AT&T Wireless 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

57

We periodically assess our network assets for impairment,

and our analyses have indicated no impairment. During

2014, due to declining customer demand for our legacy

voice and data products and the migration of our networks

to next generation technologies, we decided to abandon in

place specific copper network assets classified as cable,

wiring and conduit. These abandoned assets had a gross

book value of approximately $7,141, with accumulated

depreciation of $5,021. In 2014, we recorded a $2,120

noncash charge for this abandonment, which is included

in “Abandonment of network assets” on our consolidated

statements of income.

Certain facilities and equipment used in operations are

leased under operating or capital leases. Rental expenses

under operating leases were $5,025 for 2015, $4,345 for

2014 and $3,683 for 2013. At December 31, 2015, the

future minimum rental payments under noncancelable

operating leases for the years 2016 through 2020 were

$3,775, $3,551, $3,257, $3,003 and $2,771, with $12,488

due thereafter. Certain real estate operating leases contain

renewal options that may be exercised. Capital leases are

not significant.

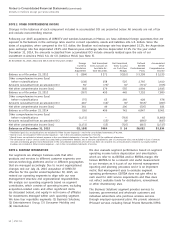

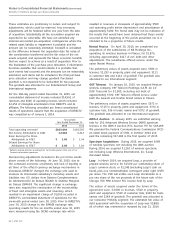

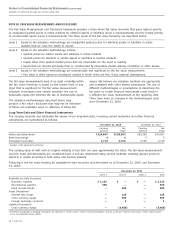

NOTE 7. GOODWILL AND OTHER INTANGIBLE ASSETS

As part of our organizational realignment discussed in

Note 4, the goodwill from the previous Wireless segment

was allocated to the Business Solutions and Consumer

Mobility segments and the goodwill from the previous

Wireline segment was allocated to the Business Solutions

and Entertainment Group segments. The allocations were

based on the relative fair value of the portions of the

previous Wireless and Wireline segments which were

moved into the new Business Solutions, Entertainment

Group and Consumer Mobility segments.

The following table sets forth the changes in the carrying

amounts of goodwill by segment, which is the same as

reporting unit for Business Solutions, Entertainment Group

and Consumer Mobility. The International segment has three

reporting units: Mexico Wireless, Brazil and PanAmericana.

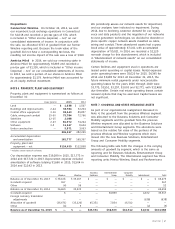

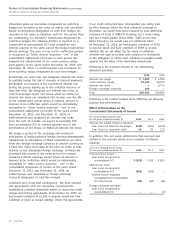

Dispositions

Connecticut Wireline On October 24, 2014, we sold

our incumbent local exchange operations in Connecticut

for $2,018 and recorded a pre-tax gain of $76, which

is included in “Other income (expense) – net,” on our

consolidated statements of income. In conjunction with

the sale, we allocated $743 of goodwill from our former

Wireline reporting unit. Because the book value of the

goodwill did not have a corresponding tax basis, the

resulting net income impact of the sale was a loss of $360.

América Móvil In 2014, we sold our remaining stake in

América Móvil for approximately $5,885 and recorded a

pre-tax gain of $1,330, which is included in “Other income

(expense) – net,” on our consolidated statements of income.

In 2013, we sold a portion of our shares in América Móvil

for approximately $1,179. América Móvil was accounted for

as an equity method investment.

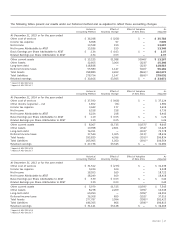

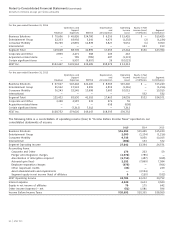

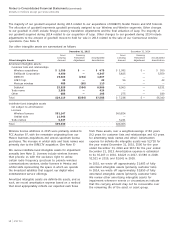

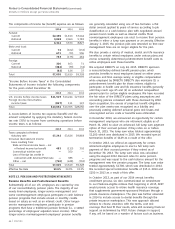

NOTE 6. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is summarized as follows at

December 31:

Lives (years) 2015 2014

Land — $ 1,638 $ 1,567

Buildings and improvements 2-44 33,784 32,204

Central office equipment1 3-10 93,643 89,857

Cable, wiring and conduit 15-50 75,784 72,766

Satellites 12-15 2,088 —

Other equipment 2-23 81,972 74,244

Software 3-5 11,347 8,604

Under construction — 5,971 3,053

306,227 282,295

Accumulated depreciation

and amortization 181,777 169,397

Property, plant and

equipment – net $124,450 $112,898

1 Includes certain network software.

Our depreciation expense was $19,289 in 2015, $17,773 in

2014 and $17,722 in 2013. Depreciation expense included

amortization of software totaling $1,660 in 2015, $1,504 in

2014 and $2,142 in 2013.

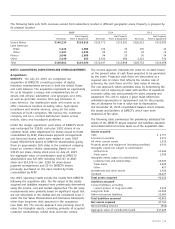

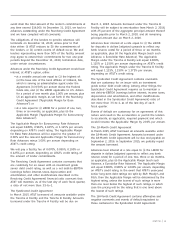

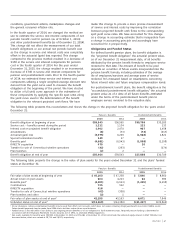

Business Entertainment Consumer

Wireless Wireline Solutions Group Mobility International Total

Balance as of December 31, 2013 $ 36,106 $ 33,167 $ — $ — $ — $ — $ 69,273

Goodwill acquired 367 — — — — — 367

Other (4) 56 — — — — 52

Balance as of December 31, 2014 36,469 33,223 — — — — 69,692

Goodwill acquired 6 — — 30,839 — 4,672 35,517

Foreign currency translation

adjustments — — — — — (638) (638)

Allocation of goodwill (36,471) (33,226) 45,351 7,834 16,512 — —

Other (4) 3 — — — (2) (3)

Balance as of December 31, 2015 $ — $ — $45,351 $38,673 $16,512 $4,032 $104,568