AT&T Wireless 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

15

AT&T NextSM (AT&T Next) program and the increase in sales

of higher-priced smartphones.

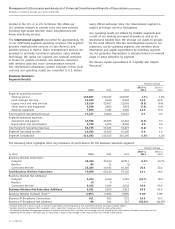

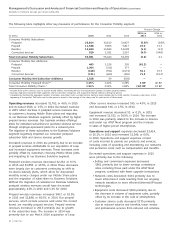

Operations and support expenses decreased $880, or 1.9%,

in 2015 and increased $2,384, or 5.5%, in 2014. Operations

and support expenses consist of costs incurred to provide

our products and services, including costs of operating and

maintaining our networks and personnel costs, such as

compensation and benefits.

Expense decreases in 2015 were primarily due to:

• Lower commission costs of $995 primarily due

to lower average commission rates and fewer

upgrade transactions.

• Lower employee-related charges of $508 resulting

from workforce reductions and other cost initiatives.

• Reductions of $269 in access costs, primarily due

to lower interconnect, roaming and traffic

compensation costs.

• Lower customer service costs of $146 primarily resulting

from our simplified offerings and increased efforts to

resolve customer inquiries on their first call.

Partially offsetting the decreases in 2015 were:

• Higher wireless handset insurance cost of $370

resulting from higher claim rates and costs per claim.

• Increased equipment expense of $304 due to the

continuing trend of customers choosing higher-cost

devices.

• Higher bad debt expense of $173 resulting from a

higher AT&T Next subscriber base.

Expense increases in 2014 were primarily due to:

• Increased equipment expense of $1,779 due to

increased sales and the continuing trend of

customers choosing higher-cost devices.

• Network system costs increased $315 due to increased

lease fees, higher maintenance and energy costs

resulting from the increase in the number of cell sites

and expenses related to our network enhancement efforts.

• Higher wireless handset insurance cost of $159

resulting from higher claim rates and costs per claim.

Depreciation expense increased $434, or 4.6%, in 2015

and $390, or 4.4%, in 2014. The increases were primarily

due to the increase in ongoing capital spending for

network upgrades and expansion partially offset by

fully depreciated assets.

Operating income increased $967, or 6.3%, in 2015 and

$185, or 1.2%, in 2014. Our Business Solutions segment

operating income margin was 23.0% in 2015, compared to

21.8% in 2014 and 22.5% in 2013. Our Business Solutions

EBITDA margin was 36.8% in 2015, compared to 35.1% in

2014 and 35.8% in 2013.

Operating revenues increased $521, or 0.7%, in 2015

and $2,959, or 4.4%, in 2014. Revenue growth was driven

by wireless revenues and continued growth in fixed

strategic business services, partially offset by continued

declines in our legacy voice and data services and foreign

exchange pressures.

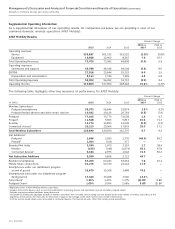

Wireless service revenues increased $505, or 1.7%, in 2015

and $486, or 1.6%, in 2014. The revenue increases reflect

smartphone and tablet gains as well as customer migrations

from our Consumer Mobility segment.

Business wireless subscribers increased 13.1%, to 73.7million

subscribers at December 31, 2015 compared to 14.0%, to

65.1 million subscribers at December31,2014. Postpaid

subscribers increased 6.9% in 2015 compared to 10.7% in

2014 reflecting the addition of new customers as well as

migrations from our Consumer Mobility segment, partially

offset by continuing competitive pressures in the industry.

Connected devices, which have lower average revenue per

average subscriber (ARPU) and lower churn, increased 26.8%

in 2015 compared to 22.2% in 2014 reflecting growth in

business customers using tracking, monitoring and other

sensor-embedded devices on their equipment.

The effective management of subscriber churn is critical to

our ability to maximize revenue growth and to maintain and

improve margins. Business wireless postpaid churn increased

to 0.99% in 2015 from 0.90% in 2014 and 0.89% in 2013.

Fixed strategic services revenues increased $1,244, or 12.9%,

in 2015 and $1,222, or 14.5%, in 2014. Our revenues,

which were negatively impacted by foreign exchange rates,

increased in 2015 and 2014 due to: Ethernet increases of

$389 and $340, U-verse services increases of $247 and

$170, Ethernet access to Managed Internet Services increases

of $190 and $163 and VPN increases of $116 and $359.

Legacy wired voice and data service revenues decreased

$1,838, or 9.3%, in 2015 and $1,812, or 8.4%, in 2014.

Traditional data revenues in 2015 and 2014 decreased

$1,040 and $1,318 and long-distance and local voice

revenues decreased $797 and $475. The decreases were

primarily due to lower demand as customers continue

to shift to our more advanced IP-based offerings or

our competitors.

Other service revenues decreased $302, or 7.8%, in 2015

and $18, or 0.5%, in 2014. Other service revenues include

project-based revenue, which is nonrecurring in nature, as

well as revenues from other managed services, outsourcing,

government professional service and customer premises

equipment. The declines in 2015 and 2014 are primarily

due to lower project-based and equipment revenues,

as well as impacts from foreign exchange rates.

Wireless equipment revenues increased $912, or 13.0%,

in 2015 and $3,081, or 77.8%, in 2014. The increase was

primarily due to the increase in handsets sold under our