AT&T Wireless 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

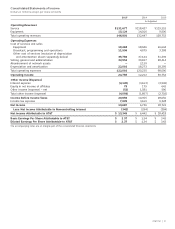

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

32

|

AT&T INC.

The Revolving Credit Agreement contains covenants that

are customary for an issuer with an investment grade senior

debt credit rating, as well as a net debt-to-EBITDA (earnings

before interest, taxes, depreciation and amortization, and

other modifications described in the Revolving Credit

Agreement) financial ratio covenant that AT&T will maintain,

as of the last day of each fiscal quarter, a ratio of not

more than 3.5-to-1.

The Syndicated Credit Agreement

In March 2015, AT&T borrowed all amounts available under

the Tranche A Facility and the Tranche B Facility. Amounts

borrowed under the Tranche A Facility will be due on

March2,2018. Amounts borrowed under the TrancheB

Facility will be subject to amortization from March2,2018,

with 25percent of the aggregate principal amount thereof

being payable prior to March2,2020, and all remaining

principal amount due on March2,2020.

Advances bear interest at a rate equal to: (i) the LIBOR

for deposits in dollars (adjusted upwards to reflect any

bank reserve costs) for a period of three or six months,

as applicable, plus (ii) the Applicable Margin (each such

Advance, a Eurodollar Rate Advance). The Applicable Margin

under the Tranche A Facility will equal 1.000%, 1.125%

or 1.250% per annum depending on AT&T’s credit rating.

The Applicable Margin under the Tranche B Facility will

equal 1.125%, 1.250% or 1.375% per annum, depending

on AT&T’s credit rating.

The Syndicated Credit Agreement contains covenants that

are customary for an issuer with an investment grade senior

debt credit rating. Among other things, the Syndicated

Credit Agreement requires us to maintain a net debt-to-

EBITDA (earnings before interest, income taxes, depreciation

and amortization, and other modifications described in

the Syndicated Credit Agreement) ratio of not more

than 3.5-to-1, as of the last day of each fiscal quarter.

Events of default are customary for an agreement of this

nature and result in the acceleration or permit the lenders

to accelerate, as applicable, required payment and which

would increase the Applicable Margin by 2.00% per annum.

The 18-Month Credit Agreement

In March 2015, AT&T borrowed all amounts available under

the 18-Month Credit Agreement. Amounts borrowed under

the 18-Month Credit Agreement will be due and payable

on September2,2016. In September 2015, we partially

repaid the amount borrowed.

Advances bear interest at a rate equal to: (i) the LIBOR

for deposits in dollars (adjusted upwards to reflect any bank

reserve costs) for a period of one, two, three or six months,

as applicable, plus (ii) the Applicable Margin (each such

Advance, a Eurodollar Rate Advance). The Applicable Margin

will equal 0.800%, 0.900% or 1.000% per annum, depending

Revolving Credit Agreement

In the event advances are made under the Revolving

Credit Agreement, those advances would be used for

general corporate purposes. Advances are not conditioned

on the absence of a material adverse change. All advances

must be repaid no later than the date on which lenders

are no longer obligated to make any advances under the

agreement. We can terminate, in whole or in part, amounts

committed by the lenders in excess of any outstanding

advances; however, we cannot reinstate any such terminated

commitments. We also may request that the total amount

of the lender’s commitments be increased by an integral

multiple of $25 effective on a date that is at least 90days

prior to the scheduled termination date then in effect,

provided that no event of default has occurred and in

no event shall the total amount of the lender’s commitments

at any time exceed $14,000. At December31,2015,

we had no advances outstanding under the Revolving Credit

Agreement and we have complied will all covenants.

The obligations of the lenders to provide advances will

terminate on December11,2020, unless prior to that

date either: (i) AT&T reduces to $0 the commitments

of the lenders, or (ii) certain events of default occur.

We and lenders representing more than 50% of the facility

amount may agree to extend their commitments for two

one-year periods beyond the December11,2020,

termination date, under certain circumstances.

Advances under the Revolving Credit Agreement would bear

interest, at AT&T’s option, either:

• at a variable annual rate equal to (1) the highest of:

(a)the base rate of the bank affiliate of Citibank, N.A.

which is serving as administrative agent under the

Agreement, (b)0.50% per annum above the Federal

funds rate, and (c)the LIBOR applicable to U.S. dollars

for a period of one month plus 1.00% per annum,

plus (2) an applicable margin, as set forth in the

Revolving Credit Agreement (“Applicable Margin

for Base Advances”); or

• at a rate equal to: (i) LIBOR for a period of one,

two, three or six months, as applicable, plus (ii) the

Applicable Margin (“Applicable Margin for Eurocurrency

Rate Advances”).

The Applicable Margin for Eurocurrency Rate Advances

will equal 0.680%, 0.910%, 1.025%, or 1.125% per annum,

depending on AT&T’s credit rating. The Applicable Margin

for Base Rate Advances will be equal to the greater of

0.00% and the relevant Applicable Margin for Eurocurrency

Rate Advances minus 1.00% per annum depending on

AT&T’scredit rating.

We will pay a facility fee of 0.070%, 0.090%, 0.100%

or 0.125% per annum, depending on AT&T’s credit rating,

of the amount of lender commitments.