Singapore Airlines 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE FINANCIAL STATEMENTS

31 March 2007

Singapore Airlines 132 Annual Report 2006-07

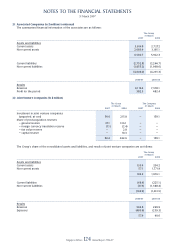

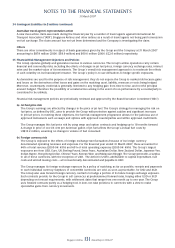

35 Financial Risk Management Objectives and Policies (continued)

(c) Interest rate risk

The Group’s earnings are also affected by changes in interest rates due to the impact such changes have on interest

income and expense from short-term deposits and other interest-bearing fi nancial assets and liabilities. The Group

enters into interest rate swaps to manage interest rate costs on its fi nancial assets and liabilities, with the prior

approval of the BEC or Boards of Subsidiaries. The majority of the Group’s interest-bearing fi nancial liabilities with

maturities above one year have fi xed rates of interest or are hedged by matching interest-bearing fi nancial assets.

(d) Market price risk

The Group owned $522.5 million (2006: $397.6 million) in quoted equity and non-equity investments at

31 March 2007.

The market risk associated with these investments is the potential loss resulting from a decrease in market prices.

(e) Counterparty risk

Surplus funds are invested in interest-bearing bank deposits and other high quality short-term liquid investments.

Counterparty risks are managed by limiting aggregated exposure on all outstanding fi nancial instruments to any

individual counterparty, taking into account its credit rating. Such counterparty exposures are regularly reviewed,

and adjusted as necessary. This mitigates the risk of material loss arising in the event of non-performance by

counterparties.

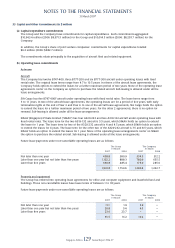

(f) Liquidity risk

At 31 March 2007, the Group had at its disposal, cash and short-term deposits amounting to $5,117.6 million

(2006: $3,151.6 million). In addition, the Group had available short-term credit facilities of about $880.6 million

(2006: $1,449.1 million). The Group also has Medium Term Note Programmes under which it may issue notes up to

$1,500 million (2006: $1,500 million). Under these Programmes, notes issued by the Company may have maturities

as may be agreed with the relevant fi nancial institutions, and notes issued by one of its subsidiary companies may

have maturities between one month and ten years.

The Group’s holdings of cash and short-term deposits, together with committed funding facilities and net cash fl ow

from operations, are expected to be suffi cient to cover the cost of all fi rm aircraft deliveries due in the next fi nancial

year. It is expected that any shortfall would be met by bank borrowings or public market funding. Due to the

necessity to plan aircraft orders well in advance of delivery, it is not economical for the Group to have committed

funding in place at present for all outstanding orders, many of which relate to aircraft which will not be delivered for

several years. The Group’s policies in this regard are in line with the funding policies of other major airlines.