AT&T Wireless 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

77

value. The estimated value of the device trade-ins considers

prices offered to us by independent third parties that

contemplate changes in value after the launch of a device

model. The fair value measurements used are considered

Level 3 under the Fair Value Measurement and Disclosure

framework (see Note 10).

During 2015, we repurchased installment receivables

previously sold to the Purchasers, with a fair value of $685.

These transactions reduced our current deferred purchase

price receivable by $534, resulting in a gain of $151 in

2015. This gain is included in “Selling, general and

administrative” in the consolidated statements of income.

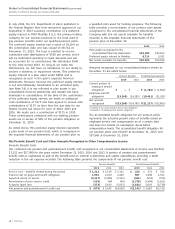

At December 31, 2015, our deferred purchase price

receivable was $2,961, of which $1,772 is included in

“Other current assets” on our consolidated balance sheets,

with the remainder in “Other Assets.” At December 31, 2014,

our deferred purchase price receivable was $1,606, which is

included in “Other Assets.” Our maximum exposure to loss

as a result of selling these equipment installment receivables

is limited to the amount of our deferred purchase price at

any point in time.

The sales of equipment installment receivables did not have

a material impact on our consolidated statements of income

or to “Total Assets” reported on our consolidated balance

sheets. We reflect the cash flows related to the arrangement

as operating activities in our consolidated statements of

cash flows because the cash received from the Purchasers

upon both the sale of the receivables and the collection of

the deferred purchase price is not subject to significant

interest rate risk.

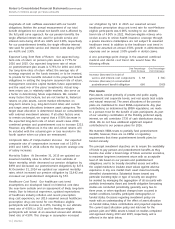

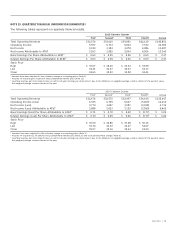

NOTE 16. TOWER TRANSACTION

On December 16, 2013, we closed our transaction with

Crown Castle International Corp. (Crown Castle) in which

Crown Castle gained the exclusive rights to lease and

operate 9,048 wireless towers and purchased 627 of our

wireless towers for $4,827 in cash. The leases have various

terms with an average length of approximately 28 years.

As the leases expire, Crown Castle will have fixed price

purchase options for these towers totaling approximately

$4,200, based on their estimated fair market values at the

end of the lease terms. We sublease space on the towers

from Crown Castle for an initial term of 10 years at current

market rates, subject to optional renewals in the future.

We determined our continuing involvement with the

tower assets prevented us from achieving sale-leaseback

accounting for the transaction, and we accounted for the

cash proceeds from Crown Castle as a financing obligation

on our consolidated balance sheets. We record interest on

the financing obligation using the effective interest method

at a rate of approximately 3.9%. The financing obligation

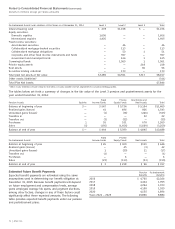

value plus any unpaid cumulative dividends, and in

installments, as specified in the contribution agreement

upon the occurrence of any of the following: (1) at any

time if the ratio of debt to total capitalization of Mobility

exceeds that of AT&T, (2) the date on which AT&T Inc. is

rated below investment grade for two consecutive calendar

quarters, (3) upon a change of control if AT&T does not

exercise its purchase option, or (4) at any time after a

seven-year period from the contribution date. In the event

AT&T elects or is required to purchase the preferred equity

interest, AT&T may elect to settle the purchase price in cash

or shares of AT&T common stock or a combination thereof.

Because the preferred equity interest was not considered

outstanding for accounting purposes at year-end, it did not

affect the calculation of earnings per share.

NOTE 15. SALES OF EQUIPMENT INSTALLMENT RECEIVABLES

We offer our customers the option to purchase certain

wireless devices in installments over a period of up to

30 months, with the right to trade in the original equipment

for a new device within a set period and have the remaining

unpaid balance satisfied. As of December 31, 2015 and

December 31, 2014, gross equipment installment receivables

of $5,719 and $4,265 were included on our consolidated

balance sheets, of which $3,239 and $2,514 are notes

receivable that are included in “Accounts receivable – net.”

In 2014, we entered into the first of a series of uncommitted

agreements pertaining to the sale of equipment installment

receivables and related security with Citibank and various

other relationship banks as purchasers (collectively, the

Purchasers). Under these agreements, we transferred

the receivables to the Purchasers for cash and additional

consideration upon settlement of the receivables, referred

to as the deferred purchase price. Under the terms of the

arrangements, we continue to bill and collect on behalf

of our customers for the receivables sold. To date, we have

collected and remitted approximately $4,520 (net of fees),

of which $580 was returned as deferred purchase price.

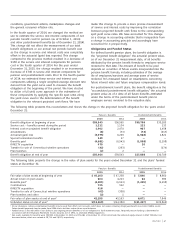

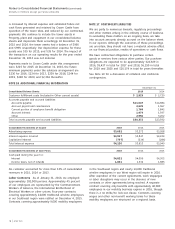

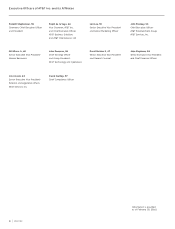

The following table sets forth a summary of equipment

installment receivables sold during 2015 and 2014:

2015 2014

Gross receivables sold $7,436 $4,707

Net receivables sold1 6,704 4,126

Cash proceeds received 4,439 2,528

Deferred purchase price recorded 2,266 1,629

1 Receivables net of allowance, imputed interest and trade-in right guarantees.

The deferred purchase price was initially recorded at

estimated fair value, which was based on remaining

installment payments expected to be collected, adjusted

by the expected timing and value of device trade-ins, and

is subsequently carried at the lower of cost or net realizable