Singapore Airlines 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160

|

|

Singapore Airlines 49 Annual Report 2006-07

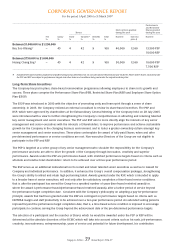

Performance of the Group (continued)

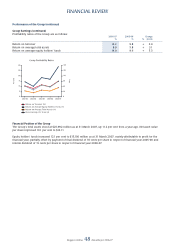

Financial Position of the Group (continued)

The Group improved its net liquid assets R1 position from $1,706 million a year ago to $3,810 million as at 31 March 2007.

This stronger liquidity position (+$2,104 million) was brought about largely by increased cash and bank balances in the

Group (+$1,966 million), as a result of stronger operations and monetisation of the Group’s non-core assets. Total debt to

equity ratio improved 0.05 times to 0.12 times.

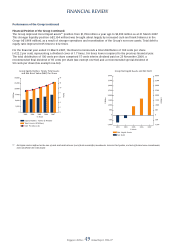

For the fi nancial year ended 31 March 2007, the Board recommends a total distribution of 100 cents per share

(+122.2 per cent), representing a dividend cover of 1.7 times, 0.6 times lower compared to the previous fi nancial year.

The total distribution of 100 cents per share comprised 15 cents interim dividend paid on 23 November 2006, a

recommended fi nal dividend of 35 cents per share (tax exempt one-tier) and a recommended special dividend of

50 cents per share (tax exempt one-tier).

R1 Net liquid assets is defi ned as the sum of cash and bank balances (net of bank overdrafts), investments, loans to third parties, and net of fi nance lease commitments,

loans and fi xed rate notes issued.

FINANCIAL REVIEW