Singapore Airlines 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines 87 Annual Report 2006-07

NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

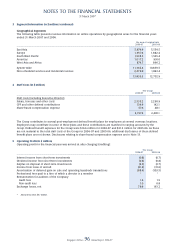

2 Accounting Policies (continued)

(s) Employee benefi ts (continued)

(i) Equity compensation plans (continued)

Equity-settled transactions

The cost of equity-settled transactions with employees is measured by reference to the fair value at the date

on which the share options are granted. In valuing the share options, no account is taken of any performance

conditions, other than conditions linked to the price of the shares of the Company.

The cost of equity-settled transactions is recognised, together with a corresponding increase in the share-based

compensation reserve, over the period in which the service conditions are fulfi lled, ending on the date on which

the relevant employees become fully entitled to the award (“the vesting date”). Non-market vesting conditions are

included in the estimation of the number of shares under options that are expected to become exercisable on the

vesting date. At each balance sheet date, the Group revises its estimates of the number of shares under options

that are expected to become exercisable on the vesting date and recognises the impact of the revision of the

estimates in the income statement, with a corresponding adjustment to the share-based compensation reserve

over the remaining vesting period.

No expense is recognised for awards that do not ultimately vest, except for awards where vesting is conditional

upon a market condition, which are treated as vested irrespective of whether or not the market condition is

satisfi ed, provided that all other performance conditions are satisfi ed.

The share-based compensation reserve is transferred directly back to general reserve upon cancellation or expiry

of the vested options.

(ii) Defi ned contribution plans

As required by law, the companies in Singapore make contributions to the state pension scheme, the Central

Provident Fund (“CPF”). Certain of the Group’s companies and overseas stations outside Singapore make

contributions to their respective countries’ pension schemes. Such contributions are recognised as compensation

expenses in the same period as the employment that gave rise to the contributions.

(iii) Defi ned benefi t plans

The Group contributes to several defi ned benefi t pension and other post-employment benefi t plans for employees

stationed in certain overseas countries. The cost of providing benefi ts includes the Group’s contribution for the

year plus any unfunded liabilities under the plans, which is determined separately for each plan. Contributions

to the plans over the expected average remaining working lives of the employees participating in the plans are

expensed as incurred.

(t) Trade creditors

Trade creditors and amounts owing to subsidiary and associated companies are initially recognised at fair value and

subsequently measured at amortised cost using the effective interest method.

Gains and losses are recognised in the profi t and loss account when the liabilities are derecognised as well as

through the amortisation process.

(u) Provisions

Provisions are recognised when the Group has a present obligation (legal or constructive) where, as a result of a

past event, it is probable that an outfl ow of resources embodying economic benefi ts will be required to settle the

obligation and a reliable estimate can be made of the amount of the obligation. Where the Group expects some

or all of a provision to be reimbursed, the reimbursement is recognised as a separate asset but only when the

reimbursement is virtually certain. The expense relating to any provision is presented in the profi t and loss account

net of any reimbursement.