AT&T Wireless 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

18

|

AT&T INC.

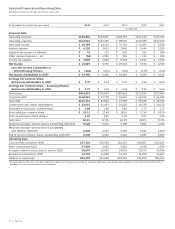

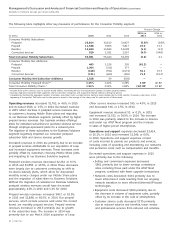

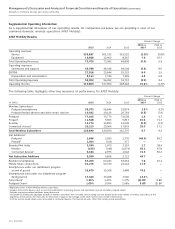

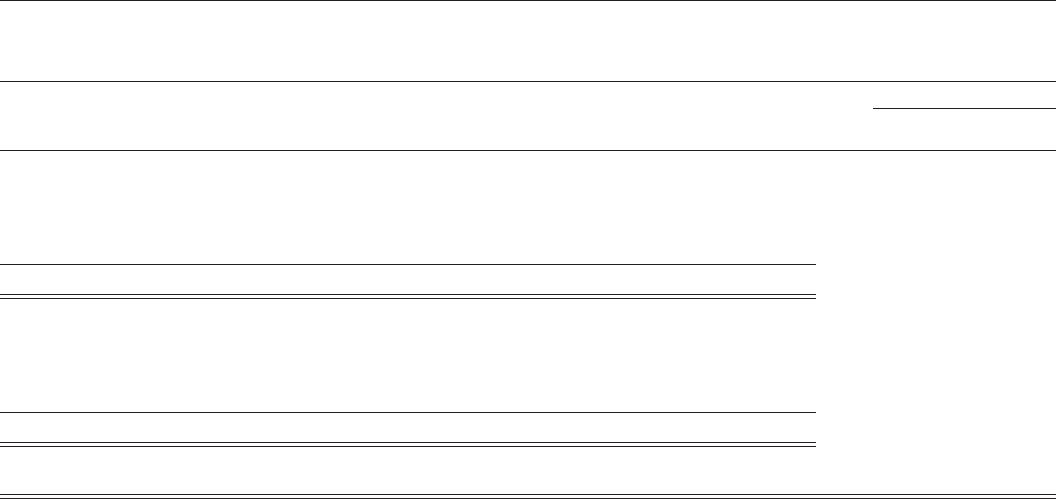

The following table highlights other key measures of performance for the Consumer Mobility segment:

Percent Change

2015 vs. 2014 vs.

(in 000s) 2015 2014 2013 2014 2013

Consumer Mobility Subscribers

Postpaid 28,814 30,610 31,827 (5.9)% (3.8)%

Prepaid 11,548 9,965 5,817 15.9 71.3

Reseller 13,690 13,844 14,028 (1.1) (1.3)

Connected devices1 929 1,021 1,567 (9.0) (34.8)

Total Consumer Mobility Subscribers 54,981 55,440 53,239 (0.8) 4.1

Consumer Mobility Net Additions2

Postpaid 463 1,226 395 (62.2) —

Prepaid 1,364 (311) 377 — —

Reseller (168) (351) (1,074) 52.1 67.3

Connected devices1 (131) (465) (390) 71.8 (19.2)

Consumer Mobility Net Subscriber Additions 1,528 99 (692) — —

Consumer Mobility Postpaid Churn2,3 1.25% 1.22% 1.26% 3 BP (4) BP

Total Consumer Mobility Churn2,3 1.94% 2.06% 1.84% (12) BP 22 BP

1 Includes data-centric devices such as session-based tablets, monitoring devices and automobile systems. Excludes postpaid tablets.

2 Excludes migrations between AT&T segments and/or subscriber categories and acquisition-related additions during the period.

3 Calculated by dividing the aggregate number of wireless subscribers who canceled service during a period divided by the total number of wireless subscribers at the

beginning of that period. The churn rate for the period is equal to the average of the churn rate for each month of that period.

Other service revenue increased $95, or 4.0%, in 2015

and decreased $36, or 1.5%, in 2014.

Equipment revenue decreased $3, or 0.1%, in 2015

and increased $1,532, or 34.9%, in 2014. The increase

in 2014 was primarily related to the increase in devices

sold under our AT&T Next program and the increase

in sales of higher-priced smartphones.

Operations and support expenses decreased $2,414,

or 10.1%, in 2015 and increased $1,346, or 6.0%,

in 2014. Operations and support expenses consist

of costs incurred to provide our products and services,

including costs of operating and maintaining our networks

and personnel costs, such as compensation and benefits.

Decreased operations and support expenses in 2015

were primarily due to the following:

• Selling and commission expenses decreased

$861 primarily due to lower average commission

rates, including those paid under the AT&T Next

program, combined with fewer upgrade transactions.

• Network costs decreased $434 primarily due to

lower interconnect costs resulting from our ongoing

network transition to more efficient Ethernet/IP-based

technologies.

• Equipment costs decreased $406 primarily due to

the decrease in volume of equipment sales, partially

offset by an increase in the cost of smartphones.

• Customer service costs decreased $275 primarily

due to reduced salaries and benefits, lower vendor

and professional services from reduced call volumes.

Operating revenues decreased $1,703, or 4.6%, in 2015

and increased $526, or 1.5%, in 2014. Decreased revenues

in 2015 reflect declines in postpaid service revenues due

to customers choosing Mobile Share plans and migrating

to our Business Solutions segment, partially offset by higher

prepaid service revenues. Our business wireless offerings

allow for individual subscribers to purchase wireless services

through employer-sponsored plans for a reduced price.

The migration of these subscribers to the Business Solutions

segment negatively impacted our consumer postpaid

subscriber total and service revenue growth.

Increased revenues in 2014 are primarily due to an increase

in prepaid services attributable to our acquisition of Leap

and increased equipment revenues. These increases were

partially offset by customers choosing Mobile Share plans

and migrating to our Business Solutions segment.

Postpaid wireless revenues decreased $2,252, or 9.3%,

in 2015 and $2,858, or 10.5%, in 2014. These decreases

were largely due to customers continuing to shift to

no-device-subsidy plans, which allow for discounted

monthly service charges under our Mobile Share plans

and the migration of subscribers to Business Solutions.

Without the migration of customers to Business Solutions,

postpaid wireless revenues would have decreased

approximately 4.0% in 2015 and 5.4% for 2014.

Prepaid wireless revenues increased $457, or 10.9%,

in 2015 and $1,888, or 81.5%, in 2014. Our prepaid

services, which include services sold under the Cricket

brand, are monthly prepaid services. Prepaid wireless

revenues increased in 2015 primarily due to growth

in the subscriber base. The increase in 2014 was

primarily due to our March 2014 acquisition of Leap.