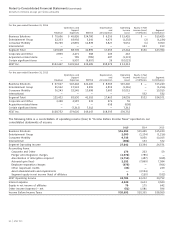

During 2015, we issued $33,969 in long-term debt in various

markets, with an average weighted maturity of approximately

12 years and a weighted average coupon of 2.7%. We

redeemed $10,042 in borrowings of various notes with

stated rates of 0.80% to 9.10%.

During 2015 we completed the following long-term debt

issuances:

• February 2015 issuance of $2,619 of 4.600% global

notes due 2045.

• March 2015 borrowings under a variable rate term loan

facility due 2018, variable rate term loan facility due

2020 and variable rate 18-month credit agreement due

2016, together totaling $11,155.

• March 2015 issuance of €1,250 of 1.300% global notes

due 2023 and €1,250 of 2.450% global notes due 2035

(together, equivalent to $2,844, when issued).

• May 2015 issuance of $3,000 of 2.450% global notes

due 2020; $2,750 of 3.000% global notes due 2022;

$5,000 of 3.400% global notes due 2025; $2,500 of

4.500% global notes due 2035; $3,500 of 4.750%

global notes due 2046; and $750 floating rate global

notes due 2020. The floating rate for the note is based

upon the three-month London Interbank Offered Rate

(LIBOR), reset quarterly, plus 93 basis points.

On February 9, 2016, we completed the following long-term

debt issuances:

• $1,250 of 2.800% global notes due 2021.

• $1,500 of 3.600% global notes due 2023.

• $1,750 of 4.125% global notes due 2026.

• $1,500 of 5.650% global notes due 2047.

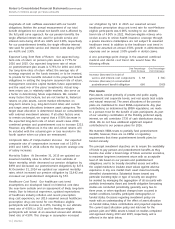

As of December 31, 2015 and 2014, we were in compliance

with all covenants and conditions of instruments governing

our debt. Substantially all of our outstanding long-term

debt is unsecured. Maturities of outstanding long-term

notes and debentures, as of December 31, 2015, and the

corresponding weighted-average interest rate scheduled

for repayment are as follows:

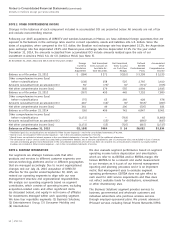

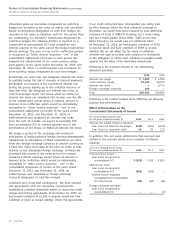

There-

2016 2017 2018 2019 2020 after

Debt

repayments1 $7,383 $7,789 $13,058 $7,863 $9,459 $83,891

Weighted-

average

interest rate 2.8% 2.3% 3.5% 3.9% 3.2% 4.8%

1 Debt repayments assume putable debt is redeemed by the holders at the next

opportunity.

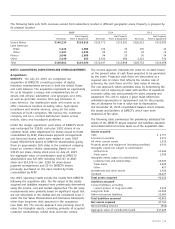

Credit Facilities

On December 11, 2015, we entered into a five-year, $12,000

credit agreement (the “Revolving Credit Agreement”) with

Citibank, N.A. (Citibank), as administrative agent, replacing

our $5,000 credit agreement that would have expired in

December 2018. At the same time, AT&T and the lenders

terminated their obligations under the existing revolving

$3,000 credit agreement with Citibank that would have

expired in December 2017.

In January 2015, we entered into a $9,155 credit agreement

(the “Syndicated Credit Agreement”) containing (i) a $6,286

term loan facility (the “Tranche A Facility”) and (ii) a $2,869

term loan facility (the “Tranche B Facility”), with certain

investment and commercial banks and Mizuho Bank, Ltd.

(“Mizuho”), as administrative agent. We also entered into a

$2,000 18-month credit agreement (the “18-Month Credit

Agreement”) with Mizuho as initial lender and agent. On

December 11, 2015, AT&T amended the Syndicated Credit

Agreement and the 18-Month Credit Agreement to, among

other things, revise the financial covenant to match the

financial covenant in the Revolving Credit Agreement.

Revolving Credit Agreement

In the event advances are made under the Revolving

Credit Agreement, those advances would be used for

general corporate purposes. Advances are not conditioned

on the absence of a material adverse change. All advances

must be repaid no later than the date on which lenders

are no longer obligated to make any advances under the

agreement. We can terminate, in whole or in part, amounts

committed by the lenders in excess of any outstanding

advances; however, we cannot reinstate any such terminated

commitments. We also may request that the total amount

of the lender’s commitments be increased by an integral

multiple of $25 effective on a date that is at least 90 days

prior to the scheduled termination date then in effect,

provided that no event of default has occurred and in no