Singapore Airlines 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines 59 Annual Report 2006-07

FINANCIAL REVIEW

Performance of the Company (continued)

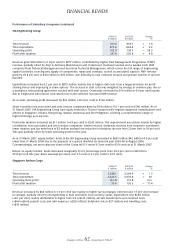

Expenditure (continued)

Handling costs, at $753 million, was 2.7 per cent more than last year due to higher handling rates, increase in the number

of fl ights operated and fl ights to new destinations, partially offset by a stronger SGD.

Sales costs decreased $27 million from the year before, mainly due to reduction in agency commission rates and

introduction of more stringent and productive incentives schemes which led to reduced incentive payouts.

Infl ight meals and other passenger costs rose $46 million as a result of increase in passenger carriage, higher infl ight meals

rates and setup costs resulting from the new B777-300ER aircraft.

Aircraft maintenance and overhaul costs fell $20 million, with fewer aircraft due for maintenance checks as newer aircraft

were introduced into the fl eet and decommissioning of some of the older B747-400 aircraft.

Rentals on leased aircraft increased $17 million mainly because of sale and leaseback of four B777-300 aircraft during the

year, partially offset by extension of lease at lower rates for six B747-400 aircraft and a weaker USD against SGD.

Other costs dropped by $36 million, largely due to lower foreign exchange hedging and revaluation loss.

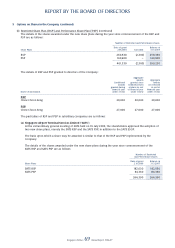

Fuel Productivity and Sensitivity Analysis

Fuel productivity as measured by load tonne-km per American gallon (ltk/AG) increased by 3.0% over the previous year

to 9.81 ltk/AG. This was attributable to higher load factor and a younger aircraft fl eet, arising from the addition of the new

B777-300ER aircraft and decommissioning of some of the older B747-400 aircraft.

A change in fuel productivity (passenger aircraft) of 1.0 per cent would impact the Company’s annual fuel cost by about

$37 million, before accounting for changes in fuel price, USD exchange rate and fl ying operations.

A change in price of one US cent per American gallon affects the Company’s annual fuel cost by about $18 million, before

accounting for USD exchange rate movements, and changes in volume of fuel consumed.

Finance Charges

Finance charges increased 50.5 per cent due mainly to higher interest rates.

Interest income was 65.5 per cent higher due mainly to an increase in interest rates and increase in funds placed in

short-term deposits.

Surplus on Disposal of Aircraft, Spares and Spare Engines

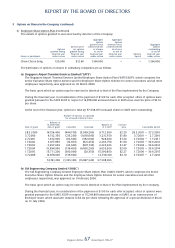

Surplus on the disposal of aircraft, spares and spare engines was $110 million higher than the year before. During the year,

four B747-400 and three A310-300 aircraft were sold and four B777-300 aircraft were sold and leased back.

Gross Dividends from Subsidiaries

Gross dividends from subsidiaries increased by $200 million, contributed by higher dividends received from SIA Engineering

Company (+$187 million) due to payment of special dividend for fi nancial year 2005-06 in August 2006.