Singapore Airlines 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Singapore Airlines 39 Annual Report 2006-07

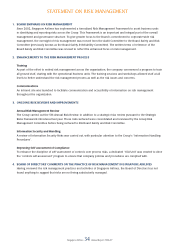

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Performance

and Restricted

Shares granted

Bonus during the year

––––––––––––––––––––––– –––––––––––––––––––––––– ––––––––––––––––––

Fee Salary Fixed Variable # Benefi ts Total Number Exercise Number

% % % % % % price $

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Between $1,000,001 to $1,250,000

Bey Soo Khiang # – 45 4 42 9 100 40,000 12.60 13,500 PSP

10,000 RSP

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Between $750,001 to $1,000,000

Huang Cheng Eng # – 45 4 42 9 100 30,000 12.60 10,000 PSP

7,500 RSP

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

# Includes EVA-based incentive payment and profi t-sharing bonus determined on an accrual basis for the fi nancial year ended 31 March 2007. Shares awarded under

the PSP and RSP are subject to performance targets and other terms and conditions being met under the respective share plans.

Long-Term Share Incentives

The Company has put in place share-based remuneration programmes allowing employees to share in its growth and

success. These plans comprise the Performance Share Plan (PSP), Restricted Share Plan (RSP) and Employee Share Option

Plan (ESOP).

The ESOP was introduced in 2000 with the objective of promoting unity and team spirit through a sense of share

ownership. In 2005, the Company enlisted an external consultant to review its share-based incentives. The PSP and

RSP, which were approved by shareholders at the Extraordinary General Meeting of the Company held on 28 July 2005,

were introduced with a view to further strengthening the Company’s competitiveness in attracting and retaining talented

key senior management and senior executives. The PSP and RSP aim to more directly align the interests of key senior

management and senior executives with the interests of Shareholders, to improve performance and achieve sustainable

growth for the Company in the changing business environment, and to foster a greater ownership culture amongst key

senior management and senior executives. These plans contemplate the award of fully paid Shares, when and after

pre-determined performance or service conditions are met. Non-executive Directors of the Group are not eligible to

participate in the PSP and RSP.

The PSP is targeted at a select group of key senior management who shoulder the responsibility for the Company’s

performance and who are able to drive the growth of the Company through innovation, creativity and superior

performance. Awards under the PSP are performance-based, with stretched performance targets based on criteria such as

absolute and relative total shareholders’ return to be achieved over a three-year performance period.

The RSP serves as an additional motivational tool to recruit and retain talented senior executives as well as to reward for

Company and individual performance. In addition, it enhances the Group’s overall compensation packages, strengthening

the Group’s ability to attract and retain high performing talent. Awards granted under the RSP, which is intended to apply

to a broader base of senior executives, will vest only after the satisfactory completion of time-based service conditions,

that is, after the participant has served the Group for a specifi ed number of years (time-based restricted awards) or,

where the award is performance-based (performance-based restricted awards), after a further period of service beyond

the performance target completion date. Consistent with the Company’s philosophy on adopting a pay-for-performance

principle, awards that had been granted under the RSP are contingent on performance targets based on criteria such as

EBITDAR margin and staff productivity to be achieved over a two-year performance period. An extended vesting period is

imposed beyond the performance target completion date, that is, a time-based service condition is imposed to encourage

participants to continue serving the Group beyond the achievement date of the pre-determined performance targets.

The selection of a participant and the number of Shares which he would be awarded under the PSP or RSP will be

determined at the absolute discretion of the BCIRC which will take into account criteria such as his rank, job performance,

creativity, innovativeness, entrepreneurship, years of service and potential for future development, his contribution

CORPORATE GOVERNANCE REPORT

For the period 1 April 2006 to 31 March 2007

Stock options granted

during the year