AT&T Wireless 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

51

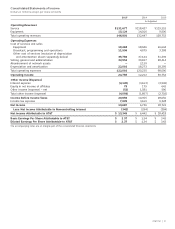

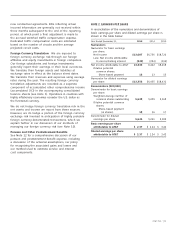

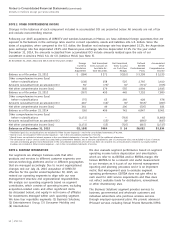

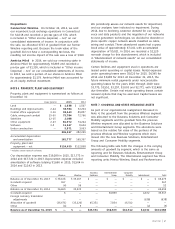

NOTE 2. EARNINGS PER SHARE

A reconciliation of the numerators and denominators of

basic earnings per share and diluted earnings per share is

shown in the table below:

Year Ended December 31, 2015 2014 2013

Numerators

Numerator for basic earnings

per share:

Net income $13,687 $6,736 $18,722

Less: Net income attributable

to noncontrolling interest (342) (294) (304)

Net income attributable to AT&T 13,345 6,442 18,418

Dilutive potential

common shares:

Share-based payment 13 13 13

Numerator for diluted earnings

per share $13,358 $6,455 $18,431

Denominators (000,000)

Denominator for basic earnings

per share:

Weighted-average number of

common shares outstanding 5,628 5,205 5,368

Dilutive potential common

shares:

Share-based payment

(in shares) 18 16 17

Denominator for diluted

earnings per share 5,646 5,221 5,385

Basic earnings per share

attributable to AT&T $ 2.37 $ 1.24 $ 3.42

Diluted earnings per share

attributable to AT&T $ 2.37 $ 1.24 $ 3.42

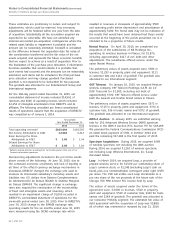

new contractual agreements. Bills reflecting actual

incurred information are generally not received within

three months subsequent to the end of the reporting

period, at which point a final adjustment is made to

the accrued switched traffic compensation expense.

Dedicated traffic compensation costs are estimated

based on the number of circuits and the average

projected circuit costs.

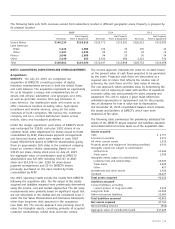

Foreign Currency Translation We are exposed to

foreign currency exchange risk through our foreign

affiliates and equity investments in foreign companies.

Our foreign subsidiaries and foreign investments

generally report their earnings in their local currencies.

We translate their foreign assets and liabilities at

exchange rates in effect at the balance sheet dates.

We translate their revenues and expenses using average

rates during the year. The resulting foreign currency

translation adjustments are recorded as a separate

component of accumulated other comprehensive income

(accumulated OCI) in the accompanying consolidated

balance sheets (see Note 3). Operations in countries with

highly inflationary economies consider the U.S. dollar as

the functional currency.

We do not hedge foreign currency translation risk in the

net assets and income we report from these sources.

However, we do hedge a portion of the foreign currency

exchange risk involved in anticipation of highly probable

foreign currency-denominated transactions, which we

explain further in our discussion of our methods of

managing our foreign currency risk (see Note 10).

Pension and Other Postretirement Benefits

See Note 12 for a comprehensive discussion of our

pension and postretirement benefit expense, including

a discussion of the actuarial assumptions, our policy

for recognizing the associated gains and losses and

our method used to estimate service and interest

cost components.