AT&T Wireless 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

53

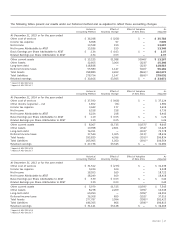

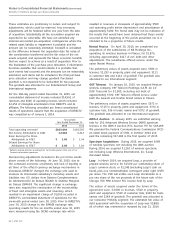

wide decisions for which the individual operating segments

are not being evaluated, including interest costs and

expected return on plan assets for our pension and

postretirement benefit plans.

Certain operating items are not allocated to our business

segments:

• Acquisition-related items include (1) operations

and support items associated with the merger and

integration of newly acquired businesses, and (2) the

noncash amortization of intangible assets acquired

in acquisitions.

• Certain significant items include (1) noncash actuarial

gains and losses from pension and other

postretirement benefits, (2) employee separation

charges associated with voluntary and/or strategic

offers, (3) losses resulting from abandonment or

impairment of assets and (4) other items for which the

segments are not being evaluated.

Interest expense and other income (expense) – net,

are managed only on a total company basis and are,

accordingly, reflected only in consolidated results. Therefore,

these items are also not included in each segment’s

reportable results.

Our operating assets are utilized by multiple segments and

consist of our wireless and wired networks as well as an

international satellite fleet. We manage our assets to provide

for the most efficient, effective and integrated service to

our customers, not by operating segment, and therefore

asset information and capital expenditures by segment are

not presented. Depreciation is allocated based on network

usage or asset utilization by segment.

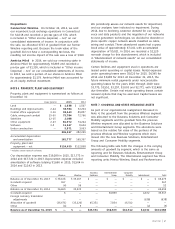

Ethernet-related products and broadband, collectively

referred to as strategic business services, as well as

traditional data and voice products. We utilize our wireless

and wired network and are marketed to provide a complete

communications solution to our business customers.

The Entertainment Group segment provides video, Internet

and voice communication services to residential customers

located in the U.S. or in U.S. territories. We utilize our copper

and IP-based (referred to as “wired” or “wireline”) wired

network and/or our satellite technology.

The Consumer Mobility segment provides nationwide

wireless service to consumers, and wireless wholesale and

resale subscribers located in the U.S. or in U.S. territories.

We utilize our U.S. wireless network to provide voice and

data services, including high-speed Internet, video

entertainment and home monitoring services.

The International segment provides entertainment

services in Latin America and wireless services in Mexico.

Video entertainment services are provided to primarily

residential customers using satellite technology. We utilize

our regional and national networks in Mexico to provide

consumer and business customers with wireless data

and voice communication services. Our international

subsidiaries conduct business in their local currency and

operating results are converted to U.S. dollars using

official exchange rates.

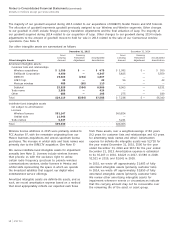

In reconciling items to consolidated operating income and

income before income taxes, Corporate and Other includes:

(1) operations that are not considered reportable segments

and that are no longer integral to our operations or which

we no longer actively market, and (2) impacts of corporate-

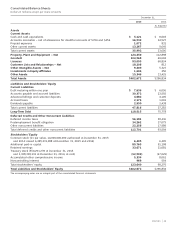

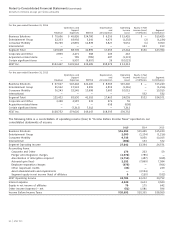

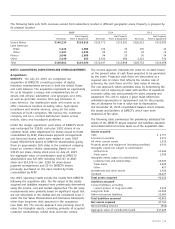

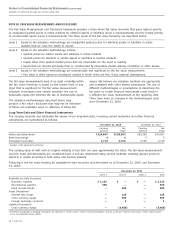

For the year ended December 31, 2015

Operations and Depreciation Operating Equity in Net

Support and Income Income (Loss) Segment

Revenue Expenses EBITDA Amortization (Loss) of Affiliates Contribution

Business Solutions $ 71,127 $ 44,946 $26,181 $ 9,789 $16,392 $— $16,392

Entertainment Group 35,294 28,345 6,949 4,945 2,004 (4) 2,000

Consumer Mobility 35,066 21,477 13,589 3,851 9,738 — 9,738

International 4,102 3,930 172 655 (483) (5) (488)

Segment Total 145,589 98,698 46,891 19,240 27,651 $(9) $27,642

Corporate and Other 1,297 1,057 240 64 176

Acquisition-related items (85) 1,987 (2,072) 2,712 (4,784)

Certain significant items — (1,742) 1,742 — 1,742

AT&T Inc. $146,801 $100,000 $46,801 $22,016 $24,785