AT&T Wireless 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

25

competitive pressures, for a number of years we have

used a bundling strategy that rewards customers who

consolidate their services (e.g., telephone, high-speed

Internet, wireless and video) with us. We continue to

focus on bundling services, including combined packages

of wireless data and voice and video service. We will

continue to develop innovative and integrated services

that capitalize on our wireless and IP-based network

and satellites.

Additionally, we provide local and interstate telephone

and switched services to other service providers, primarily

large Internet Service Providers using the largest class

of nationwide Internet networks (Internet backbone),

wireless carriers, other telephone companies, cable

companies and systems integrators. These services

are subject to additional competitive pressures from

the development of new technologies, the introduction

of innovative offerings and increasing satellite, wireless,

fiber-optic and cable transmission capacity for services.

We face a number of international competitors, including

Orange Business Services, British Telecom, Singapore

Telecommunications Limited and Verizon Communications

Inc., as well as competition from a number of large systems

integrators, such as HP Enterprise Services.

ACCOUNTING POLICIES AND STANDARDS

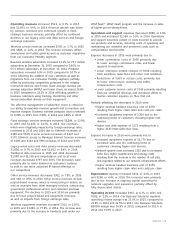

Critical Accounting Policies and Estimates Because

of the size of the financial statement line items they relate

to or the extent of judgment required by our management,

some of our accounting policies and estimates have a more

significant impact on our consolidated financial statements

than others. The following policies are presented in the

order in which the topics appear in our consolidated

statements of income.

Allowance for Doubtful Accounts We record expense

to maintain an allowance for doubtful accounts for

estimated losses that result from the failure or inability

of our customers to make required payments. When

determining the allowance, we consider the probability

of recoverability based on past experience, taking into

account current collection trends as well as general

economic factors, including bankruptcy rates. Credit

risks are assessed based on historical write-offs, net

of recoveries, as well as an analysis of the aged

accounts and installment receivable balances with

reserves generally increasing as the receivable ages.

Accounts receivable may be fully reserved for when

specific collection issues are known to exist, such as

pending bankruptcy or catastrophes. The analysis of

receivables is performed monthly, and the allowances

for doubtful accounts are adjusted through expense

accordingly. A 10% change in the amounts estimated

to be uncollectible would result in a change in the

provision for uncollectible accounts of approximately $142.

and services are now operational, others are being developed

or may be developed. We compete for customers based

principally on service/device offerings, price, call quality,

coverage area and customer service.

Our subsidiaries providing communications and digital

entertainment services will face continued competitive

pressure in 2016 from multiple providers, including

wireless, satellite, cable and other VoIP providers, online

video providers, and interexchange carriers and resellers.

In addition, the desire for high-speed data on demand,

including video, and lingering economic sluggishness are

continuing to lead customers to terminate their traditional

wired services and use our or competitors’ wireless, satellite

and Internet-based services. In most markets, we compete

for customers, often on pricing of bundled services,

with large cable companies, such as ComcastCorporation,

CoxCommunications Inc. and Time Warner CableInc.,

for high-speed Internet, video and voice services and

other smaller telecommunications companies for both

long-distance and local services. In addition, in Latin

American countries served by our DIRECTV subsidiary,

we also face competition from other video providers,

including América Móvil and Telefónica.

Our Entertainment Group and Business Solutions segments

generally remain subject to regulation for certain legacy

wireline wholesale services by state regulatory commissions

for intrastate services and by the FCC for interstate services.

Under the Telecom Act, companies seeking to interconnect

to our networks and exchange local calls enter into

interconnection agreements with us. Any unresolved issues

in negotiating those agreements are subject to arbitration

before the appropriate state commission. These agreements

(whether fully agreed-upon or arbitrated) are then subject

to review and approval by the appropriate state commission.

Our Entertainment Group and Business Solutions

segments operate portions of their business under state-

specific forms of regulation for retail services that were

either legislatively enacted or authorized by the appropriate

state regulatory commission. Most states deregulate

the competitive services; impose price caps for some

services where the prices for these services are not tied

to the cost of providing the services or to rate-of-return

requirements; or adopt a regulatory framework that

incorporates deregulation and price caps. Some states

may impose minimum customer service standards with

required payments if we fail to meet the standards.

We continue to lose legacy voice and data subscribers

due to competitors (e.g., wireless, cable and VoIP providers)

who can provide comparable services at lower prices

because they are not subject to traditional telephone

industry regulation (or the extent of regulation is in dispute),

utilize different technologies, or promote a different business

model (such as advertising based). In response to these